How to capitalize on the marketing revolution

In years past, we have published marketing spending benchmarks gathered through the CMO Survey — a collaboration between American Marketing Association, Duke University and Deloitte. It’s important to note that the companies that participate in the survey have Chief Marketing Officers, and thus may spend more on marketing than Vistage members.

Yet, 62% of respondents are B2B (business-to-business), 40% are less than $100 million in revenue, and analysis of annual benchmarks informs on key marketing trends that impact all businesses.

There is much to learn from this year’s CMO survey and other changes in the environment.

- When compared to the Vistage Confidence Index, CMO participants are less optimistic than Vistage members and are likely to curtail marketing spending. That is, competition may be reducing marketing investment and could lose share to more aggressive rivals.

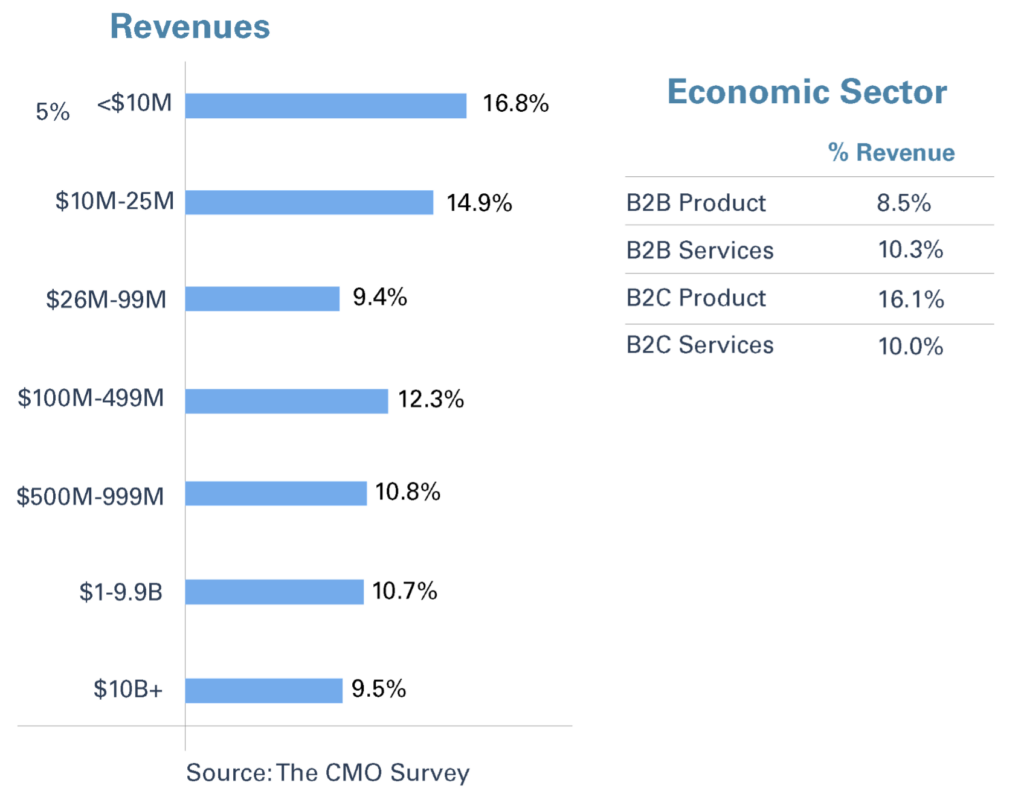

- While marketing spend has dramatically increased over the last few years, it slowed from growing 10% in 2021 to a 3% increase last year. See Marketing Spending Benchmarks below.

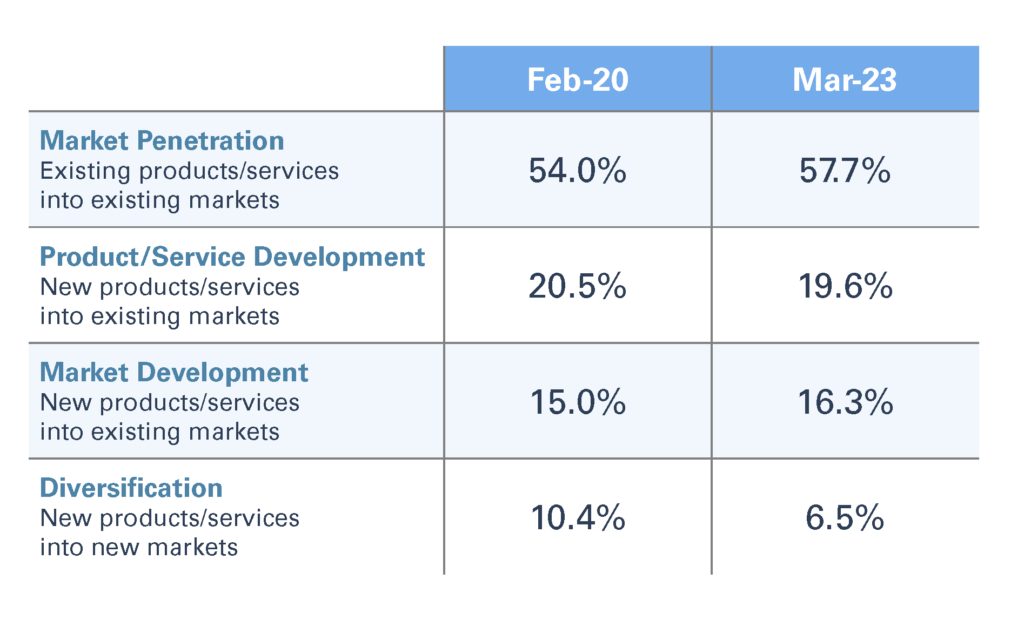

- In terms of strategic growth initiatives, 58% was spent on low-risk market penetration activities, with 71% of revenue increases coming from organic growth.

- In anticipation of a recession, companies have dramatically decreased investment in product development.

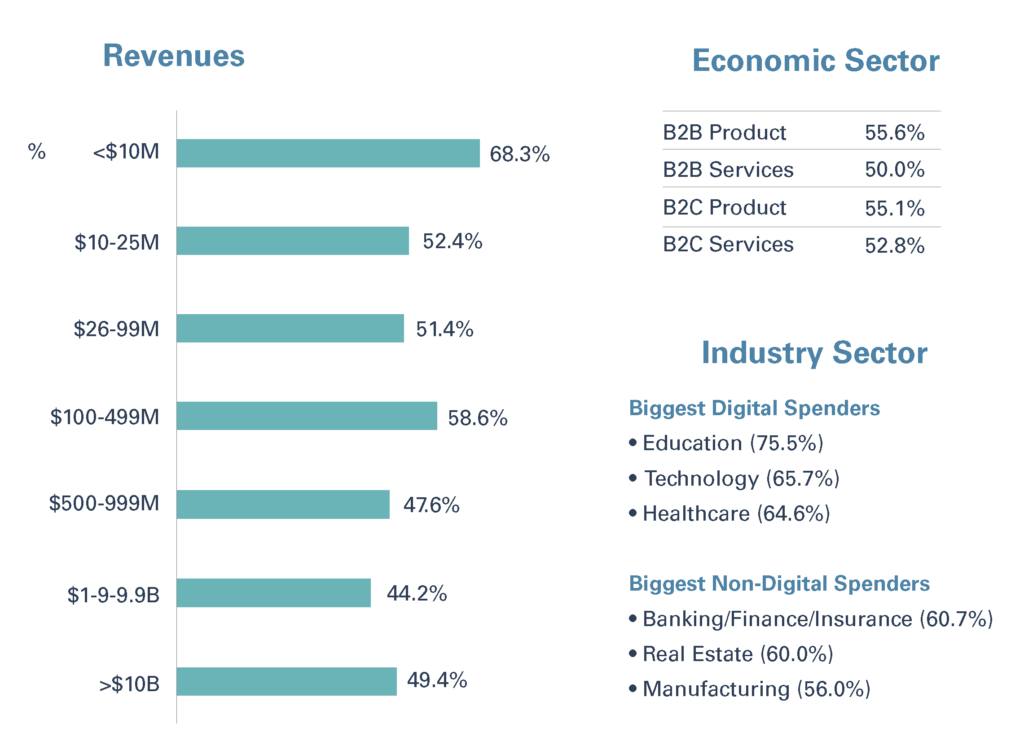

- Digital growth has also slowed to around 8.2% last year. On average, CMOs spend 54% of their marketing budget on digital. AI is taking center stage.

- Yet, marketing as a percentage of revenue is increasing in some companies as a result of softer sales increases.

- Inflationary pressure is impacting marketing investment, but e-commerce is more insulated from inflation. This could be a function of providers having the ability to price more dynamically.

- Product quality is of heightened importance in a period of supply-chain-induced inflation. While price is still the No. 2 buying criterion, the importance of price has dramatically declined since 2019.

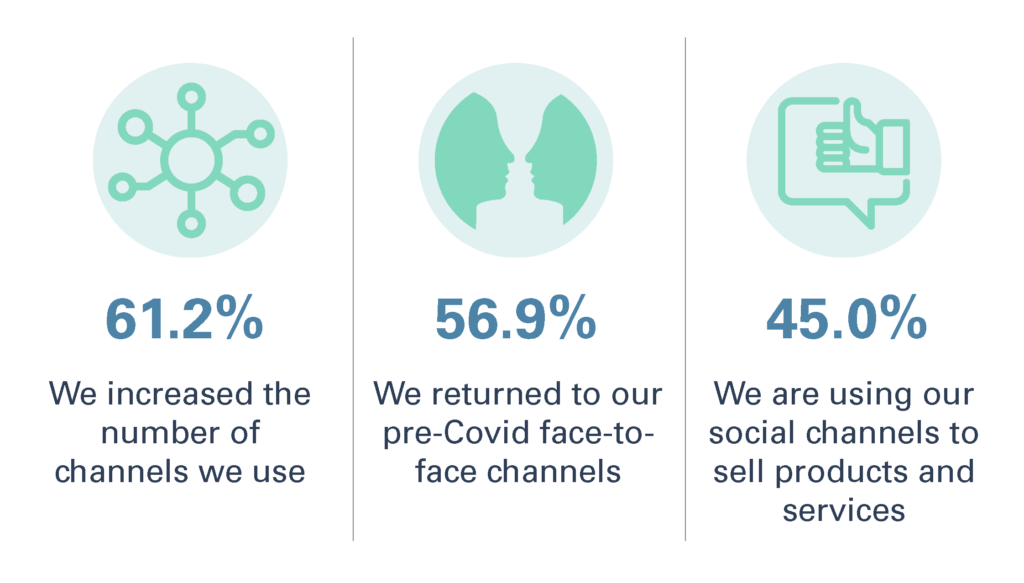

- 61% of companies have increased the number of channels they are participating in since the beginning of the pandemic (64% among B2B services). Only 57% have returned to pre-COVID, face-to-face channels. In other words, about half of suppliers have found new ways to interact with and sell to customers.

- There is a shift away from CRM, brand building, and customer experience, where spending dropped roughly 50% in the last year. We suspect some of the drop in CRM investment may have to do with massive adoption in years prior.

- The role of marketing is typically focused on branding, advertising and digital. But often these activities are less strategic and more tactical.

- 55% of CMO survey companies maintain a singular brand.

The shift toward conservatism

Given recession fears, companies are not only tempering marketing investment, but have shifted away from diversification to investment in core (market penetration).

They are also shifting investment away from product development to selling existing products into new markets. There is a clear opportunity for growing companies to expand into new markets where competition is weakened.

CMO Company Growth Strategies

Source: CMO Survey and Christine Moorman

Marketing spending benchmarks

When utilizing the Vistage Confidence Index as a gauge for sentiment, there is a clear indication that Vistage members are more optimistic and fell less vulnerable to swings in the economy than nonmembers.

According to the Q1 2023 Vistage CEO Confidence Index, 83% of respondents expect revenues to either increase or stay the same in the next 12 months. As noted, participants of the CMO Survey skew slightly toward technology and those who heavily invest in marketing. Smaller companies spend a much higher percentage of revenue on marketing (as they are Blitzscaling) than larger, established companies.

CMO Company Marketing Spending as a Percentage of Revenue

Within our firm, we benchmark various statistics across dozens of companies and Vistage member clients, who are typically B2B service companies that spend closer to 4% of revenue on marketing. Companies in some sectors might even spend less.

Impact of digital transformation & AI

Hypergrowth (often startups who are Blitzscaling) companies spend a higher proportion on digital, as do providers in education, technology, and healthcare. But the methods by which companies are utilizing digital is changing.

CMO Companies — Percent of Marketing Spending on Digital

Source: The CMO Survey

Vistage members are coming around to the idea that they will either embrace AI, or they will compete with it.

In our Q4 2022 Trend Report, we suggested that AI as a service would be one of the biggest technology trends for 2023, and Vistage members are utilizing low-cost subscription AI tools such as:

AI video: Providers like Synthesia, which creates realistic-looking AI models for AI-enabled videos.

Content creators: ChatGPT-4, the paid version of ChatGPT, has an even more powerful content creator than the free version.

Contact scrubbers: Seamless.AI and Wiza can mine the internet based on contact lists, tradeshow attendees, or LinkedIn connections and provide names, emails, phone numbers, and addresses.

Answer bots: Frase.io acts as the first line of defense for customer service questions.

Channel marketing

While face-to-face customer interactions and relationships will always be important, there is a shift underway where a significant portion of relationships are digital. According to the JOLT Effect, 80% of client decision-making is done outside a sales call.

Source: The CMO Survey

Only 57% of CMO companies have returned to face-to-face channels.

Findings and recommendations

- In a downturn when conversion is more difficult, client retention is of heightened importance. Growing volume with existing clients at zero acquisition cost is job No. 1. Customers may have more price sensitivity. Measure the “average tail” and take action at points where clients are at greatest risk.

- At a time when other companies are de-escalating marketing investment, growing companies should continue to invest in marketing. As ITR points out, the smart money will be invested in taking advantage of an upturn (following any upcoming recession).

- Providers should quantify their addressable market and target their marketing to specific niches.

- Private companies should specialize based on niches where they can win, and ensure a “connected offer” by having dedicated, industry-specific website landing pages, and organizing sales into sector specialists when applicable.

- Concentrate marketing investment on top prospects (account-based marketing).

- The marketing department of the future looks very different than those of the past. Today, sales and marketing must be integrated (often under one manager), with the capability to conduct market research, build channel strategies, and execute on digital. Private companies need to uplevel marketing to be more strategic and ensure their sales managers are digitally savvy.

- To compete in an AI-driven world, providers must have both content and insight. Make sure you have a specific content creation strategy as well as the resources to execute.

- Retargeting is considered by many to be the most productive marketing activity. Explore ways to track users on your website, and send them relatively low-cost ads on other channels.

- The ability to see an actual return on marketing investment in real time is critical. Digital enables more precise measurement, and every company should have clear marketing KPIs (key performance indicators). Marketing should adopt more strategic metrics including brand perception and pricing power.

- Providers must track the customer journey so they are delivering specific messaging to buyers based on where they are in that journey.

- In terms of messaging, de-risk the offer for your clients. In times of uncertainty, you may need to “chunk down” the work.

- Ensure a significant proportion of marketing spend is digital, including using cost-effective AI tools when applicable. Upgrade ChatGPT to 4-Plus ($20 per user per month) for power users. Providers are leveraging AI to create significantly more content. While the use of various AI tools is exciting, the real benefit may be in combining tools such as using Synthesia.AI to create a video, and Seamless. AI to procure a targeted list of people to distribute it to.

There is a race to create content. Savvy marketers will gain a significant competitive advantage that is only amplified by digital tools. Make sure you’re in a position to capitalize on the marketing revolution.

Related Resources

Big-picture implications: Transforming business with artificial intelligence