Big picture implications: Hiring in 2024

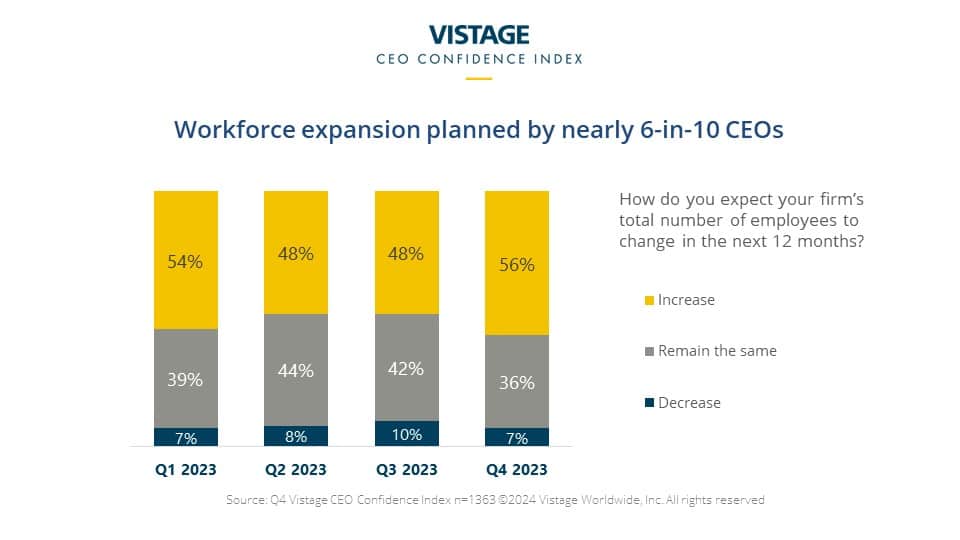

Workforce expansion plans are more optimistic at the start of 2024; new budgets and improved revenue predictions have contributed to an 8 percentage-point increase in CEOs planning to increase personnel in the next 12 months versus 7% of CEOs planning to decrease their workforce.

As quit rates continue to slow, the hiring landscape has improved with 35% of CEOs reporting it is easier than at the start of the year and only 11% reporting it is more difficult. At the intersection of investments and talent are efforts to improve efficiencies and leverage automation. Whether the goal is reduced hours, improved efficiencies or addressing talent gaps, investments in technology will offset the lack of personnel.

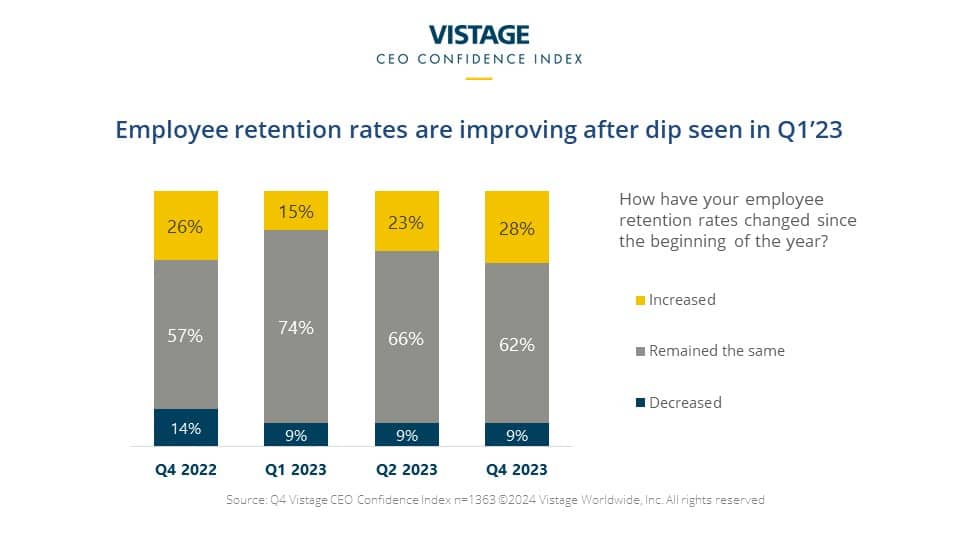

On the other side of the talent equation, employee retention rates are improving with 28% of CEOs reporting increases in retention, and just 9% reporting decreases. This is according to the Q4 Vistage CEO Confidence Index report.

Wages continue to impact businesses

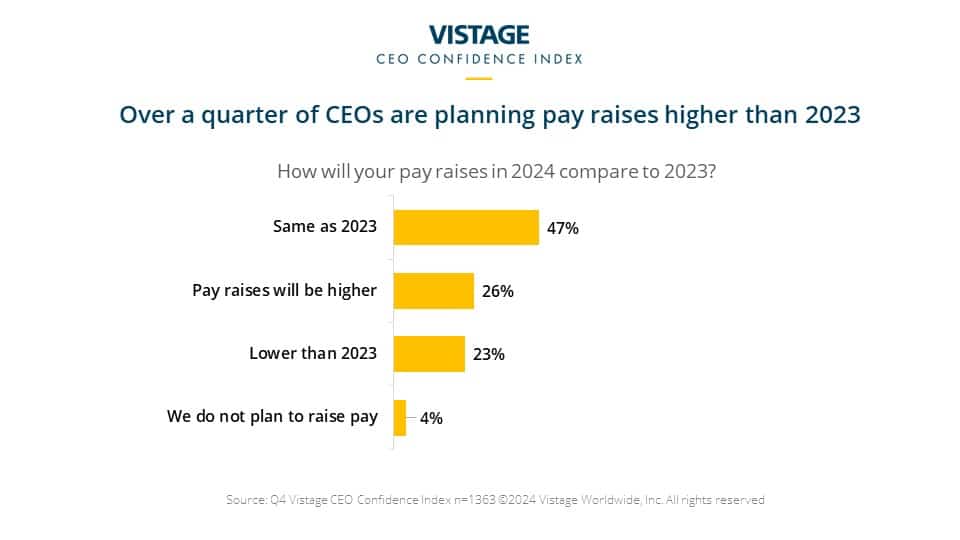

Wages continue to be the biggest contributor to inflationary pressures. While 2023 saw an emphasis on ensuring competitive wages, elevated wages continue to be one of the top costs. When asked about their budgeted wage increases for 2024, over a quarter (26%) of CEOs plan pay raises higher than 2023, while 47% intended to maintain the increases they implemented in 2023.

Analysis of our January WSJ/Vistage Small Business survey confirmed that leaders are challenged by the costs of labor, with 59% of small business leaders citing that as a top source of inflation that is impacting their business.

Meanwhile, the need for talent will continue to be a major challenge for the foreseeable future. The forecasted recession will be shallow and not result in massive layoffs, and the data from the U.S. Bureau of Labor shows that the labor market is still strong. Revenue expectations are strong and, despite labor costs, inflation is slowing.

Consider hiring needs over the next 2 years

Throughout the year, hiring and recruiting will be a top focus for CEOs. While pressure on hiring has relented somewhat, operational impacts remain with 48% of CEOs reporting they cannot operate at full capacity due to challenges in hiring. CEOs must focus on a talent pipeline and the right timing.

Our trusted partner, ITR Economics, provided an analysis of the Vistage CEO Confidence Index data in the context of their forecast; a mild recession for 2024 followed by growth the following year. Jackie Green, VP of Economics for ITR advises CEOs to “consider your employment needs in the context of the recession in 2024 and the rise in 2025. Factor in the time it takes to hire and train people to determine when you need to bring them on board to support that growth.”