Most Companies Don’t See Strategic Threats Coming Until It Is Too Late – Part 2 of 3

In Part-1 of this article series, we discussed the trend of organizations gradually adapting to increasingly effective strategic planning and strategy execution methods that allow them flexibility to quickly adjust tactics in today’s more challenging and fast-changing business environment. Gone are the days when strategic plans where meant to be static guides for a 3-5 year period. One factor behind this change: strategic threats that are emerging more quickly and in increased numbers. Business leaders are recognizing that there is now a need for more frequent “attention” to be paid to both strategy and execution than at any time in our history.

In Part-1 of this article series, we discussed the trend of organizations gradually adapting to increasingly effective strategic planning and strategy execution methods that allow them flexibility to quickly adjust tactics in today’s more challenging and fast-changing business environment. Gone are the days when strategic plans where meant to be static guides for a 3-5 year period. One factor behind this change: strategic threats that are emerging more quickly and in increased numbers. Business leaders are recognizing that there is now a need for more frequent “attention” to be paid to both strategy and execution than at any time in our history.

This segment of the article series delves into specific types of threats that organizations need to be able to detect and account for in their strategies.

Threat Surveillance: Be a Little Paranoid

“Is that just a harmless floating chunk of ice, or the tiny tip of a gigantic iceberg ahead?”

Organizations are usually more adept at spotting potential opportunities than they are at recognizing or even acknowledging strategic threats that might one day take them down. In fact, one of the keys to surviving in business is raising the periscope often in order to survey the surroundings for threats. The associated challenge is having the capability to harvest the right information in order to make intelligent strategic decisions.

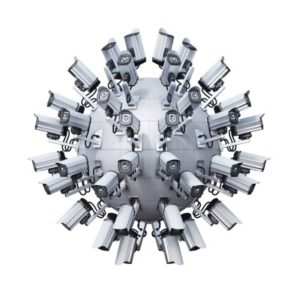

The threat surveillance aspect of strategic planning is more important than ever in today’s more complex business environment. Not only is competition fiercer than ever in global markets, but challengers can seemingly spring up at internet speed in our constantly wired and always-on electronic world.

Companies are dealing with new and potentially highly damaging threats that necessitate a stepped-up 360-degree surveillance perspective. For instance, consider the increase in computer system security breaches (IP hacking) and patent infringement lawsuits between rival smart phone device manufacturers.

So what might a company do to gain a 360-degree view of strategic threats on the horizon? It begins with looking in the “right places” for the “right things”. To explore this further, consider the external / internal threat categories that might apply.

When Talking About Threats, It’s About More Than Competition

External Forces: The Usual Suspects

Competitive analysis during strategic planning should be looking for:

– The emergence of new or stronger competitors

– The development of unique / disruptive technologies

Industry analysis should be uncovering:

Industry analysis should be uncovering:

– Shifts in the size or demographic composition of your market area

– Industry-related regulations (This a huge topic, so we’ll come back to it a bit later on)

Market analysis needs to uncover:

– Changes that alter the way customers access your business

– Fads, trends and evolving preferences

Economic analysis needs to consider:

– Positive or negative changes in the economy that will affect your customer’s buying habits (if you are the low-cost provider, but have an inferior offering to competitors…more discretionary buying power might lead your customers to switch up to more expensive substitutes.)

– Tax code changes

Political analysis that explores factors such as:

– Changes in Federal and State political party power

– Changes in policies that might affect imports, exports, markets, etc.

Let’s now revisit the industry analysis discussed earlier, because the government regulation aspect of this threat category is quite significant. It is a fact of life that businesses are tethered to an ever-increasing amount of oversight. Protecting the public is the core task of many government bodies—in particular, regulatory and law-enforcement agencies. Such protection comes at a cost to businesses however. Just maintaining compliance poses a real conundrum to firms in all industries. In the United States, the EPA and FDA are examples of two powerful bureaucracies that sometime confound business leaders with complex and often vaguely written policies that must be studied and interpreted. To illustrate this point, let’s explore just a few industries and the regulatory trends they face.

Energy

The Federal Energy Regulatory Commission (FERC) is a highly powerful U.S. government agency that has sweeping broad powers affecting the energy industry. The agency is charged with being the government watchdog overseeing the oil, natural gas and electricity businesses. The energy commission can fine firms $1 million a day for every violation.

The Energy Policy Act of 2005 expanded the scope of FERC’s authority even further to impose mandatory reliability standards on the bulk transmission system and to impose penalties on entities that manipulate the electricity and natural gas markets.

Under the Obama administration, FERC’s enforcement unit expanded its ranks and received a nearly 50 percent budget increase. The agency is bulking up to extend its watchdog authority and seek more legal action.

Banking

In the U.S. banking industry, the Federal Reserve and the FDIC are among the agencies charged with ensuring banks meet certain requirements, restrictions and guidelines. Even FERC has taken action against JPMorgan Chase and Deutsche Bank related to energy price manipulation. The agency has now threatened to impose its largest fine ever against Barclays, which could cost the British bank $470 million.

Basel III (or the Third Basel Accord) is a global regulatory standard on bank capital adequacy, stress testing and market liquidity risk agreed upon by the members of the Basel Committee on Banking Supervision in 2010–11, and scheduled to be introduced from 2013 until 2018. Basel III requirements threaten to reduce the ROE of some banks by as much as five percentage points, but the long-term effects are still uncertain as industry experts try to interpret exactly what the legislation will mean to the world of lenders.

Likewise, the newly formed Consumer Financial Protection Bureau (CFPB) is taking on multi-billion dollar industries within the financial services sector and preparing to sue companies that offer unfair or deceptive mortgages and credit cards. The payday lending industry is one that is squarely in CFPB’s cross-hairs.

While no one questions the need for fair lending practices and industry oversight, new regulations from federal agencies have a massive industry impact. Regulatory compliance cost companies money, and companies pass those costs on to consumers. In banking, that means the average cost for loans will go up in the form of interest rates and fees. For the industry, that means that some products may become so expensive and so over-regulated, that financial companies must abandon them altogether. To those in the financial services industry, such regulation poses a real threat to entire markets and associated services currently providing viable revenue streams.

Pharmaceuticals

The Food and Drug Administration (FDA) is the U.S. government agency charged with ensuring the safety and efficacy of the medicines available to Americans. The government’s control over medicines has grown in the last hundred years from literally nothing to far-reaching, and now pharmaceuticals are among the most-regulated products in this country.

The industry is facing pressure from government agencies and the insurance industry to help contain healthcare costs. This threat is coupled with the threat of further sales erosion caused by the preferred or imposed use of generic drugs or cheaper alternatives by many payers. Regulatory changes, market uncertainty, responding to price pressure and rising competition are the leading business concerns for the global pharmaceutical industry in 2013.

Airlines

For companies in the airlines industry, FAA (Federal Aviation Administration) compliance impacts all business functions operationally as well as strategically. As an example, the Continuous Analysis and Surveillance mandates require air carriers to have a method of measuring the effectiveness and performance of maintenance, inspection, and internal evaluation programs that are, in turn, important for the continual monitoring of internal processes, programs, and procedures. Mandates like this require various departments to implement policies and procedures to meet applicable Airworthiness Directives (ADs) and FAA regulatory requirements.

The daily challenges of the aviation compliance executive include rising costs, increasing regulatory compliance,the risk of non-compliance, inventory warehouse carrying costs, demand forecasting inaccuracies, and maintenance related departure delays. The problem is not alack of data gathered. In fact, most airlines are gathering much more data than they are effectively using. The problem lies inefficiently gathering the huge stream of data, increasing its quality, and processing it into information, knowledge, and ultimately actionable decisions.

Internal Forces:

There are many internal factors that can be linked to threat management, but below is a list of some significant forces to consider:

– Leadership: Leadership impacts a business more than any other single factor as it has a ripple effect on the business’ culture, ethics, employees and ultimately, its success or failure. Is the leadership team “equipped” to properly lead the organization?

– Culture: When a business’s culture stagnates and complacency sets in, performance declines, growth stalls and existing customers sense the lack of drive and erosion of value. Everyone has a role to play in the successful execution of a strategy, and a culture of accountability goes hand-in-hand with good execution. Is the culture healthy or posing an organizational threat?

– Core competencies / talent: Core competencies are the underpinnings of an organization’s skills and the cornerstone of successful strategic execution. They represent the fundamental knowledge, abilities, and expertise of an organization and are what make individuals and organizations unique. Does the business have the capabilities and capacity it needs to be successful long-term?

– Core values: When looking at Leadership as an internal force, we mentioned the effect it has on culture and ethics. Core values are another factor in the ethics equation. The system of core values that your organization owns help promote ethical business practices and shape the culture of the enterprise, the decision-making criteria of your managers and the actions of your employees. The more strongly defined the organization’s core values, the more likely that this value system will serve as a code of conduct that promotes and guides strategically-aligned behaviors within managers and employees. Are core values established and are they reinforced by the actions of the organization’s leaders?

– Ability to innovate and capitalize on innovations: The ability to innovate and the capability to successfully leverage innovations is powerful internal force and a distinct threat to many business organizations. As an example, look at the case of Kodak:

Kodak was a company that dominated in its space for over a century, yet was essentially done in by its own invention. Although the company pioneered digital technology, it chose not to capitalize on the invention. It was in 1975 that Kodak prototyped the first digital camera. From that time, and up through the 1990s, Kodak invested $4 billion on developing the photo technology utilized inside most of today’s popular smart phones and digital devices. Unfortunately, Kodak misread the real threat they were facing at that time. Buyer preferences were changing as a consumer appetite for digital technology was growing by leaps and bounds. Instead of recognizing the threat this trend posed to Kodak, the company decided to protect their stake in analog film. It turned out to be a text book misread of a major environmental threat. By deciding not to surge into the digital product arena with their own offering, Kodak allowed rivals like Canon and Sony to achieve dominant market positions built on top of powerful brands in the digital arena. The immensely lucrative analog business Kodak concerned themselves with protecting was virtually erased a decade later by the “filmless” photography that they invented.

Black Swan Events:

Black Swans pose one of the challenging of business threats to consider and plan for effectively. A Black Swan is an event with the following three attributes:

– It lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility

– It carries an extreme ‘impact’

– In spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable

The Black Swan theory was developed by Nassim Nicholas Taleb to explain:

– The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology

– The non-computability of the probability of the consequential rare events using scientific methods (owing to the very nature of small probabilities)

– The psychological biases that make people individually and collectively blind to uncertainty and unaware of the massive role of the rare event in historical affairs

Some have said that there are really two ways to approach the Black Swan phenomena in strategic planning. The first is to rule out the extraordinary and focus planning on the “normal.” The second is to consider that in order to understand something, you first need to consider the extremes, given that Black Swan effects are so significant. Those in the latter school of thought recommend planning for the outliers in order to think through impacts and contingencies. Taking such an approach can be tedious, but is the most responsible way to fulfill management duties and leads to the most complete threat analysis.

Bottom Line:

Watching the competition is but one aspect of the threat landscape, as that provide an incomplete view for true strategic navigation. This segment examined specific types of threats that organizations need to be able to detect and account for in their strategies. In the upcoming final segment of this series, tactics for detecting and surviving threats are shared, along with a model to incorporate threat surveillance into a modernized strategic planning process.

Read more:

> Read Part 1 of this series – “Most Companies Don’t See Strategic Threats Coming Until It Is Too Late – Part 1 of 3”

> Read Part 3 of this series – “Most Companies Don’t See Strategic Threats Coming Until It Is Too Late – Part 3 of 3“

Category : Business Operations

Many companies fail to recognize threats because they are internally focused – they can’t see problems ahead never bothered to look. Other companies over react to things that have already happened – which is a very expensive way to operate. With a forward looking strategic and tactile competitive intelligence program, many

of these “blind-sided” problems can be avoided.

Scott – Thanks for the comment. I agree. A threat surveillance process in strategic planning has to have a balanced view (holistic) that encompasses the internal and external business ecosystem. Next week’s segment really gets into what that looks like in more detail. – Joe