Small business confidence posts largest surge in 2 years [WSJ/Vistage Dec 2022]

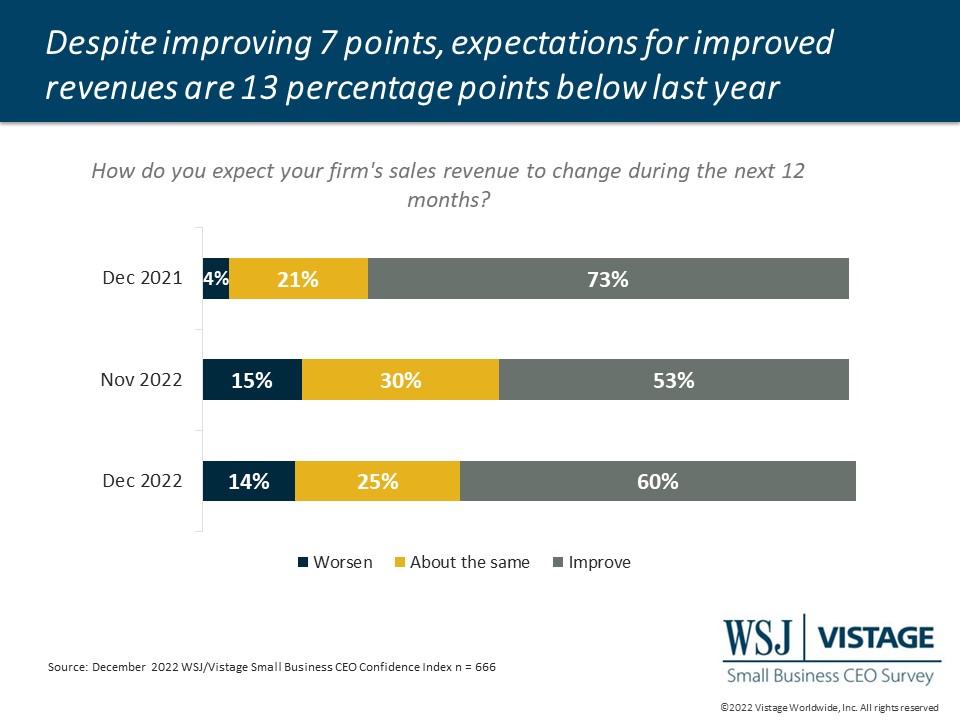

In the face of negative business headlines about inflation, interest rates, layoffs and a potential recession, small businesses see emerging opportunities in the chaos. Coming into the year, small businesses rise above these challenges with a greater proportion intending to expand their workforce in the year ahead. This workforce expansion is necessary to meet demand, as 60% of small businesses expect increased revenues in 2023.

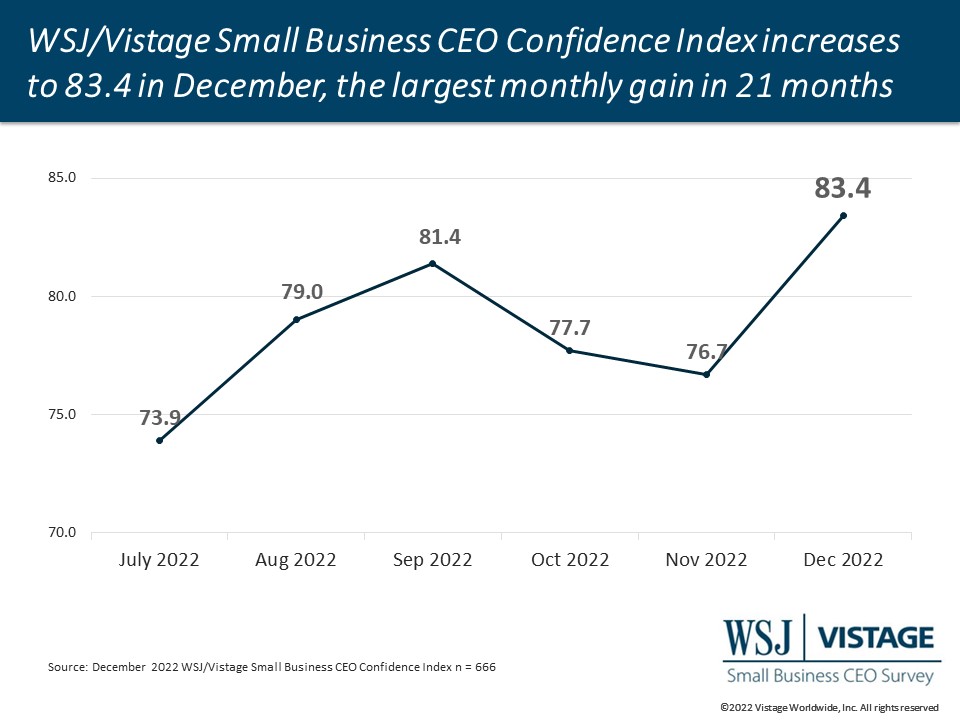

This improvement in prospects and plans resulted in an upswing in small business confidence at the end of a year marked by uncertainty, inflation and rising interest rates. The WSJ/Vistage Small Business CEO Confidence Index posted an 8.7% increase, rising to 84.3 in December, which was the largest month-over-month gain since March 2021.

Several factors drove this improvement:

- Revenues are driven by both customer demand as well as rising prices; 70% of small businesses are planning price increases in the next 12 months.

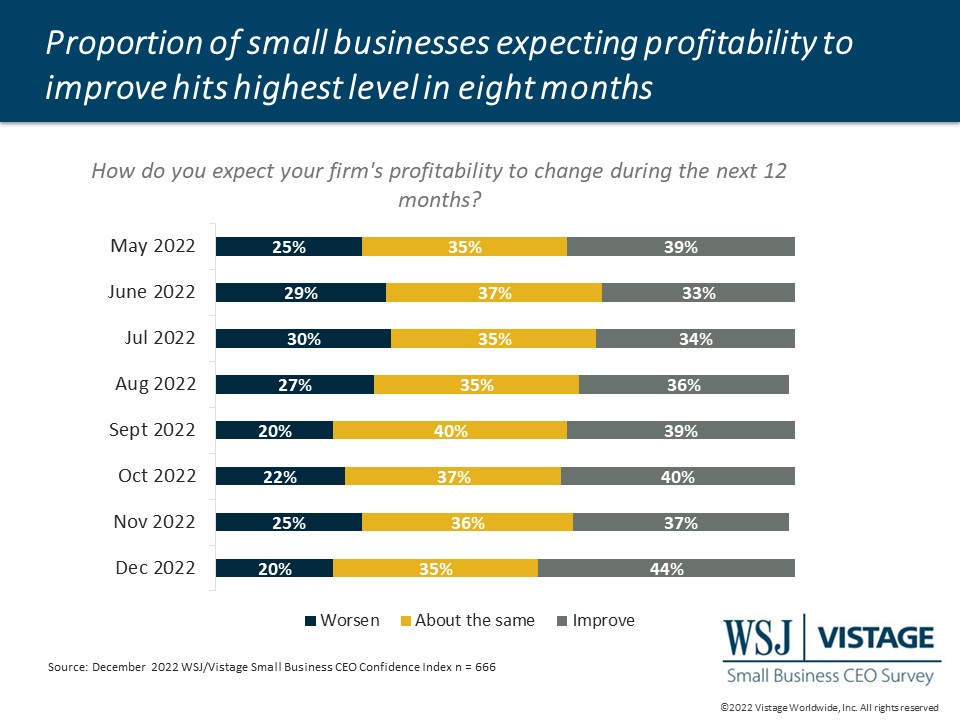

- Tempering inflation rates have led profitability expectations to improve among small businesses.

- Workforce expansion plans grow as small businesses enter 2023 with new goals and budgets.

Revenue and profitability expectations rebound as the pace of inflation moderates

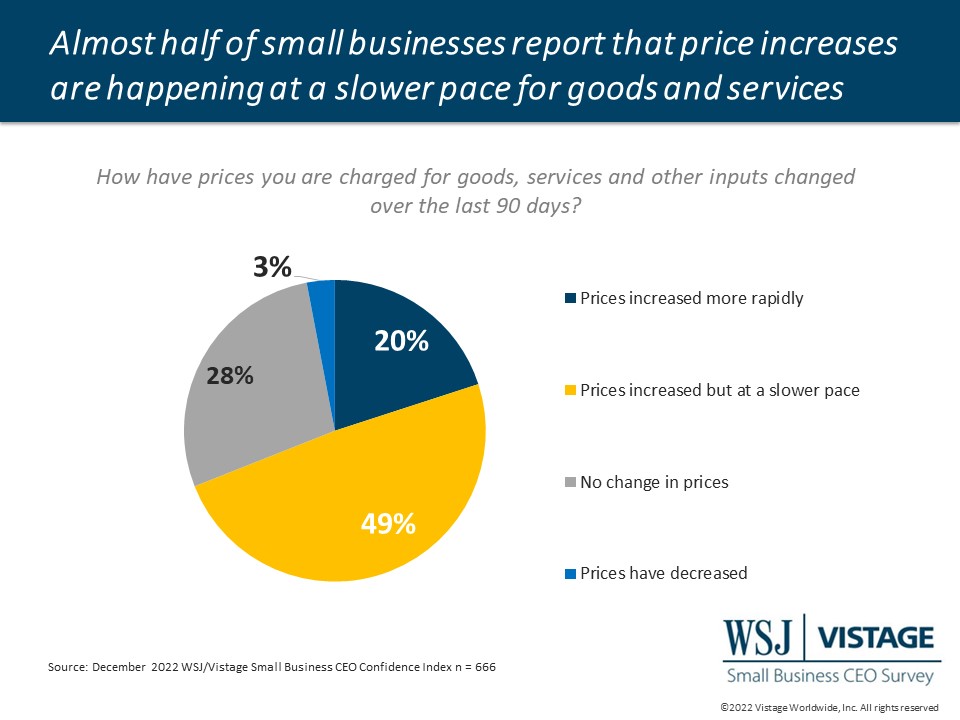

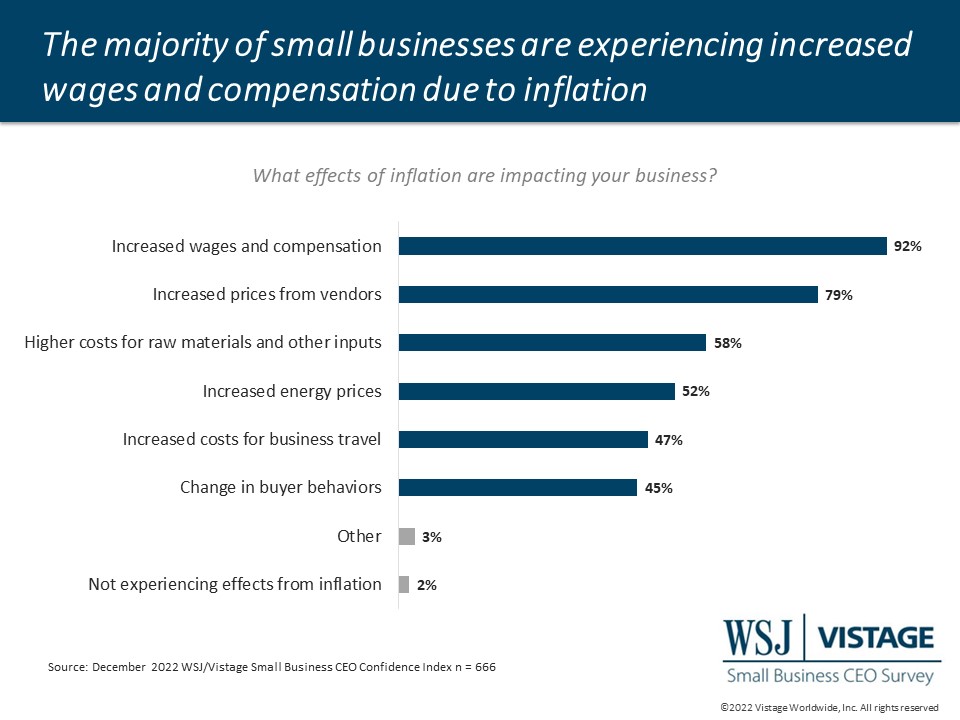

Inflationary pressures have moved past the crest reached in June as the inflation rate in November dropped to 7.1%, the fifth straight month of decline from June’s rate of 9.1%. Small business support the slowing in inflationary impacts with 28% reporting prices have remained the same in the last 90 days, and nearly half reporting that prices are rising at a slower pace.

With the inflation rates slowing over the last 6 months, prospects for small businesses have improved. Six-in-10 companies reported they expect increased revenues in the next 12 months, a 7-point increase from November. More significantly, the proportion of small businesses that expect increased profits in the next 12 months grew over 10% in one month to reach the highest level — 44% — since March 2022.

While vendors and suppliers may be increasing prices at a slower rate, small businesses continue to drive revenues and maintain profitability with price increases as well as 70% report plans to raise prices in the next 12 months. If they follow suit with vendors, their price increases are likely at a more pace moderate as well, though they continue to be challenged by rising wages.

Workforce expansion plans span the horizon of the new year

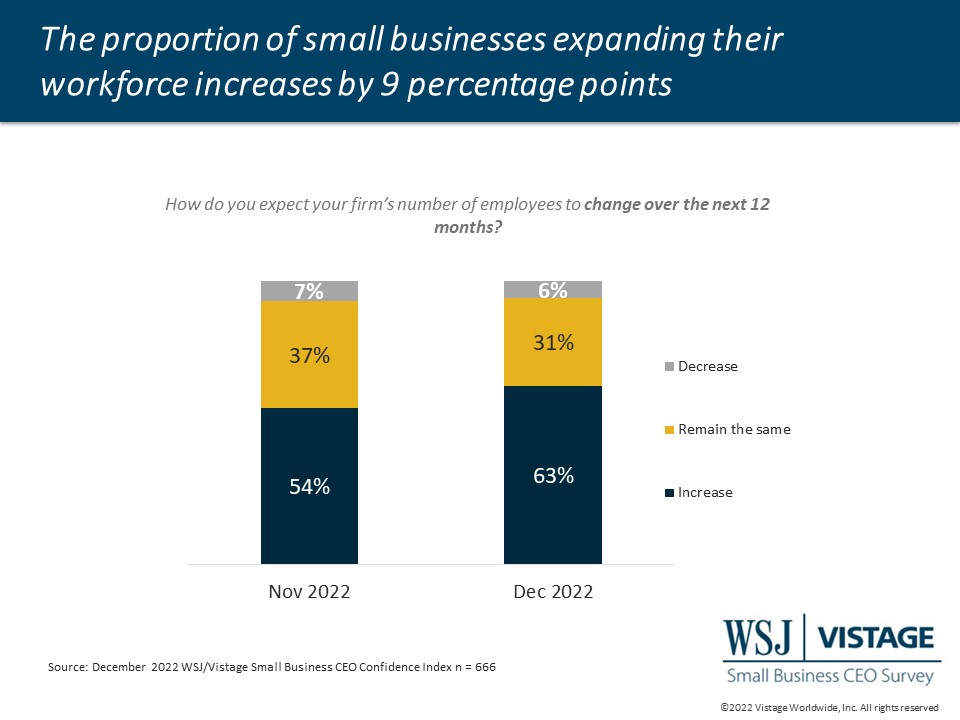

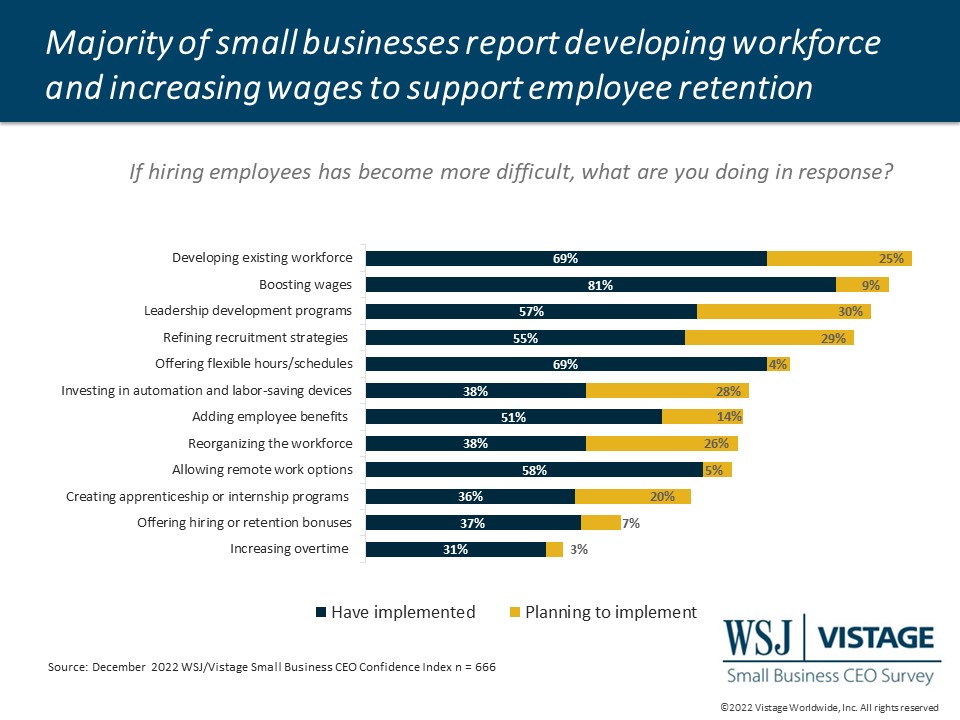

Looking ahead to a new year, the proportion of small businesses planning workforce expansion increased 9 percentage points from last month to reach 63%. This increase is one of the main drivers in the overall increase in small business confidence. While certain sectors have made headlines for recent layoffs, just 6% of small businesses report plans of reducing the size of their workforce in the year ahead. Nearly one-third of companies (31%) plan to maintain the size of their workforce, which ultimately means they have some level of hiring taking place based on attrition as the labor market continues to be competitive.

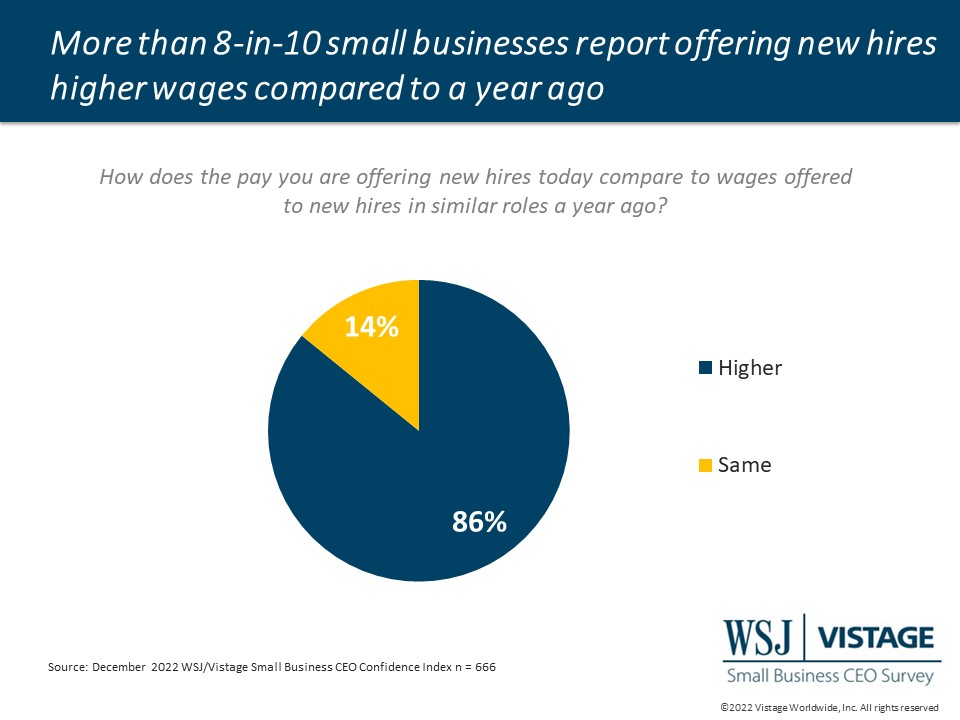

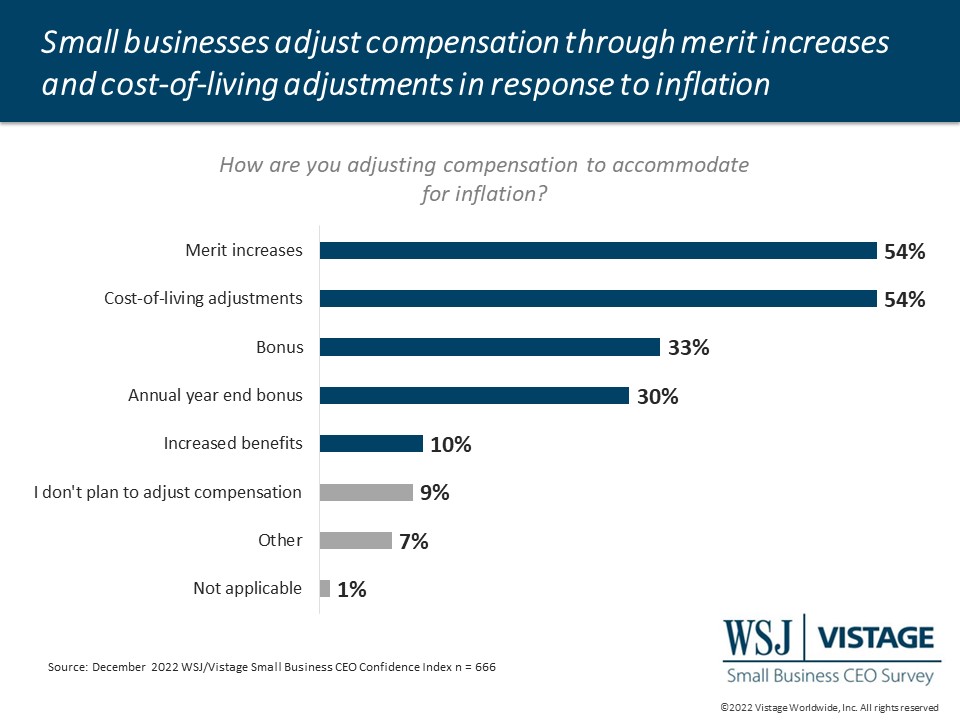

With this focus on hiring at the start of the year, small businesses need to increase salary budgets or examine the volume of new hires they will be able to make as 81% of small businesses report they have increased wages in response to challenges hiring, and 86% report they are paying higher wages for similar roles than offered earlier last year.

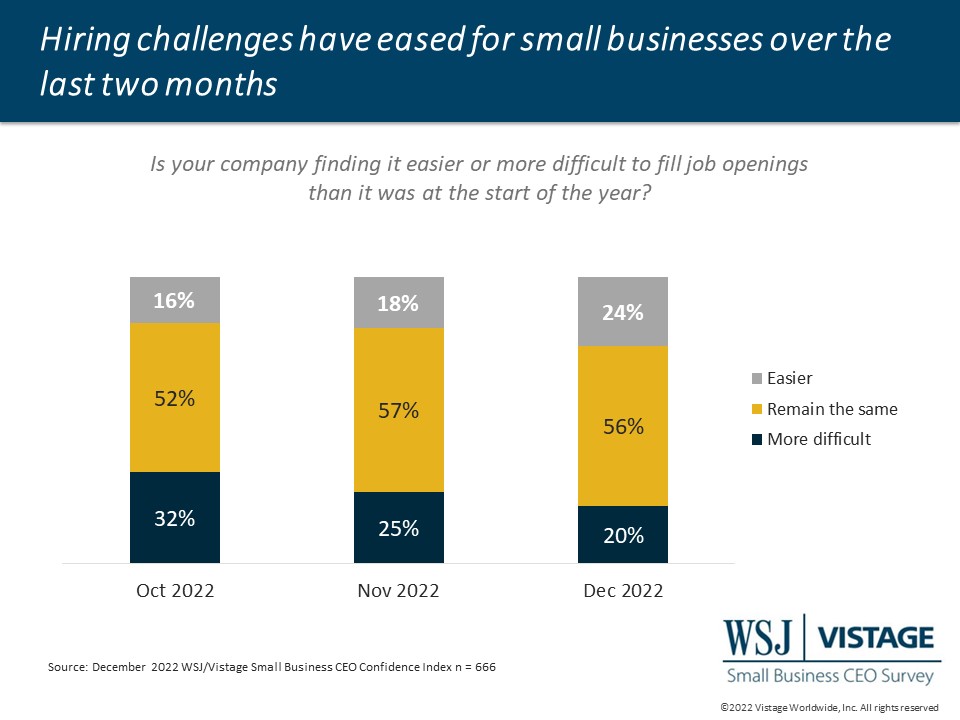

The good news is that the talent pool is seeing calmer waters as 24% report that hiring is easier than at the start of the year, compared to the 20% that say it is more difficult. Notably, this is the first time that the proportion of small businesses who report it is easier is higher than those who believe it is more difficult.

Layoffs in big tech companies like Amazon or Salesforce might result in a new crop of talent for small businesses to mine. With the quit rate still hovering around 4 million a month, retention needs to remain a key area of focus, setting a strong foundation from which to maintain and grow personnel.

December Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index reached 84.3 in December, posting the largest monthly increase in nearly 2 years.

- Looking over the next 12 months, 60% of small businesses plan to expand their workforce, a 9 percentage point increase from last month.

- Prices are rising, but at a slower rate according to 49% of small businesses, while 28% report prices they are changed have remained the same over the last 90 days.

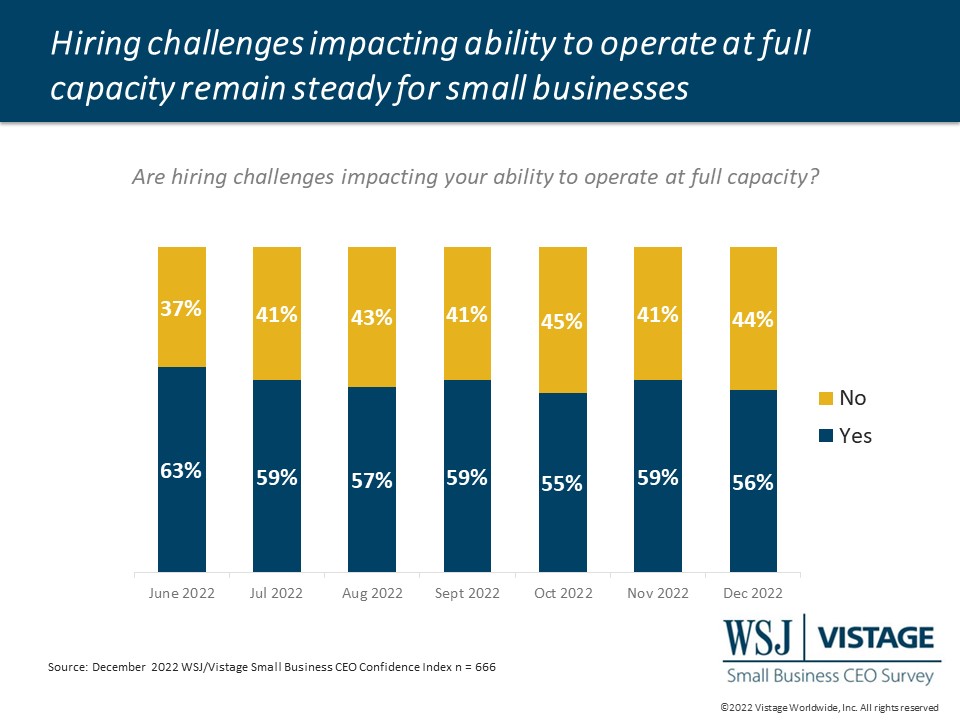

- The talent shortage continues to impact operations, with 56% of small businesses reporting they are not able to operate at full capacity.

Download the December report for complete data and analysis

For a complete dataset and analysis of the December WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD DECEMBER 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD DECEMBER 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business CEO Survey

The December WSJ/Vistage Small Business CEO survey was conducted December 5-12, 2022, and gathered 666 responses from CEOs and leaders of small businesses. Our next survey will be in the field January 9-16, 2023.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey