WSJ/Vistage June 2020: New workplaces emerge as employees return to work

Highlights:

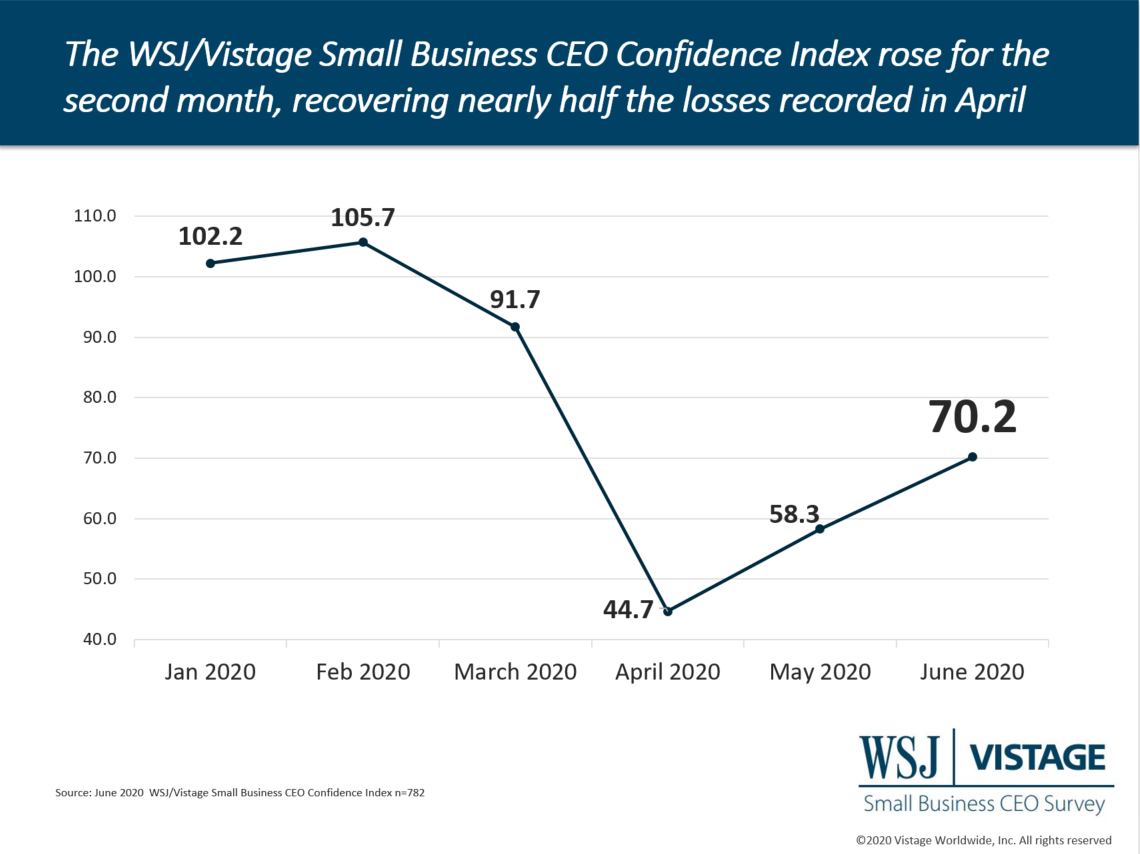

- The WSJ/Vistage Small Business CEO Confidence Index increased for the second month reaching 70.2 in June

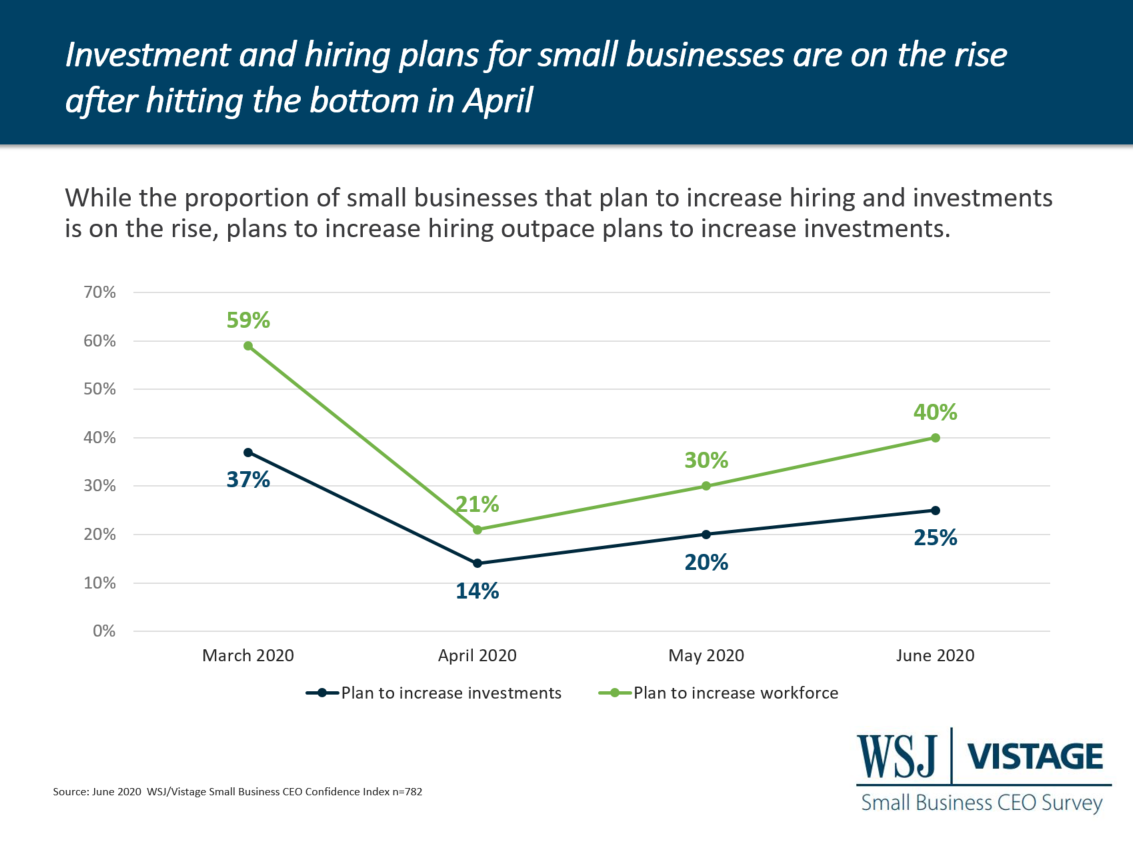

- Investment and hiring plans are on the rise after hitting the bottom in April

- 61% of those who applied for the PPP expect their loan to be forgiven

While confidence of small and midsize business CEOs tumbled in the Q2 Vistage CEO Confidence Index, the monthly survey of small businesses showed that confidence improved for the second consecutive month largely driven by increasing expectations for economic improvement. This is according to the most recent survey conducted of small businesses — those with $1 to 20 million in annual revenues — by Vistage in partnership with the Wall Street Journal.

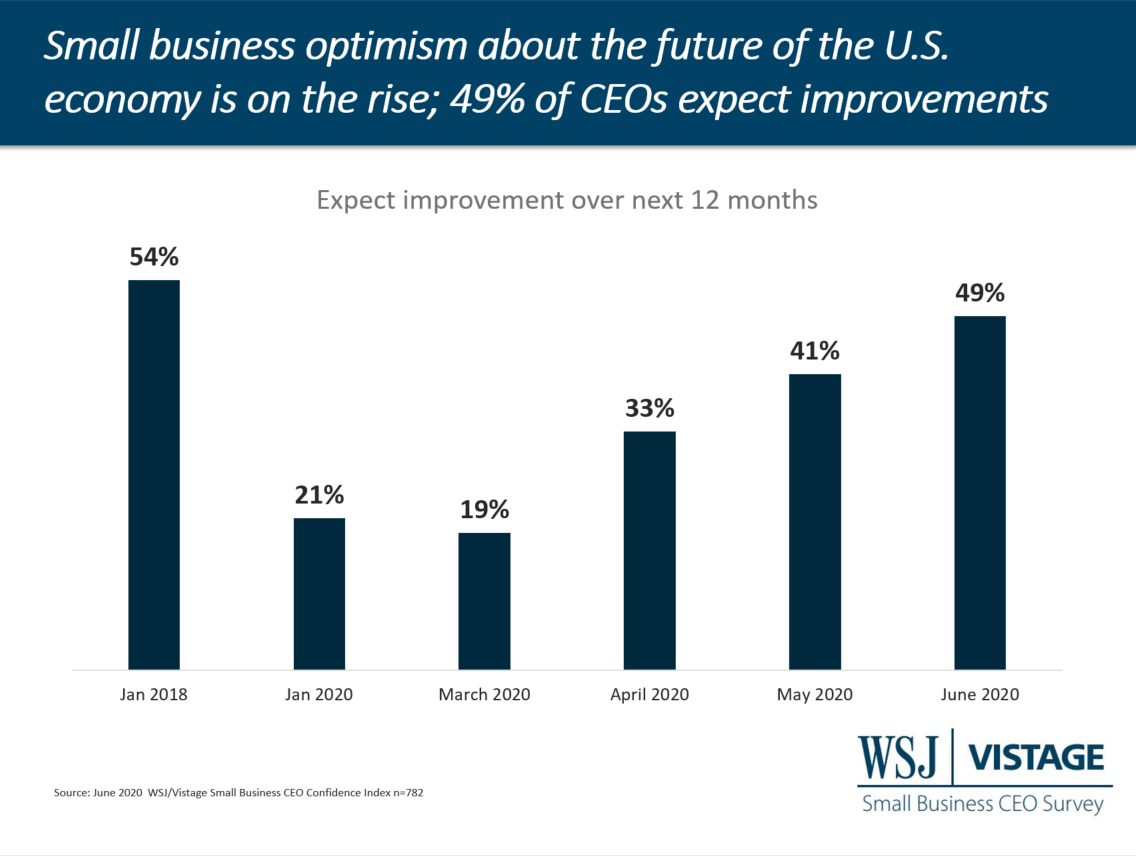

Data revealed that while small businesses still hold a negative view of current economic conditions, their optimistic outlook for the national economy over the next 12 months was a key driver in the gains in the Small Business Index. The last time small business CEOs reported such favorable expectations for the economy was January 2018. The upward trend is encouraging as it illustrates the slow climb out of the “corona ditch” — the bottom reached in April. Another indicator of improvement is that over half of small business CEOs (54%) agreed that customer activity has started to increase.

Financial assistance improves cash reserves

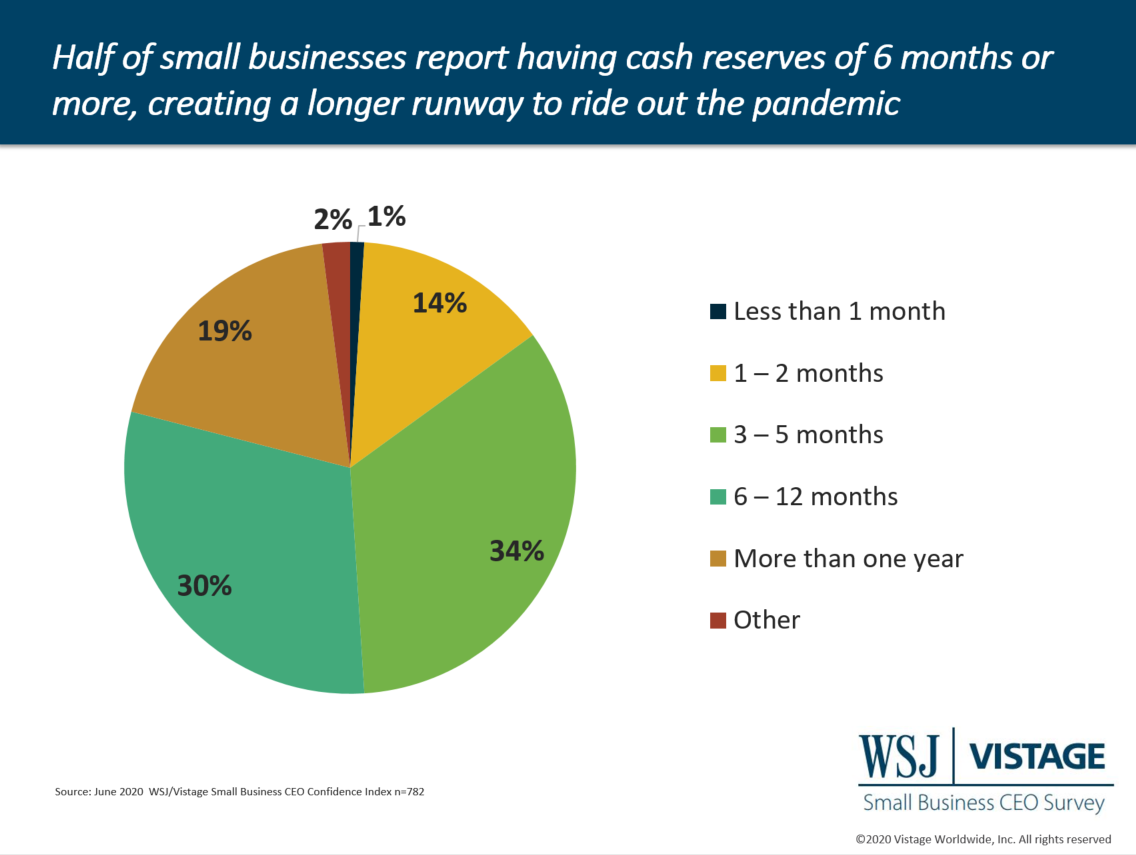

Increased customer activity and financial assistance leads to a longer cash runway for small businesses. Nearly all small businesses surveyed — 9 out of 10 — reported plans to leverage the Paycheck Protection Program (PPP). Even more significantly is that nearly all CEOs who applied for the PPP expect most or all of their loan to be forgiven.

- 61% of CEOs expect the entire loan to be forgiven

- 34% anticipate most would be forgiven

- 5% expect only some to be forgiven

As a result, half of small businesses report having cash reserves of longer than six months. With improved cash reserves, businesses can not only ride out the pandemic, they can employ the tactics necessary to thrive. This starts with ensuring they have a safe and productive workforce as business activity increases.

Workforce expansion on the rise

While maintaining the workforce is requisite for small businesses seeking forgiveness from their PPP loans, small businesses are also increasingly hiring to expand their workforces or upgrade talent.

In April our survey found that just 21% of small businesses were planning to expand their workforces over the next 12 months. While not at pre-COVID levels, that figure has almost doubled in just two months with 40% now reporting plans to expand their workforces. The record levels of unemployment have created a whole new talent pool, and 45% of small business CEOs agreed that their companies are leveraging this expanded labor pool to upgrade talent.

New workplaces emerge

Just over half of all small businesses surveyed (54%) agreed that they have robust return to work plans that they have put to use. At the time of the survey, 20% of small business CEOs reported that remote employees had returned to the workplace and an additional 25% had begun a phased plan to bring employees back slowly. Two-thirds (66%) of small business CEOs are confident that employees will feel safe returning to the workplace.

The CEOs surveyed reported that new safety workplace policy includes health checks, with more than half of all small businesses (57%) expecting to perform daily checks of employee temperatures and symptoms.

Workplace safety is critical as cases rise in certain areas and impacts on the economy loom. In fact, 70% of small business CEOs agreed that they are concerned about the impact of a second wave of the coronavirus on their businesses.

Dr. Curtin, a researcher from the University of Michigan who analyzed the data notes that “the strength shown by small businesses has been as remarkable as it has been unexpected. The risks from a resurgence in COVID-19 cases are still present, and those risks will continue until a vaccine is developed and administered. Small businesses are adopting risk-reducing safety measures and mitigating health risks that come with the re-opening of the economy.”

The June WSJ/Vistage Small Business CEO survey was conducted June 1 – 8, 2020 and gathered 816 responses from CEOs and other leaders of small businesses. Our July survey, in the field July 6 – 13, will reveal how small businesses changed their workplaces as a result of the pandemic.

Download the June report for the complete analysis

Related links

Category : Economic / Future Trends

Tags: coronavirus, US Economy, WSJ Vistage Small Business CEO Survey