CEO optimism declines amid rising costs and tariffs, according to Aug. WSJ/Vistage survey

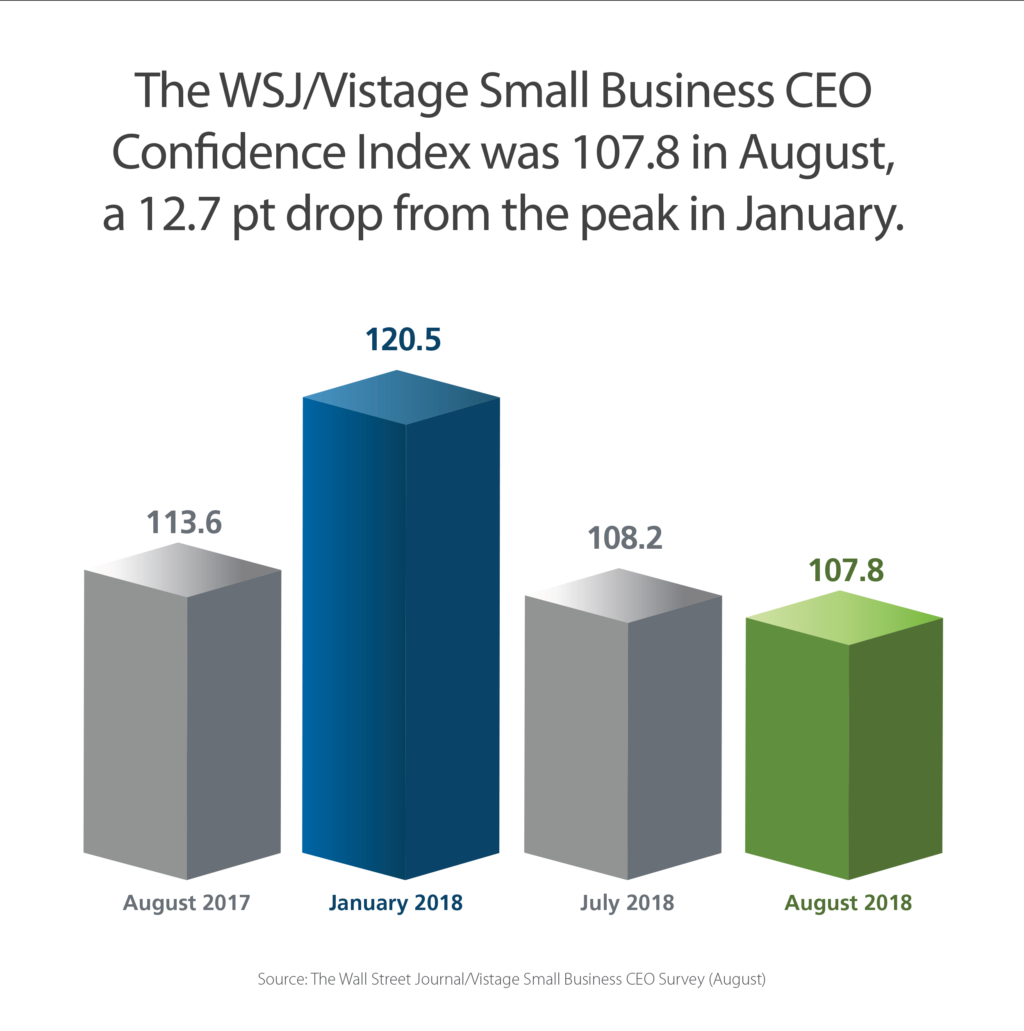

Economic optimism among small business CEOs continued its slow decline due to weaker expected growth in revenues and profits. The WSJ/Vistage Small Business CEO Confidence Index was 107.8 in August, slightly below July’s 108.2 and last August’s 113.6. While the decline from the January 2018 peak of 120.5 has been substantial, falling to its lowest level since President Trump took office, the level of small business optimism still remained quite positive.

Economic optimism among small business CEOs continued its slow decline due to weaker expected growth in revenues and profits. The WSJ/Vistage Small Business CEO Confidence Index was 107.8 in August, slightly below July’s 108.2 and last August’s 113.6. While the decline from the January 2018 peak of 120.5 has been substantial, falling to its lowest level since President Trump took office, the level of small business optimism still remained quite positive.

Other key findings from the August 2018 survey of 731 business leaders include the following:

Rising costs and tariffs impact pricing

Rising costs and tariffs impact pricing

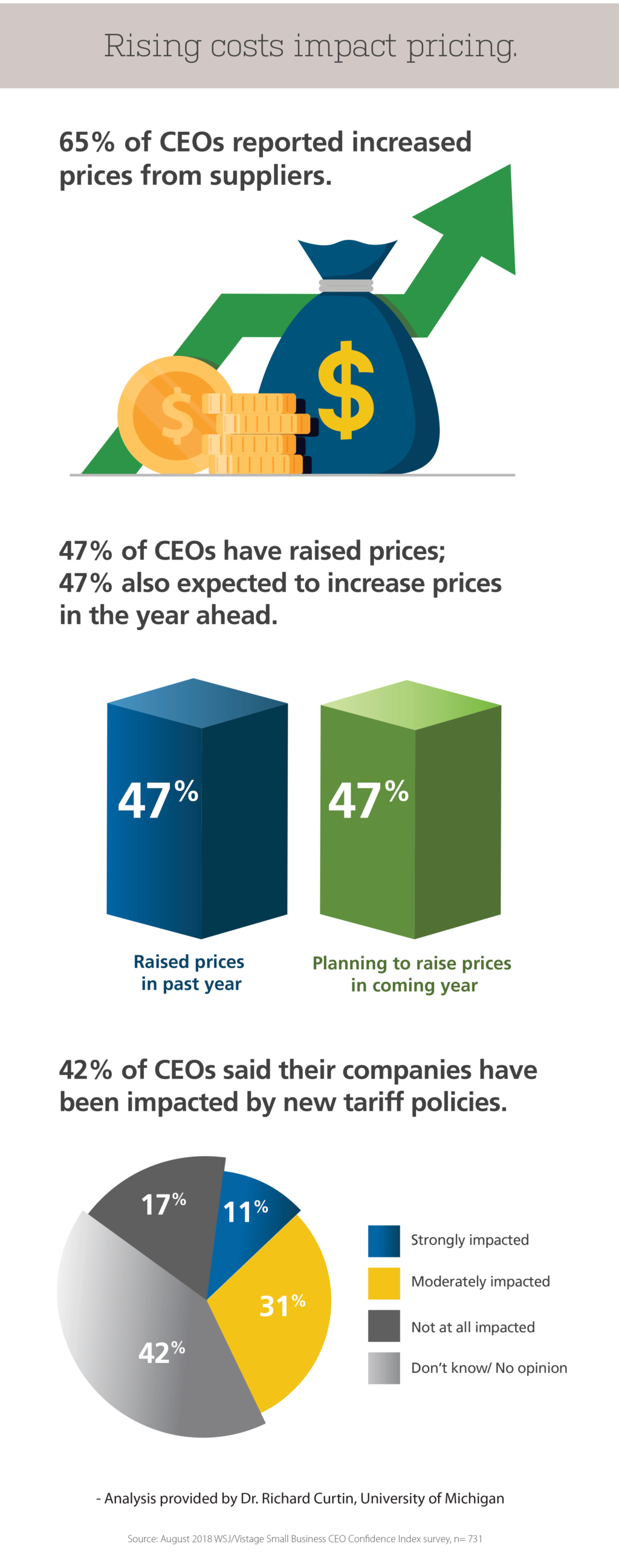

The overriding issue for small business has been rising costs of materials used for production, cited by two-thirds (65%) of CEOs in August.

Rising costs have motivated nearly half (47%) of CEOs to raise their prices and prompted nearly half (47%) to plan to raise prices during the year ahead.

Price hikes left small firms with less favorable assessments of their expected revenues and profits. Although the direct impact of tariffs on domestic inflation is quite small, the presence of tariffs could form a pretext to justify more widespread price hikes.

When asked about the impact of new tariffs on their own firms, 11% of CEOs reported a “strong impact,” and 31% reported their firm would be “moderately impacted.”

Although the enthusiasm about economic prospects based on the presidential election has evaporated, the basic economic confidence of small firms has remained strong.

Weakened prospects for revenues and profits.

Weakened prospects for revenues and profits.

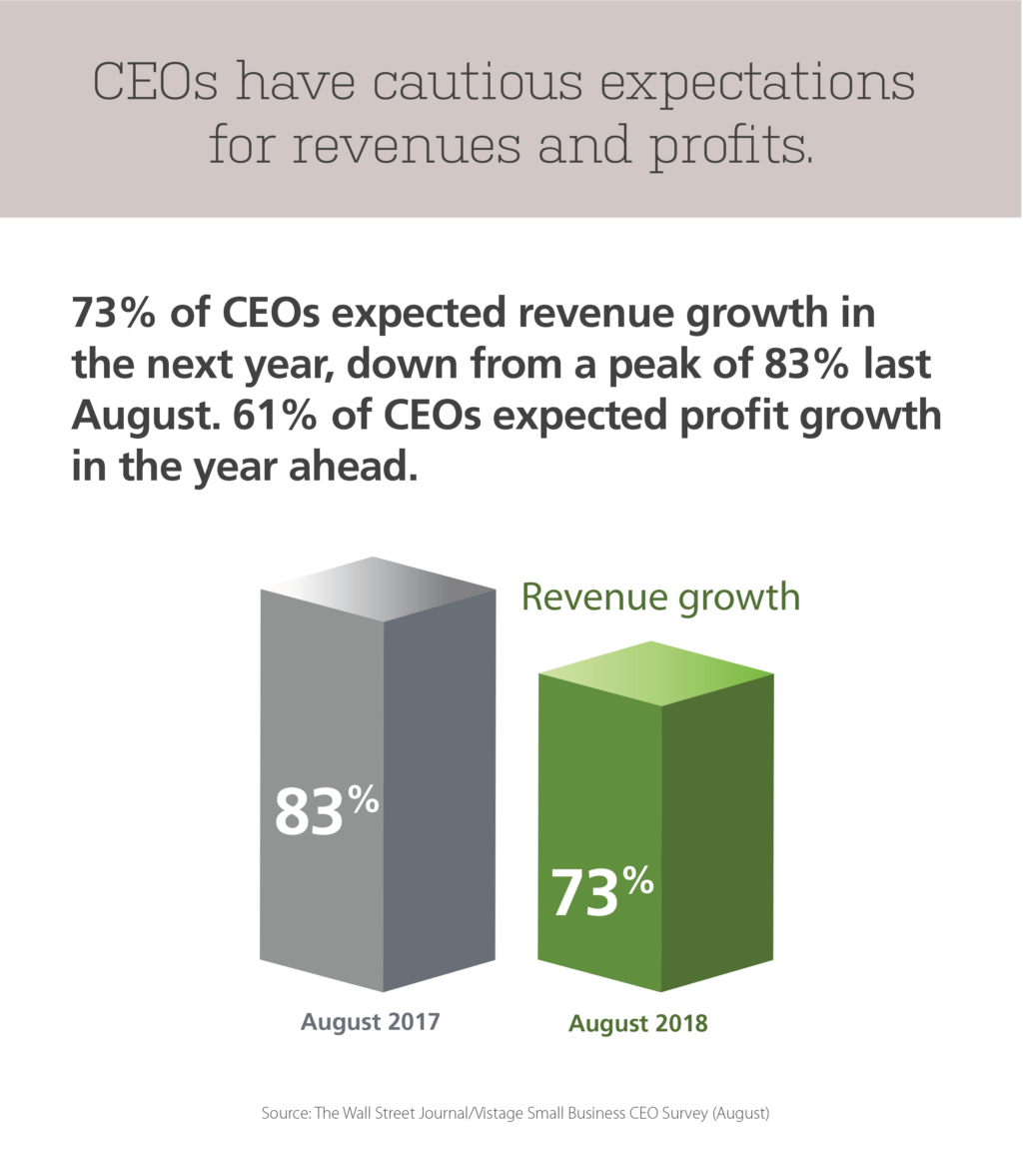

Small firms expressed more cautious expectations for sales revenues and profits for the year ahead.

73% of CEOs expected revenue growth in the next 12 months, down from 76% one month ago and 83% one year earlier.

61% of CEOs expected growth in profits over the next 12 months, just below last month’s 62% and down from last August’s 65%. Although revenue and profit expectations have declined, they remained at positive levels when compared with trends over the prior five years.

Economic growth expected to weaken.

The positive recent GDP report was reflected in how firms judged current economic conditions, but it did not have much impact on how they evaluated future economic prospects.

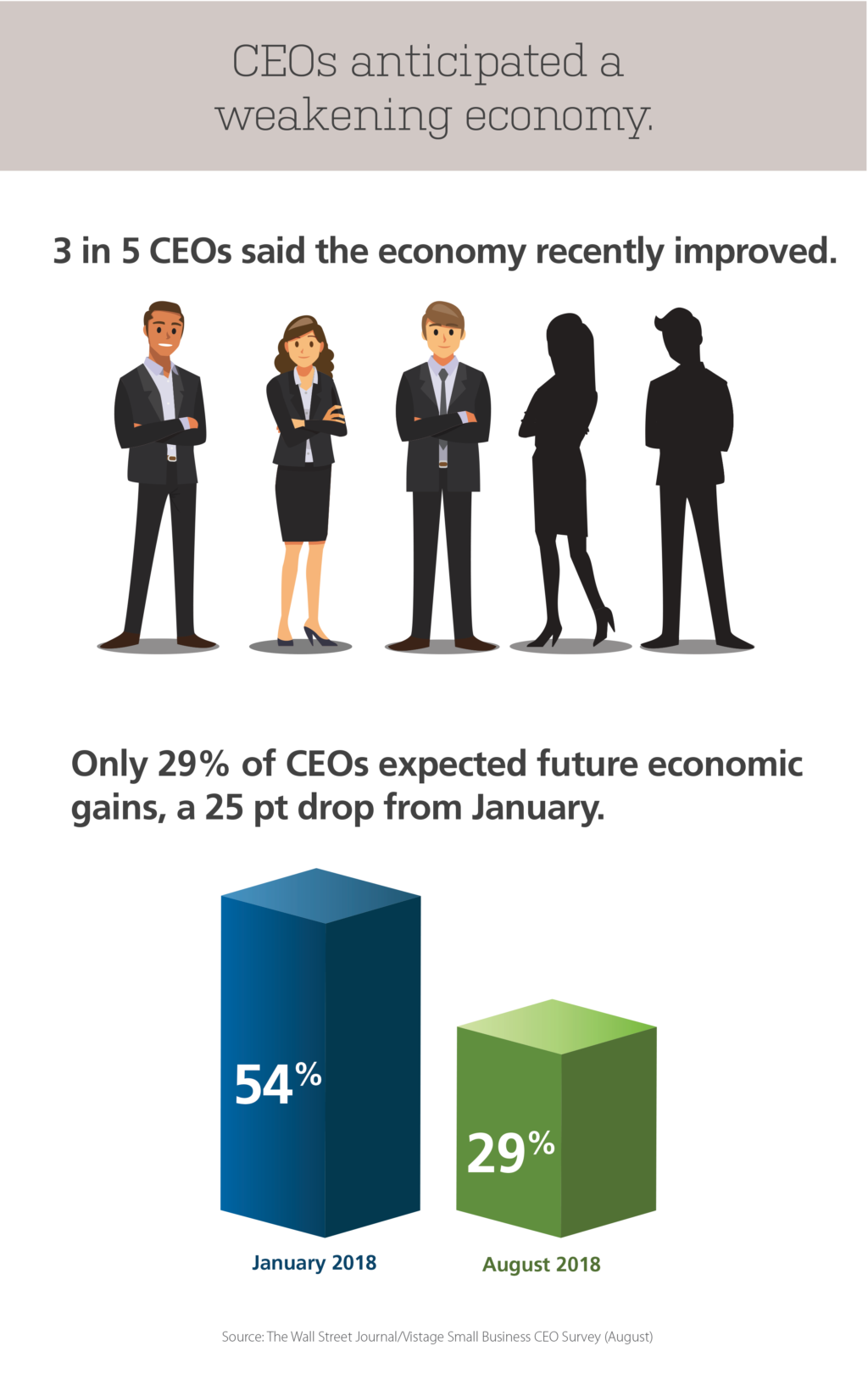

60% of CEOs reported recent gains in the economy, unchanged from last month and above last year’s 58%.

Just 29% expected future economic gains, and while this is just above last month’s 27%, this percentage was well below the 54% recorded in January who expected overall gains in business conditions.

Modest decline in business expansion plans.

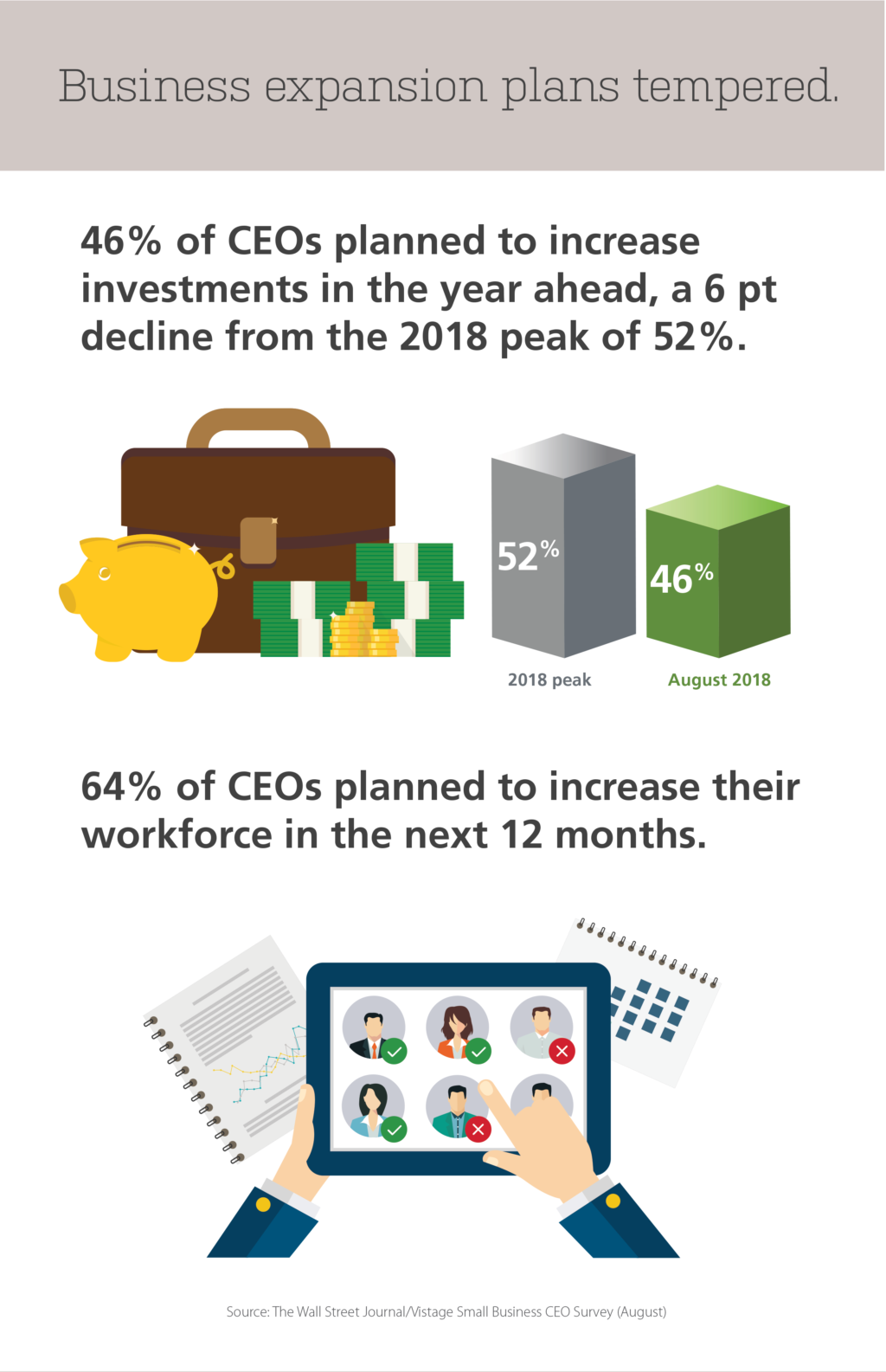

Small firms slightly reduced their planned investments in new plant and equipment in accordance with their lower anticipated revenues and profits. 46% of CEOs planned increases in investments, just below last month’s 47% and last year’s 49%. Nearly two-thirds of all firms (64%) planned expansion of their workforce, unchanged from a year ago, although slightly below the peak of 72% set in December 2017. Nonetheless, the pace of expansion of their workforces suggests that the labor market will remain quite tight during the year ahead. Growth in employees and investment spending has gradually declined over the past year, but still remains at quite favorable levels.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey