Small businesses plan investments in growth amid climbing revenue projections [WSJ/Vistage April 2021]

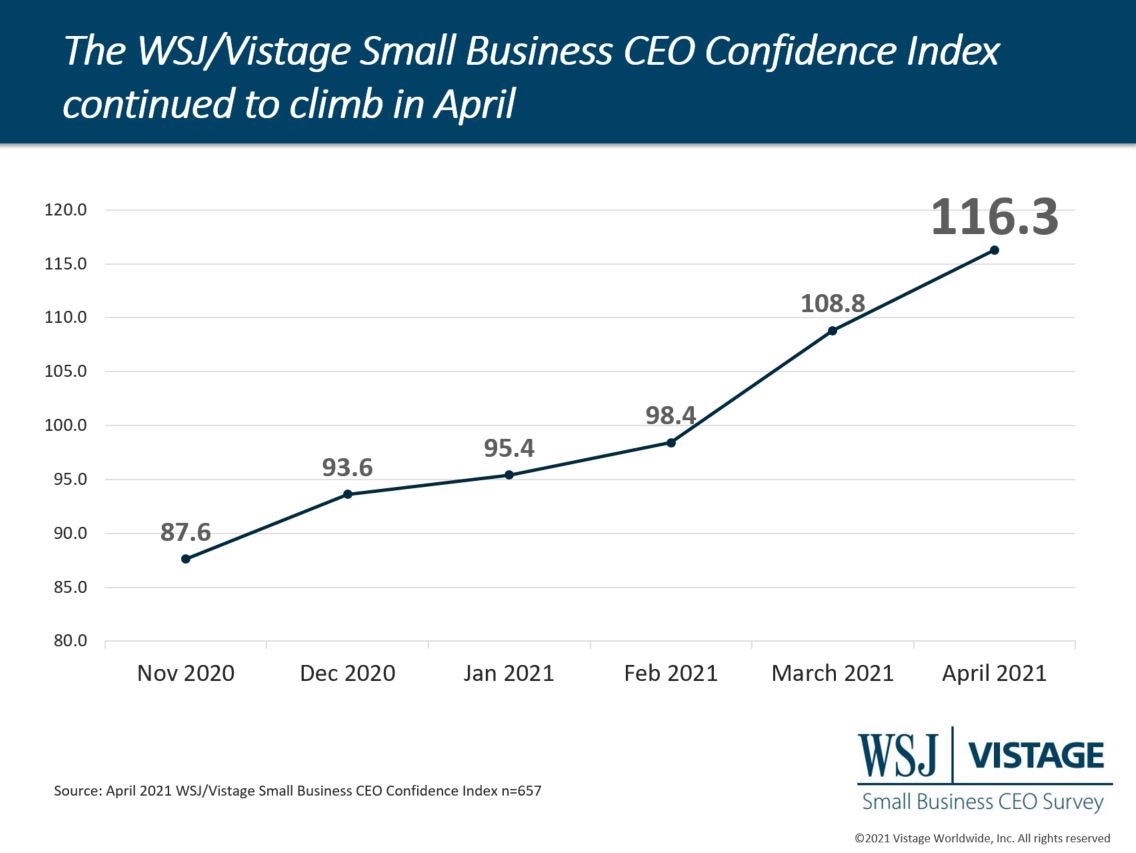

Just one year ago in the depths of the pandemic, business activity levels plummeted along with CEO confidence. Now a month after record-setting gains realized in our March survey, the “spring thaw” of pandemic recovery continues. Optimism among small businesses continues to blossom in the most recent survey conducted by Vistage in partnership with the WSJ. In April, the WSJ/Vistage Small Business CEO Confidence Index climbed to 116.3, the highest level since the burst of confidence in early 2018 when optimism was driven by Trump’s tax cuts.

DOWNLOAD APRIL 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD APRIL 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

Nowhere to go but up

While positive headlines of vaccine distribution and lessening restrictions are drivers for optimism about the future, it’s important to note that this month the year-over-year comparison of our survey data is against the pandemic low reached last April, when the Index was recorded at 44.7. The 160% YOY improvement in the Index from last April to this April is primarily driven by sentiment about the economy compared to last year. Last year a near-unanimous 94% of small businesses reported that the economy worsened compared to the year prior; this month’s survey found that just 13% of small businesses believe the economy has recently worsened.

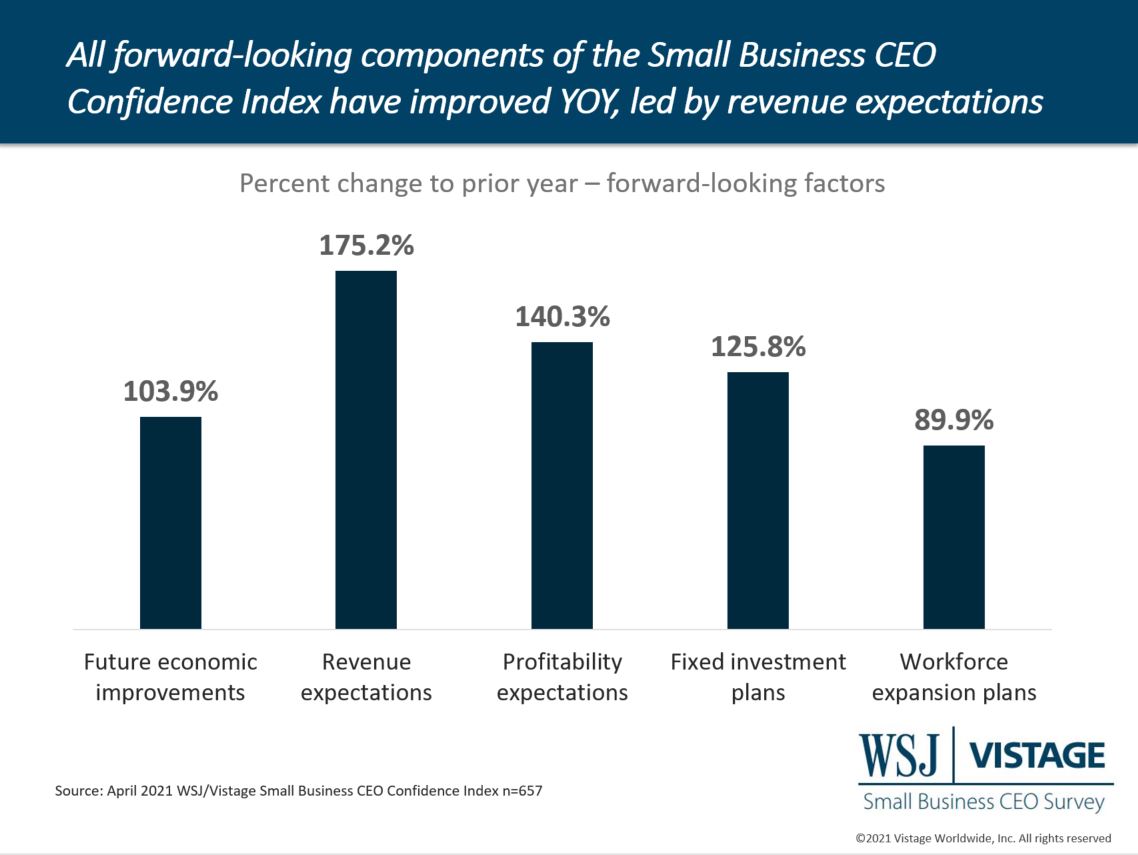

Looking forward over the next 12 months, all other components of the Index also posted YOY increases, led by the 175.2% gain in revenue expectations.

Slowdown in monthly gains

While all components of the Index improved over last year, when looking at month-over-month changes, the improving trend for future economic expectations has paused. In April, 66% of small businesses reported they expect the economy to improve in the next 12 months, on par with last month’s 67%.

Profitability expectations saw a modest decline from last month, with 59% of small businesses expecting increased profitability compared to 61% last month. Rising costs of materials and wages are presenting challenges for small businesses, who are also continuing to be plagued by supply chain problems as reported by 44% of small businesses last month.

Investing in the future

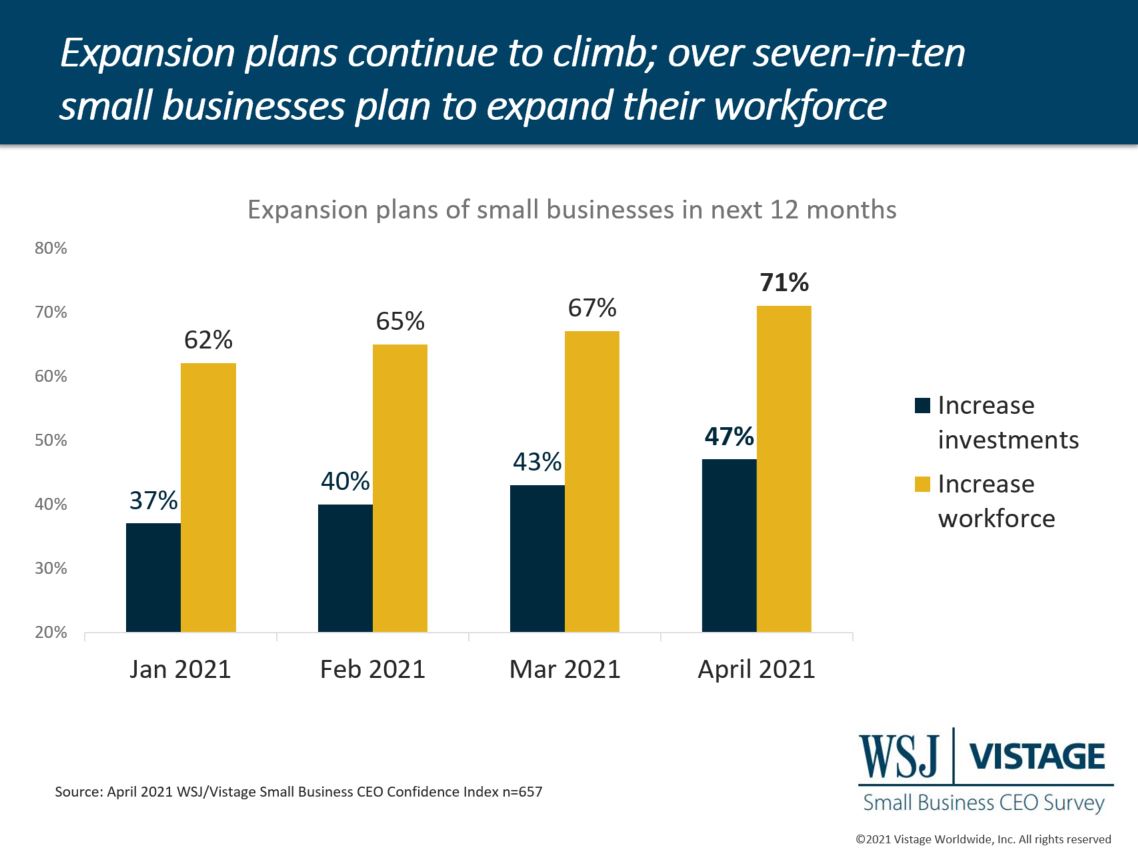

With 66% projecting the economy to improve and 78% expecting increased revenues in the year ahead, small businesses are also planning to invest to be able to capitalize on that opportunity.

Since the beginning of the year, the proportion of small businesses that are investing in fixed investment or their workforce has continued to climb, with the April survey revealing that 71% of small businesses plan to expand their workforce and 47% plan to increase fixed investment spending. Interest rates remain low, making this an ideal time to invest for the future. As the talent wars become more competitive small businesses will have to refine their talent management strategies, aligning their recruiting messages with the changing needs and expectations of candidates.

Exercising caution

While strategies and tactics to manage growing demand are the priority for small businesses, it’s important for CEOs to stay aware of local trends in vaccine distribution and COVID-19 cases in their community, understanding the potential risks while maintaining policies and practices to keep employees safe. Just last month, Malta entered into a month-long shutdown that turned into seven weeks. The spikes in India are overwhelming the healthcare system like we saw happening in Southern California in the fall. Winter in the southern hemisphere has created spikes in South America. We have to hope that the vaccine distribution in the U.S. will keep us ahead of the variants and spikes we see occurring in certain parts of the country, but hope is not a strategy.

The majority of small businesses in prior surveys indicated they would recommend but not require vaccines for their employees, as many believe that vaccination is a personal choice. In the April survey just 8% of small businesses said they would require vaccines now that they are available to all adults.

However, small businesses are more likely to require and support masking as a safety measure to keep employees and customers safe; just over half – 57% – report they are currently requiring masks. This may change as mandates lift, and it becomes a choice for companies and individuals to make. But ultimately small businesses play an important role in keeping their employees, families and communities safe.

Download the April report for complete data and analysis

For the complete dataset and analysis of the April WSJ/Vistage CEO Confidence Index survey from Dr. Richard Curtin, download the report and infographic to learn more, including:

- Improving optimism about the economy

- Investment and hiring plans continue to grow

- Revenue and profit expectations rise slightly

DOWNLOAD APRIL 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD APRIL 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

Related links

- About the WSJ/Vistage Small Business CEO Survey

- Interactive data from WSJ/Vistage Small Business survey

|

Survey Methods The April WSJ/Vistage Small Business CEO survey was conducted April 5 – 12, 2021 and gathered 657 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our May survey, in the field May 3 – 10, 2021, will capture sentiment of small businesses as restrictions lessen. |

Category : Economic / Future Trends

Tags: coronavirus, US Economy, WSJ Vistage Small Business CEO Survey