Hiring reaches record high amid economic uncertainty [Q4 2021 CEO Confidence Index]

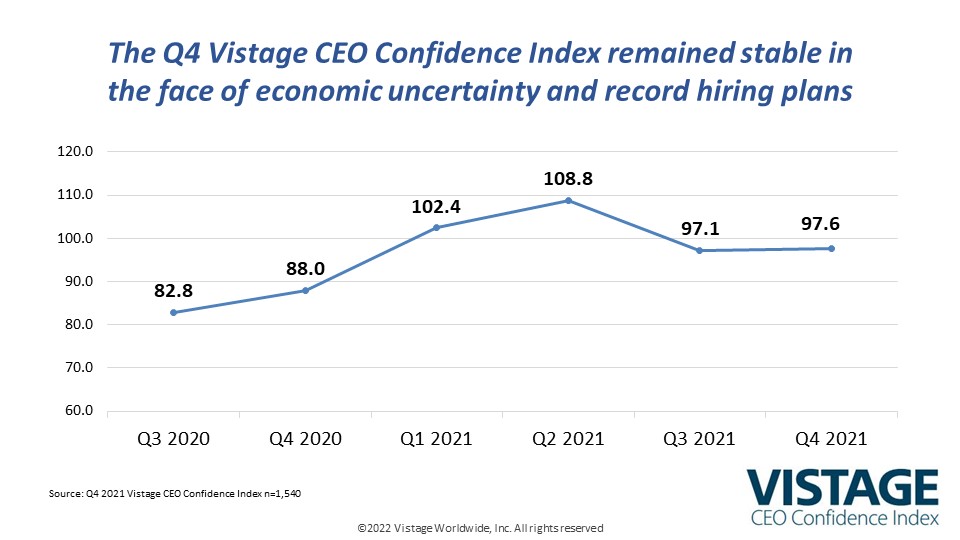

The anticipated surge and unexpected spikes of 2021 have left CEOs unsure about the economy and marketplace in 2022 but quite certain about their ability to grow their business — provided they can find enough people. Headwinds continue to blow in the form of inflation, supply chain and talent shortage but are not quite strong enough to offset the powerful tailwinds of anticipated revenue and profit growth. The dichotomy of forces caused the Q4 Vistage CEO Confidence Index to edge up to 97.6, fractionally above the Q3 Index.

Entering 2021 a strong economic recovery was expected to bring opportunities that would offset the losses from the pandemic, opportunities that included the release of pent-up consumer demand, government stimulus programs and freedom of movement unleashed by the vaccine. However, no one predicted the supply chain crunch that emerged mid-year or the rapid rise of inflation that followed. There was a strong belief that vaccine distribution would accelerate and help control the spread of COVID-19, but vaccine hesitancy and the sudden emergence of the Delta variant in the summer muted the vaccine’s impact for full recovery, dragging down growth in the second half of the year. This headwind has most recently been replaced by forecasts for a spike in cases related to the Omicron variant. The talent wars that were intensifying at the beginning of 2021 have only escalated as CEOs look to add people to fuel growth potential and raise wages to be competitive in the increasingly shrinking talent market.

2022 will certainly follow a pattern of uncertainty with unexpected plot twists. Now a political talking point, inflation will remain unknown depending on how fast the supply chain can heal, stimulus money runs out and demand begins to wane, in addition to potential Federal Reserve actions to further reel in inflation. Already playing the first card of 2022, COVID-19 has introduced the Omicron variant representing a fourth wave of infections driving up hospitalizations, deaths and all the other impacts of this disease. The duration and severity of the surge will dictate Q1 fortunes and beyond, especially with workforce impacts. Waiting in the wings for 2022 is the midterm elections, which promise to be volatile with all the divisiveness, misinformation and vitriol that will surely accompany it. What is certain is that the talent wars will go to “DEFCON 1” with retention and hiring of people dominating CEOs’ challenges, testing their resolve and driving their decisions.

Inflation impacts and expectations

The sudden rise of inflation has forced the hands of CEOs. With the sudden surge to 40-year highs, inflation is expected to moderate in 2022, but not go away. Higher costs for materials drifted down by 3 points from Q2 with 62% of CEOs reporting increases. The increasing cost of labor impacted 72% of small and midsize businesses, a small increase of 2 points. Reflecting the pressure of those increases has resulted in price increases from vendors up to 79%, jumping 10 points from Q2 as all small and midsize businesses have been forced to raise prices to offset their increases.

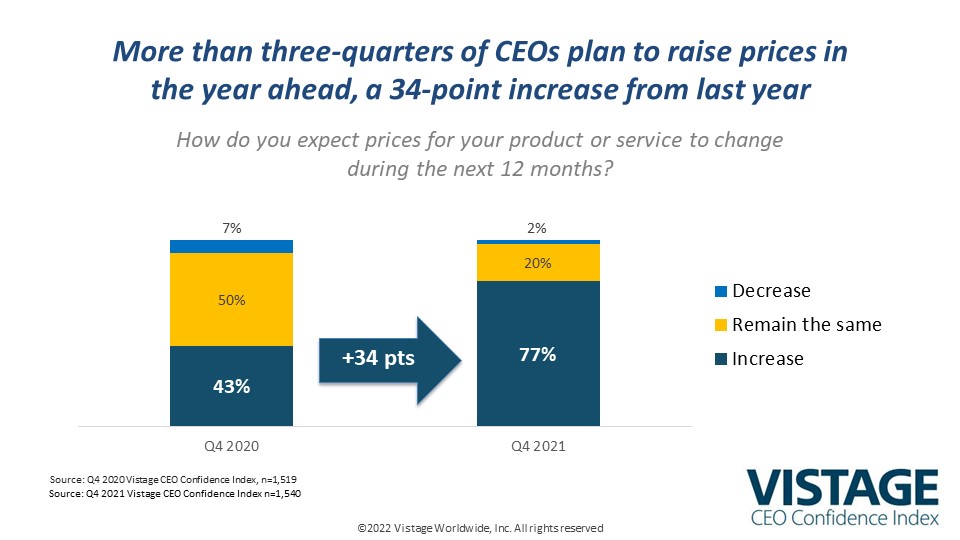

As prices rise, CEOs must strategically increase prices as well to maintain margins at a minimum. Nearly 7-in-10 CEOs (69%) reported increasing prices over the last 90 days, and 77% expect to increase prices in the year ahead. When asked about the size of the price increases, 61% of CEOs report plans to increase their prices between 5 and 10% with another 22% increasing by more than 10%; just 16% plan an increase of less than 5%. If you are among the CEOs managing price increases, Vistage speaker Casey Brown shares her expertise on how to strategically increase prices.

The supply chain challenges remain a key contributor to inflation. Bottlenecks at ports, shortages of shipping containers and lack of workers (longshoremen/truck drivers) remain problems as manufacturers have responded by producing a surge of goods to satisfy the demands of the consumer. U.S. ports are processing almost one-fifth more container volume this year than they did in 2019.

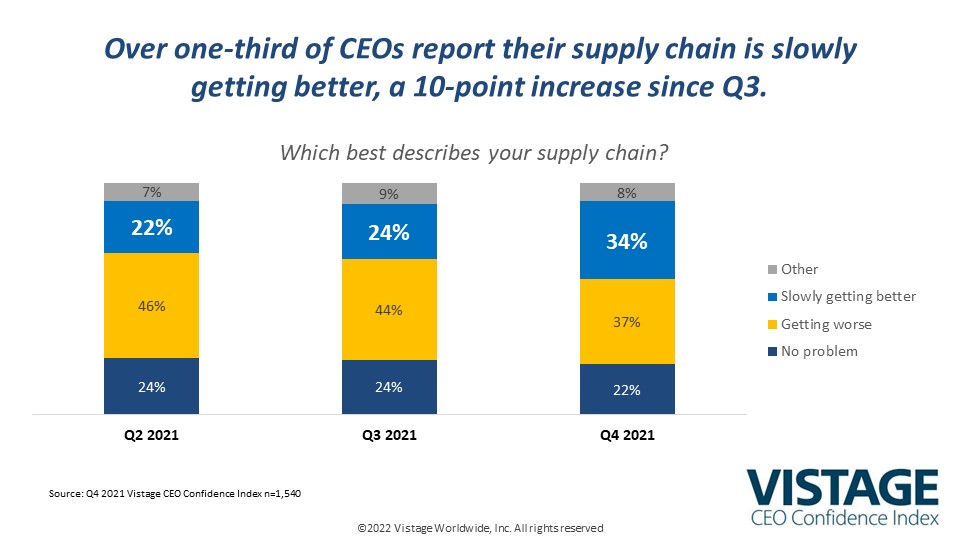

Our data suggest a slowly improving picture. In the Q2 survey, 46% of CEOs reported that their supply chain issues were getting worse, while just 22% said they were slowly improving. Six months later, our Q4 survey revealed that 37% of CEOs report supply chain issues are getting worse, a 7 point decrease. On the other end of the spectrum, in Q4 34% said their supply chain was slowly improving — a 12-point increase. With the passing of the holiday purchasing peak and as government stimulus programs run their course lessening demand, the supply chain will continue to heal, reducing cost pressures from materials, a key contributor to inflation.

The price of people

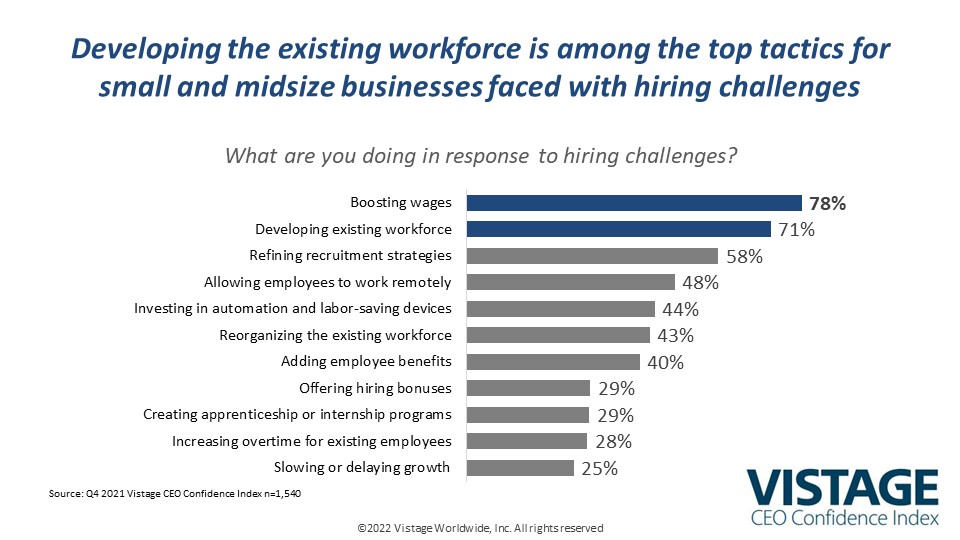

One factor not going away is the increased costs for people. 76% of CEOs said they were planning on increasing headcount in the year ahead, an all-time high since the Vistage CEO Confidence Index survey began in 2003. Hiring is critical to meeting customer demand; 71% of CEOs reported that hiring challenges are impacting their businesses’ ability to operate at full capacity. The result is increasingly aggressive recruiting with escalating wages and salaries. 78% are increasing wages as a result of hiring challenges and 29% are offering hiring bonuses. The rapid escalation of the talent wars is evident when 56% of respondents reported they were increasing wages in Q2; 69% reported in Q3. Raising wages is a delicate proposition. Increasing pay to attract new workers will create exposure with existing workers who may have been hired at a pre-talent wars rate. Vistage speaker Rena Somersan provides guidance for CEOs on how to raise wages.

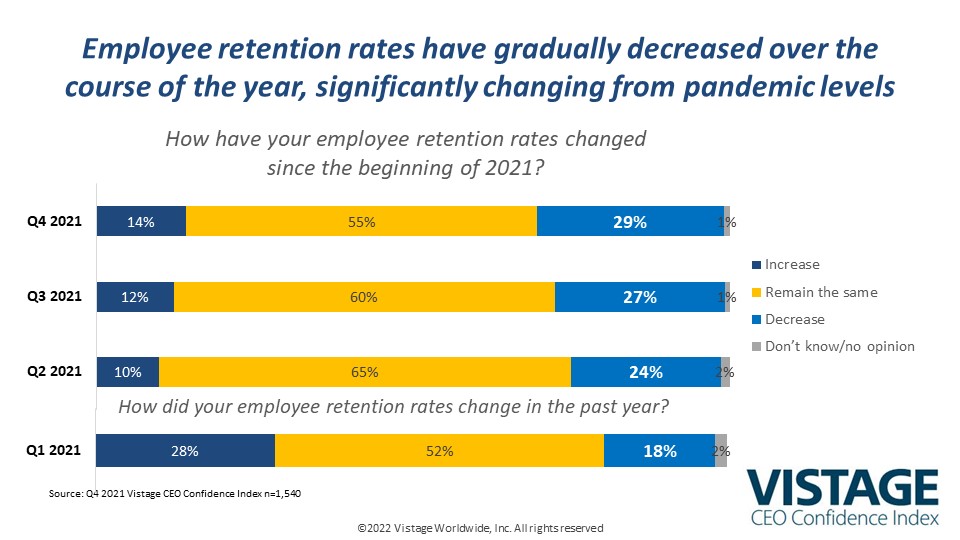

Workers at all levels are in demand with more jobs (12.0 million) than there are people looking for work. Workers have to come from someplace. The 4.5 million “quit rate” in November, an all-time record on top of the 4.2 million quits in October, suggests the workforce revolution is on and the employee migration is in full swing. This is further evidenced by the corresponding decline in employee retention rates.

Earlier this year, our Q1 survey revealed that 28% of CEOs reported their retention rates increased during the pandemic while just 17% said they had decreased. Now, looking at changes across the course of 2021, the proportion of CEOs reporting decreases in retention has grown 12 points to reach 29%, while the proportion reported improving retention rates has fallen by half, reaching 14%. Retention becomes critical in this increasingly competitive environment. Losing any employee — even a “C” player — is a major setback in productivity and morale, leading to increased costs to recruit, hire and train a replacement. It now takes longer and costs more to get a less experienced person.

Employee development has become the CEO’s go-to strategy for retaining and attracting people. In Q2, 50% of CEOs identified employee development as a strategy to attract workers. That number jumped to 70% in our Q4 survey as CEOs increasingly recognize the importance of investing in their people as a retention tactic and demonstration of their culture. The development program then becomes a strong competitive benchmark when potential employees evaluate opportunities. Employee development directly impacts retention, the ability to attract and improved performance. Evaluate your employee development program with our June 2021 research report.

Fog advisory

The trends revealed in the Q4 2021 CEO Confidence Index provide clues to the year ahead, but more so than any other year, the fog of uncertainty clouds everyone’s crystal ball. The mists of inflation, clouds of talent shortage and haze of supply chain disruptions — combined with the yet-to-be-completed story of the Omicron variant — contrasts with record hiring plans as well as surging investments. More than half (52%) of CEOs plan to increase investments in the year ahead, driven by continued historically low interest rates. The hope that we’ll see the end of the pandemic this year amid surging cases caused by Omicron or yet-to-be-identified variants sets up an uncertain start to another year. Plan for the worst, hope for the best and fasten your seat belts. It’s going to be (another) bumpy ride.

Related resources

DOWNLOAD THE Q4 2021 CEO Confidence Index REPORT

DOWNLOAD THE Q4 2021 CEO Confidence Index INFOGRAPHIC