Another step forward on the climb to recovery

The steady climb out of the COVID-19-induced economic collapse took another step forward, according to September data from the Vistage CEO Confidence Index survey. Far from the highly touted V-shaped recovery, the economy is rebounding at a slow but steady rate — moving closer to a new reality that reflects the systemic changes COVID-19 has brought to business and society.

Unlike other economic recessions, the economic crash triggered by the COVID-19 crisis was immediate and has impacted small and midsize businesses (SMBs) in random and unbalanced ways. Some SMBs have experienced a boom in business that has created growth challenges associated with headcount, production, capacity and distribution. Others have had to radically cut back, particularly those in industries like travel, leisure and hospitality, which have experienced permanent damage due to the pandemic.

No segment illustrates the duality of impact as much as construction. Commercial construction is struggling; many companies have seen contracts postponed or completely cancelled as companies reconsider their office needs. Meanwhile, residential construction is booming; many companies are experiencing high demand due to new requirements driven by work-from-home and young families’ desire for backyards and less turbulent suburban lifestyles.

Return of revenue

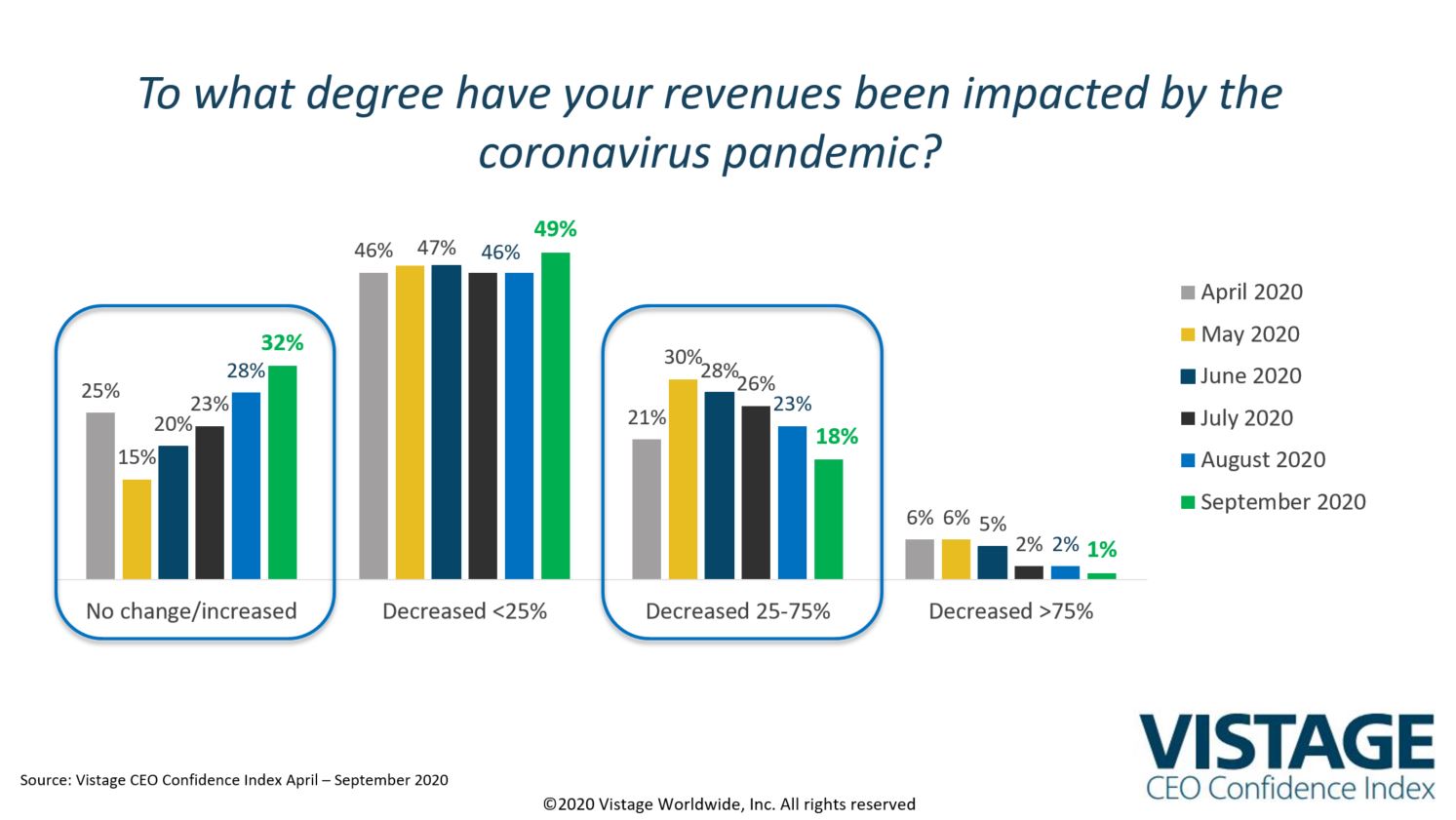

Revenue continues to improve, both in terms of how CEOs perceive its current performance, and how they project it will perform going forward. In September, CEOs’ assessment of the revenue impact of COVID-19 rebounded from the lows captured in our May survey. The proportion of CEOs reporting revenues equal to pre-pandemic revenues (9%) or greater than pre-pandemic revenues (22%) grew 4 points, to 32%. Those that reported revenue declines of up to 25% increased 4 points, while those that reported revenue declines of greater than 25-75% shrank by 6 points. This shift is a sign the economy is taking the next step up on the “Corona curve.”

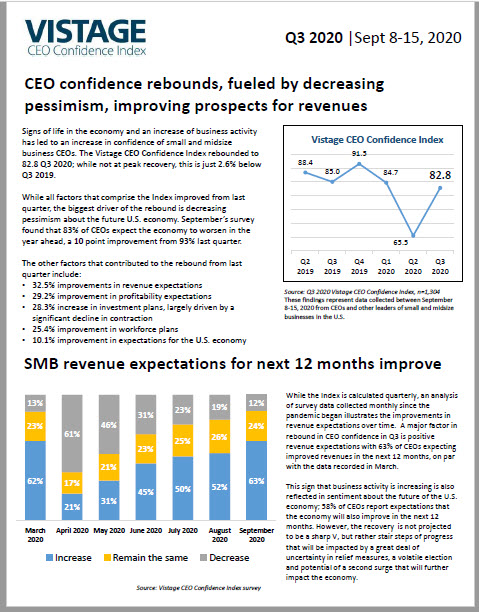

Revenue expectations also continue to increase. Jumping a whopping 11 points between August and September, 63% of CEOs now expect increased sales revenue over the next 12 months, which roughly compares to expectations from Q3 2019. Even better, just 12% of CEOs anticipate lower sales revenues in the next 12 months, an improvement from 19% last month. This shows steady progression from the lows captured in April, when just 21% of CEOs expected increases and 61% expected revenue declines.

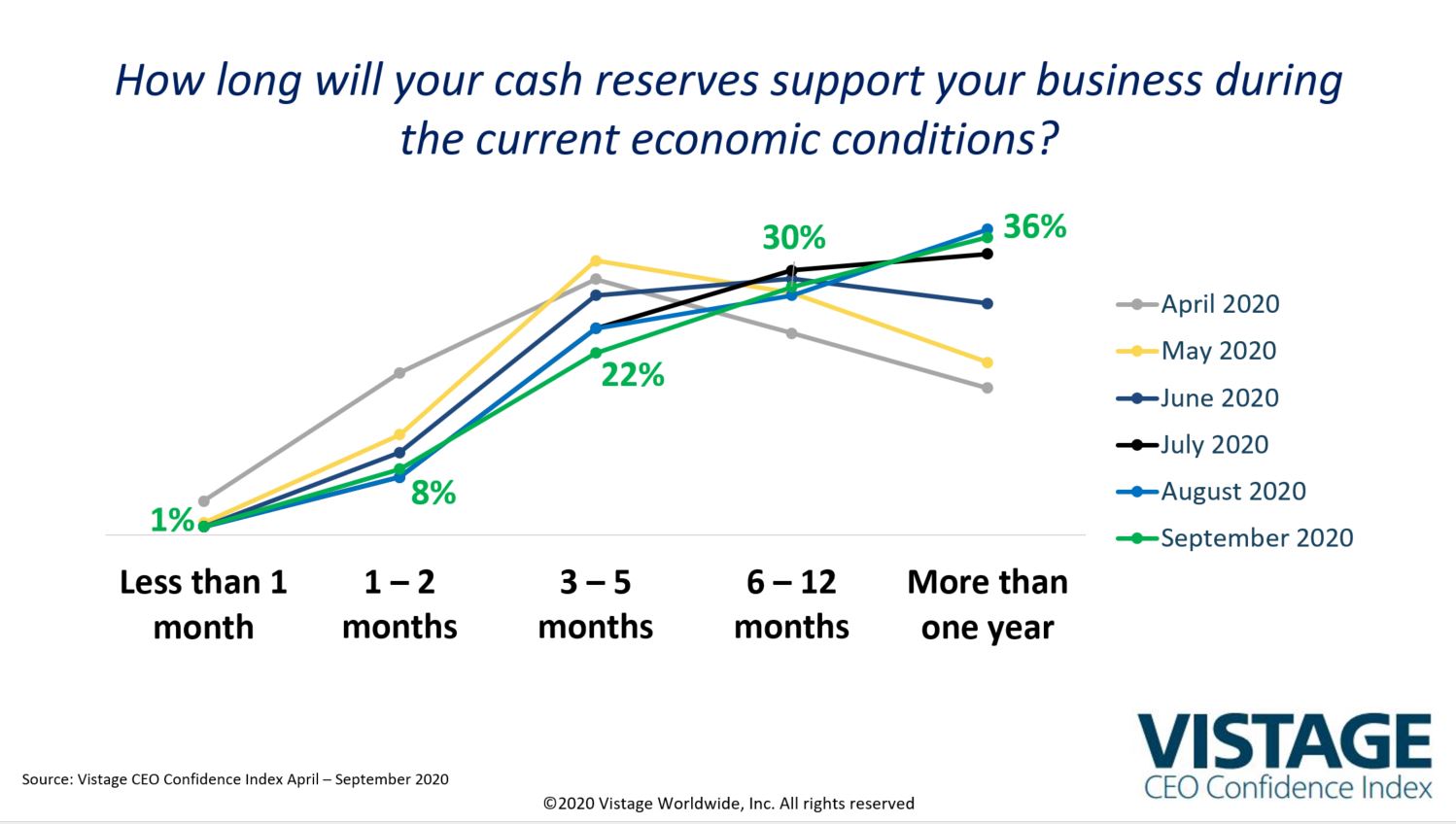

While revenue is improving, it isn’t improving fast enough for some. Improvements in cash reserves slowed for CEOs compared to the last several months. As recorded in the August survey, the majority of SMBs that received loans from the Paycheck Protection Program have already used their funds. Meanwhile, the highly volatile political climate has stalled progress on the passage of additional government stimulus packages. The 68% of CEOs who report revenue declines as a result of the pandemic may feel some pain if new relief measures cannot offset declines in business activity.

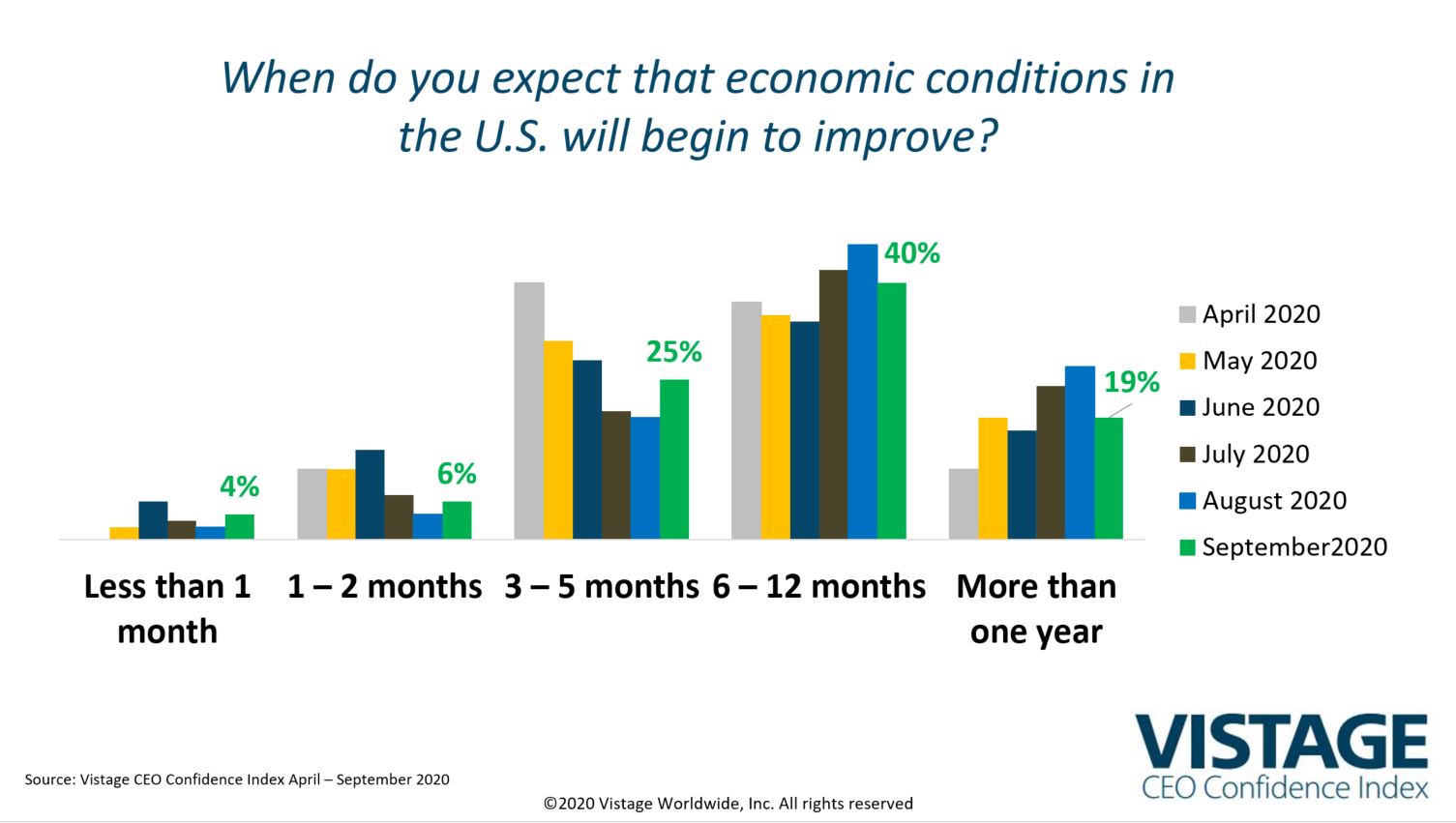

The most encouraging of all our data points is CEO expectations for when the U.S. economy will begin to improve. Since April, CEO expectations for when the U.S. economy will improve has moved progressively further out. Between August and September, the proportion of CEOs expecting improvement in more than a year fell by 8 points (from 27% to 19%); those expecting improvement in 6-12 months fell by 6 points (from 46% to 40%). The three responses that represent five months showed a continuation of positive movement, indicating that CEOs share the sentiment that an economic recovery is closer rather than further away. Only time will tell if this will play out, but the data at least confirms rising optimism.

Biggest business challenges

The climb to recovery is not without obstacles. While the business challenges faced by CEOs during the pandemic are not necessarily new, they are exacerbated by other demands — namely, that CEOs have to navigate a recovery and get to a new reality while running their businesses. In our analysis of 780 open-ended responses from CEOs to the question, “What is currently the biggest business challenge you face?” we identified the top-five challenges as:

1. Talent: Talent wars reignite

- Hiring: Finding, recruiting and hiring talent is once again a major issue

- Remote work: Managing the remote workforce and when/how to bring them back

- Culture: Maintaining culture, nurturing culture for a remote workforce and supporting morale

- Retention: Employees have options as the search for talent intensifies

2. Customers: The big slowdown

- Sales cycles are longer, deal sizes are smaller, and delays are more common

- It’s harder and takes longer to find and engage prospects

- Decision-makers are more conservative and careful

- Pipelines are smaller, less reliable, harder to grow and insufficient to meet targets

- Inability to travel and reluctant customers make face-to-face calls impossible

- Virtual selling is a new requirement for all, and hard to master

3. Political: A volatile time

- The volatile and unpredictable political environment drives uncertainty

- Some fear a republican win: The possible reelection of the president

- Some fear a democratic win: The potential of a Biden win

4. Financials: Reduced revenue rules

- Reduced revenues drive all aspects of financial decisions

- The problems of cash flow are becoming more acute for some

- The lack of growth, and inability to return to growth, creates concern

5. Uncertainty: The great unknown

- The volatility and uncertainty of a variety of pressures — political, economic, health, business activity — makes everything harder and planning impossible

Other challenges cited by respondents include issues unique to industries and local economies, and those related to supply chain, COVID-19 related issues and public safety, and productivity/technology.

A new reality

There is little question that the COVID-19 crisis is a black swan event. It was completely unpredictable — and yet, in retrospect, we should have seen it coming. Between disaster movies about deadly viruses to close calls with H1N1 and Ebola, a global pandemic was an inevitable reality.

This particular black swan event will have a profound and lasting impact on our businesses and lives. The movement toward work-from-home, coupled with new requirements for office workspace design, will permanently change the way we work. Our dependence on technology will only grow as we rapidly adapt to virtual environments for work, school and even social interactions. E-commerce will accelerate the decay of brick-and-mortar retail. Business travel will never return to the pre-COVID-19 levels. Everything will become a touchless experience. All of this has been driven by the radical behavior change we’ve seen in just a few short months.

The next several months will determine the rate and direction of our recovery — whether we continue a steady climb, plateau or slide backwards. It’s unclear what will unfold, and mixed messages from leaders, political rivals and media experts only add to this uncertainty. Emotions run deep as we close out the most volatile political season in memory.

CEOs must continue to make great decisions for their business, while also considering the impact of those decisions on their employees, families and communities. In fact, the concept of optimized decision-making has never been more important. As decisions grow in complexity and importance, CEOs must continuously refine their instincts, improve judgement and expand their perspectives by leveraging the people and resources they trust. A COVID-19 recovery is slowly progressing, but it’s up to CEOs to decide how they’ll move forward.