Optimism surges as CEOs prepare to ride the economic wave [Q2 2021 CEO Confidence Index]

Beyond the expected economic recovery, the optimism of small and midsize business CEOs is now surging with the economic wave caused by the new, post-COVID reality and market activity. The Q2 2021 Vistage CEO Confidence Index reached 108.8, the ninth highest level recorded since the inception of the Index in 2003. In comparison, the Index spiked to 110.3 in Q1 2018 following tax legislation/reform, and also was elevated for seven consecutive quarters from Q3 2003 to Q2 2005 after the burst of the internet bubble in 2001. CEOs are now preparing to ride on the wave of economic recovery.

>> Download the Q2 2021 Vistage CEO Confidence Index report

Year-over-year comparisons are significant given where we were last June compared to today. Economic expectations for the next 12 months tempered from last quarter, with 54% of CEOs expecting improved revenues in the year ahead compared to 68% in Q1 2021. Other forward-looking indicators grew again, led by increased plans for investments and hiring. There were also incremental improvements in already strong revenue and profit expectations. The result — supported by external economic forecasts of significant growth this year and into 2022 — is the challenge for CEOs to make great decisions that will allow them to set their sails to go full speed ahead into the start of the next growth wave.

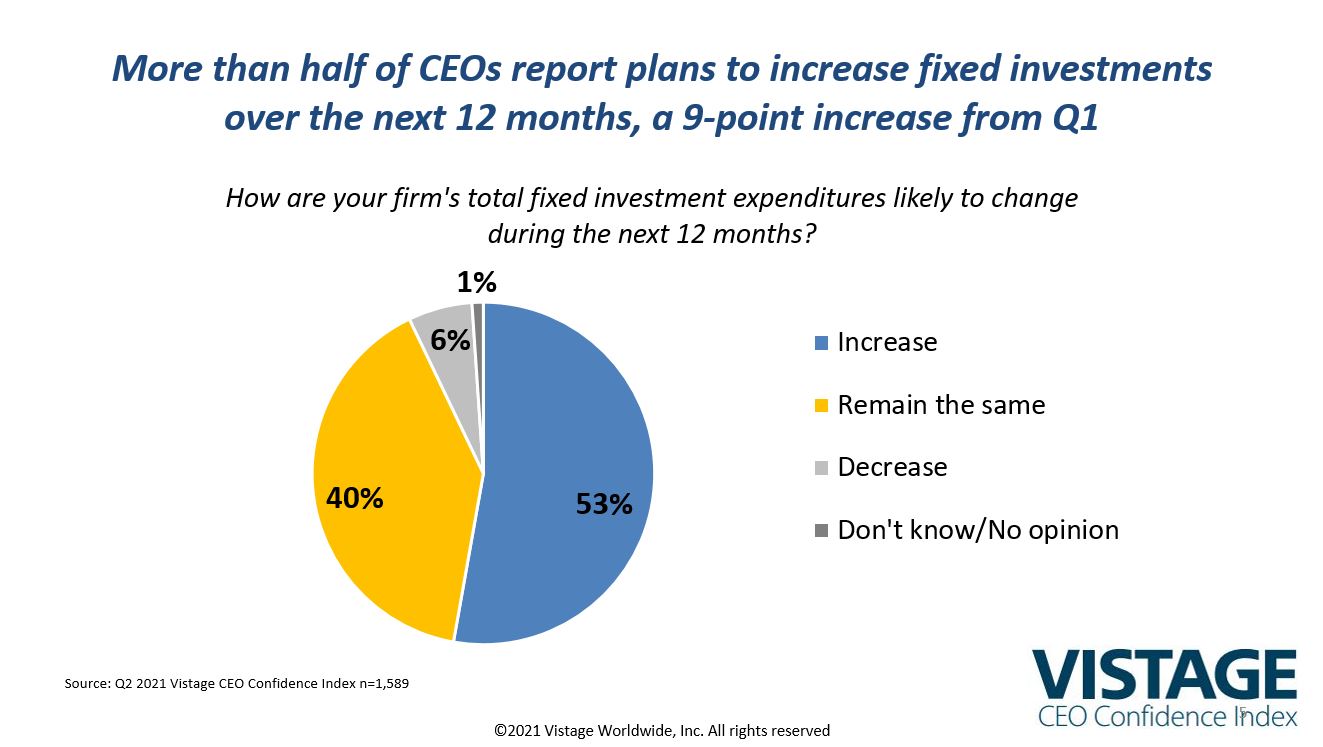

Nothing is a better indicator of confidence than plans to increase investments and headcount. Over half (53%) of CEOs plan on increasing fixed investments in the year ahead, up from an already high 44% in Q1. Increased investments in technology to reduce or offset labor were reported by 65% of CEOs, highlighting the increased attention paid to digital transformation following the pandemic. Those organizations further down the digital transformation path fared better when workplaces shut down and employees went home. Those organizations were able to quickly pivot, thanks to their IT infrastructure and a Work from Home (WfH) model that saw prior digital transformation investments pay off.

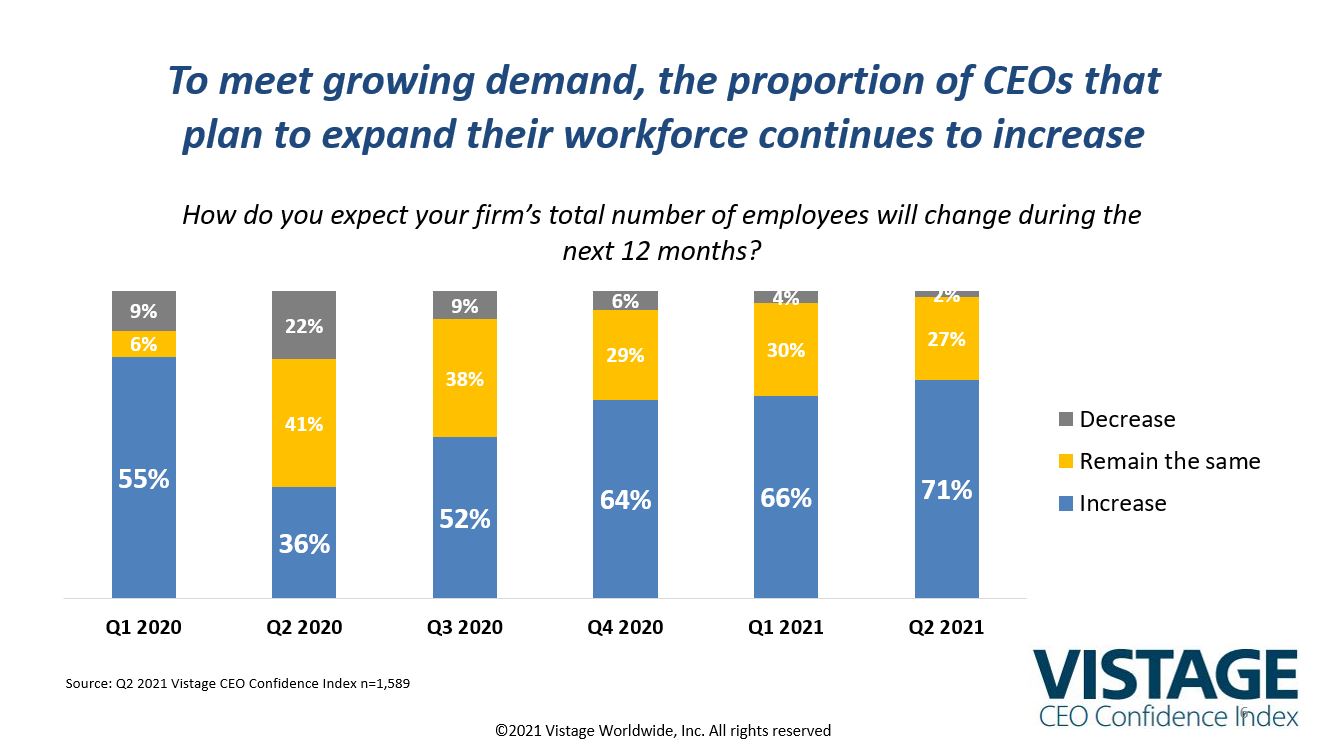

Increasing headcount is a critical part of CEOs’ expansion plans as 71% plan to add people to their organization over the next 12 months. New headcount incurs costs before productivity, but keeping pace with growing customer demands and market opportunity leaves CEOs with little choice but to participate in the raging talent wars both to retain and protect their current people as well as to compete for fresh talent on the new battlefields of Talent Wars 2.0. CEOs are being forced to increase wages (56%), refine their recruiting strategies (51%) and focus on developing their existing workforce (50%) to compete for hourly employees (44%), skilled workers (41%) and professional staff (36%).

Headwinds

While all the economic conditions are favorable, there are headwinds building that could slow expansion and challenge growth.

Inflation: Inflation has recently surged as consumers and business rush back into the marketplace as quickly as they ran from it a year ago. Absorbing the shock of volume has caused shortages as supply struggles to meet demand. CEOs of small and midsize businesses (SMBs) are seeing increased costs from suppliers (80%), labor costs (79%) and raw materials (64%) which all validate the concepts of supply and demand learned in Econ 101. As a result, 71% of CEOs plan to increase their prices, further feeding the inflationary cycle. Once the system catches up to the surge, as has been seen with the price of lumber finally beginning to fall, we should see inflation drop to a still higher, but more manageable pre-pandemic level.

Talent scarcity: Surging demand for workers at all levels has created a talent shortage, especially in those verticals least affected by the pandemic. Increasing pay, competition and the ability to migrate up to a skilled position combined with government benefits has left a vacuum for the base, no/low experience hourly worker. Skilled workers like truck drivers, welders or trained medical professionals are in short supply and high demand while the professional workforce has never had more leverage. While this will temper as the economy balances for the coming growth cycle, the Talent Wars will continue to rage.

Supply chain: More than twice as many CEOs say supply chain issues are getting worse (46%) than believe it is slowly improving (22%). Shortages of raw materials, computer chips and shipping containers combined with backlogged ports for unloading and absent truck drivers to deliver the goods has challenged the global supply chain to catch up. Its ability to quickly shutdown is not equal to the challenges of restarting and reconnecting a complex and intertwined global system for production and delivery. Again, time will solve some of the issues, but the long-term impacts will have to be absorbed and accounted for going forward. Apart from time, there are few solutions to this complex challenge.

A global pandemic: While data for infections, hospitalizations and deaths have dropped dramatically in the US since peak-COVID in January 2021, the story is not the same around the world. Europe is slowly getting back on its feet, but India, Brazil and many parts of the less-developed world may not have seen the worst with new variants emerging. Even China continues to see spot flashes, the most recent shutting down ports for a week causing a ripple delay throughout the distribution and logistics system. Until vaccines are administered around the world, which may take several years, the impact of the pandemic will continue to be a drag on the global economy.

Beware the Undertow….

Like with all big waves, the unseen undertow, lurking just beneath the surface, is equally as strong and deadlier as the surging waves above. In this case it’s the rising migration and revolt of the workforce.

The pandemic has changed us all in ways that still have not been entirely recognized. It has forced just about everyone at some level to recalibrate their personal priorities and purpose. For some that means early retirement or not returning to the workforce while government benefits remain strong. Nearly two million women left the workforce due to challenges with schools being closed, the collapse of the child care industry or the need to care for and protect aging parents. Some immunocompromised workers remain fearful of COVID and the emerging variants. Even some highly compensated professional workers are rethinking their desire to get back into the “rat race,” preferring to scale back to spend more time at home and rebalancing their work-life integration.

Many workers are able to move up the employment hierarchy. With everyone raising wages to compete, basic, unskilled hourly workers can find higher paying, improved jobs in the workplace. The very good hourly employees – those who are willing to show up every day, work hard and are able to pass a drug test – have the opportunity to compete for even higher hourly wages and better jobs. Thanks to the explosion of online retail, warehousing and distribution is pulling in workers for higher wages and potentially better working conditions. 16% of CEOs report leveraging some type of apprenticeship or intern program to create their own workforce, which provides reliable workers the skills they need to succeed. Companies that employ strategies to grow their own workforce are able to tap into the ranks of the unskilled, inexperienced workforce, which in turn enables workers to migrate upward into more stable, better paying careers.

The biggest shift and strongest undertow is seen with the professional workforce of knowledge workers. As we shared last April, the work from home (WfH) genie is out of the bottle, and for many there is no going back. With vaccination rates climbing and more states opening up, CEOs are now inviting their employees to return to the office. Soon they will be requesting a return, and some will eventually require a return once we get past summer and schools reopen in person for the fall. Prior to the pandemic, just a handful of companies were fully remote with isolated instances of WFH. 15 years of behavior change occurred in just 30 days as the pandemic chased knowledge workers from the office and we all adapted to functioning and working in the digital frames of Zoom. Now 68% of SMBs report they will have some form of a hybrid work environment.

How to hybrid is the big decision facing CEOs. The desire to have employees come back to the office from CEOs is not necessarily consistent with what workers might choose. Multiple employee studies demonstrate 41 – 47% of knowledge workers will be looking to change jobs in the year ahead primarily based on the flexibility afforded to them in the workforce model of their current employer. Having gotten a taste of WFH and not missing the stress of the daily commute, knowledge workers will look for roles that better align with their newfound priorities and purpose. Once CEOs choose their workplace model – office, hybrid or fully remote – workers will determine if that is how they want to work and the great knowledge worker revolt and migration will start. With the insatiable demand for talent, knowledge workers now have the power and alternatives to find a workplace that aligns with their priorities. Over the next 12 to 18 months this great migration will re-shuffle the workforce.

The challenge for CEOs is that no one has ever had to make decisions about how to return to the office or “How to hybrid.” There is no data, there are no experts or anyone with experience in transitioning into the new reality of the post-pandemic workplace. CEOs are navigating a surging economy without even a sextant to guide them. And while no one knows what the right answer is for any business, you can be sure that every wrong answer will be punished, causing many a pre-pandemic successful business to crash on the shoals of change.