Small business confidence holds, indicating future growth [WSJ/Vistage Mar 2024]

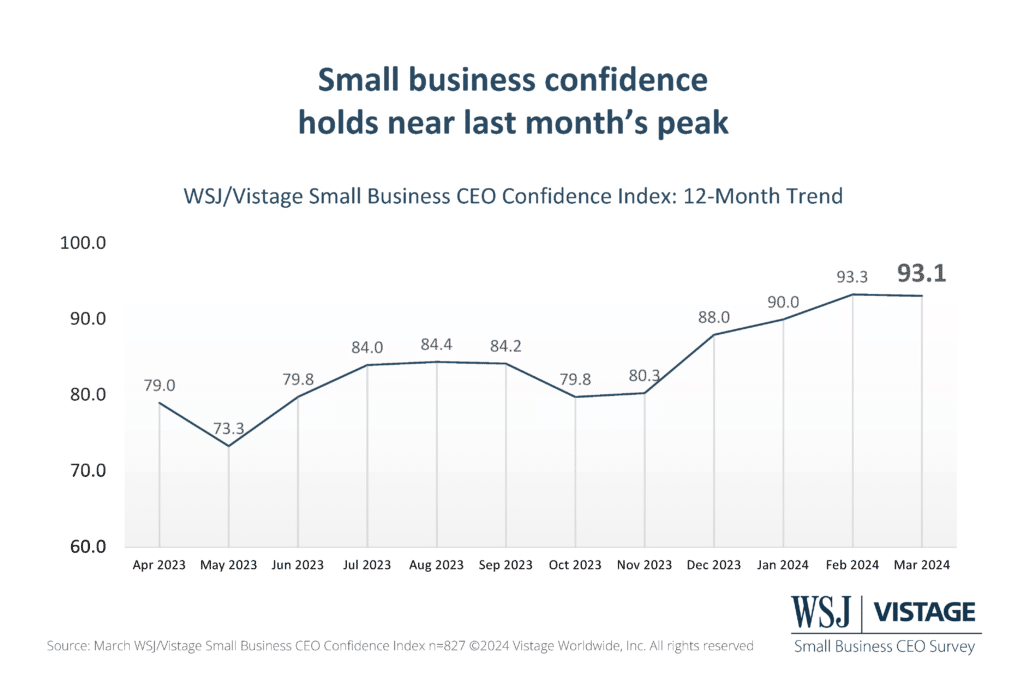

Over the past several years, we have seen many false starts in economic improvements, but after reaching a 2-year high, small business confidence continues to hold, driven by increasing optimism for the future of the U.S. economy. The WSJ/Vistage Small Business CEO Confidence Index reached 93.1 in March. While just 3 of the 6 components that comprise the Index increased last month, the rise in economic optimism was more significant than the slight declines in other factors.

Rise and fall of the components

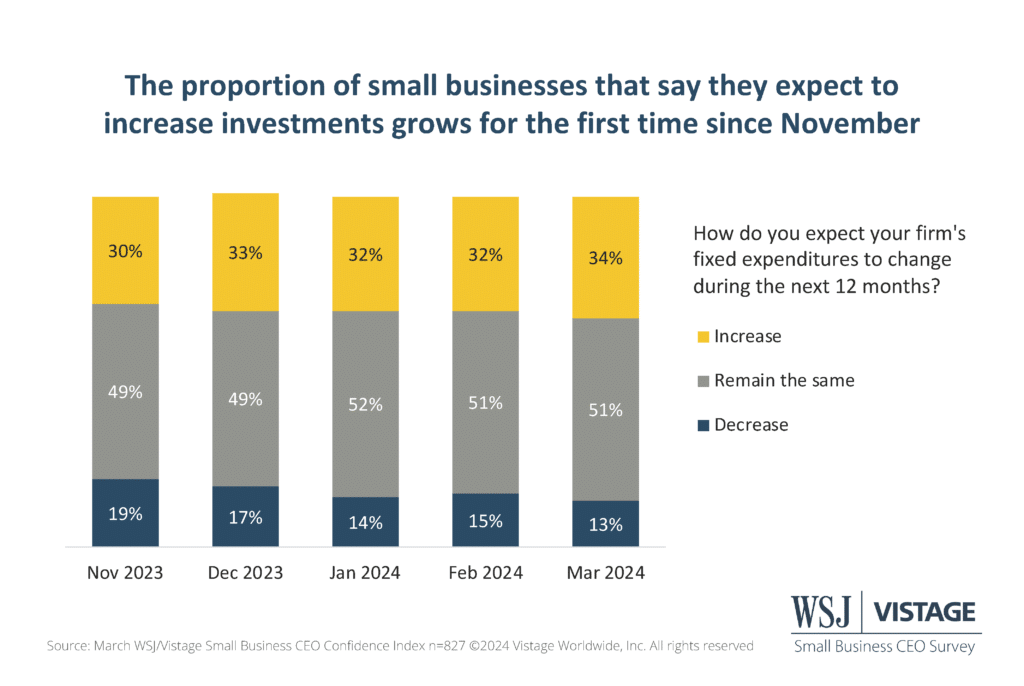

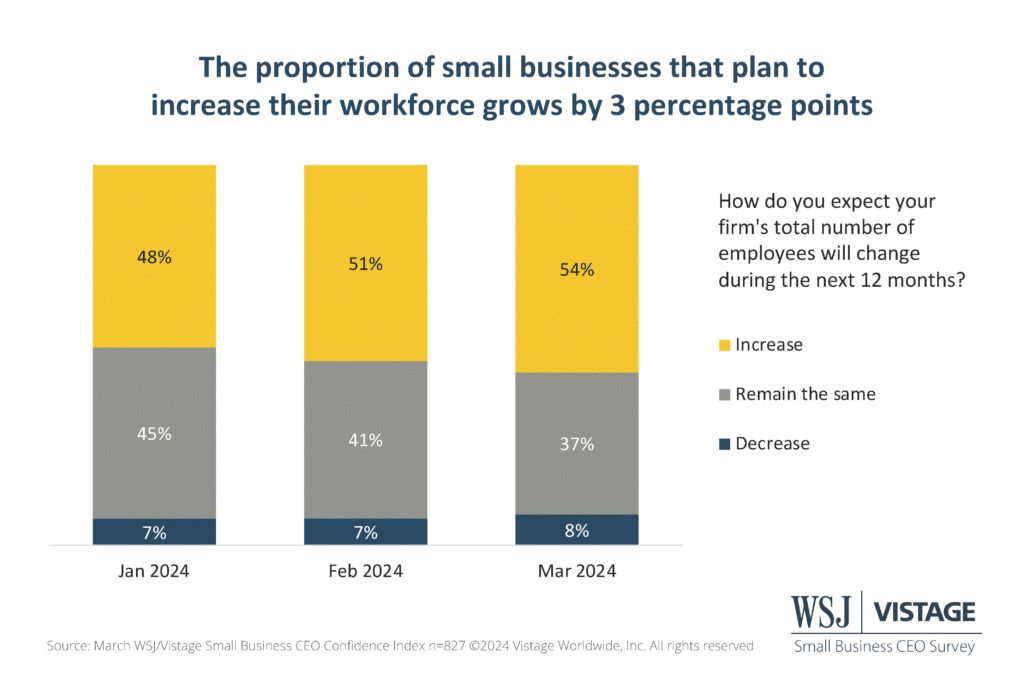

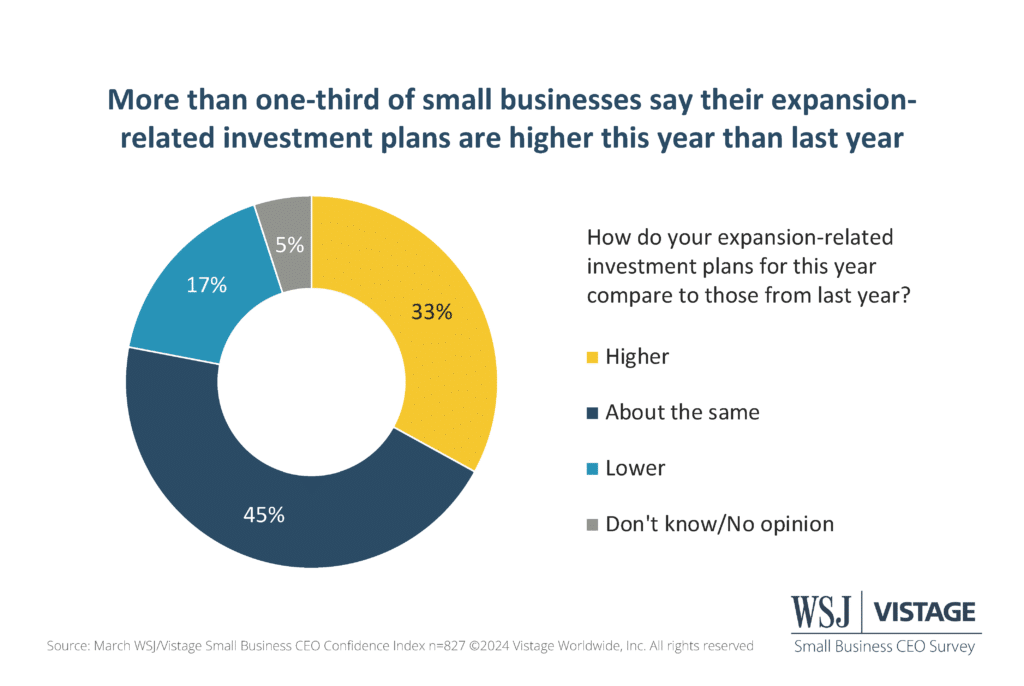

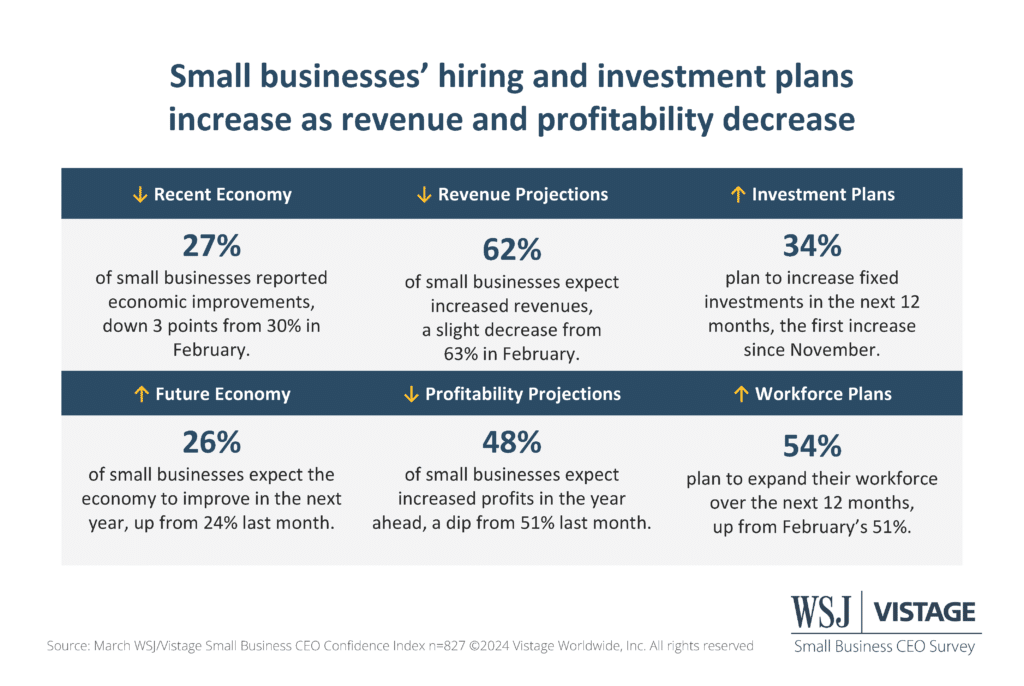

The factors that rose include sentiment about the economy’s future and 2 other components related to expansion plans: fixed investments and workforce plans.

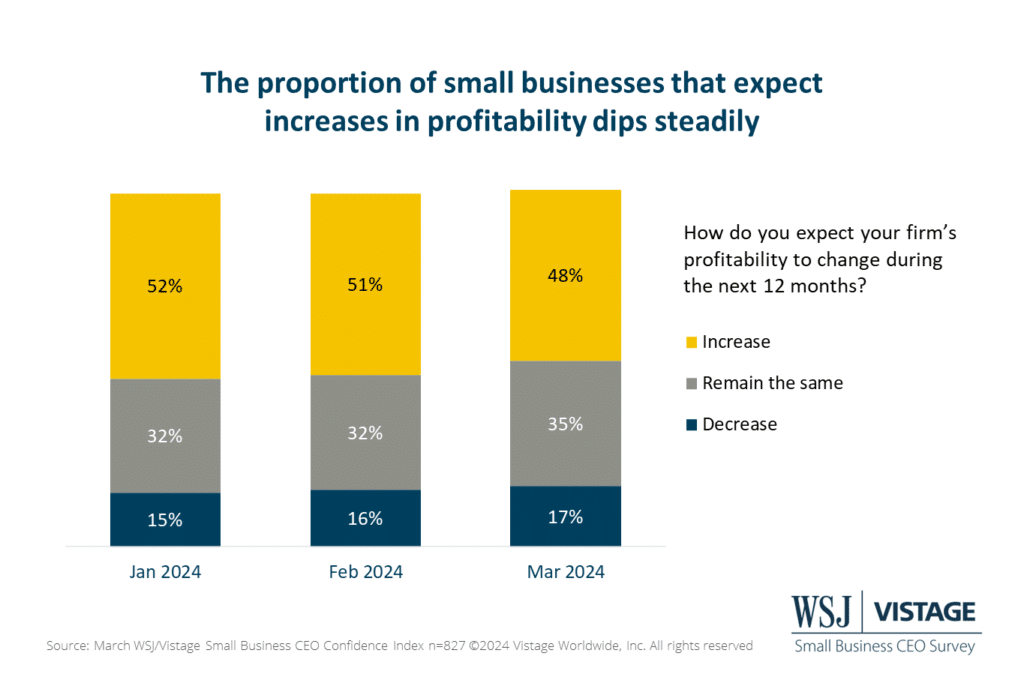

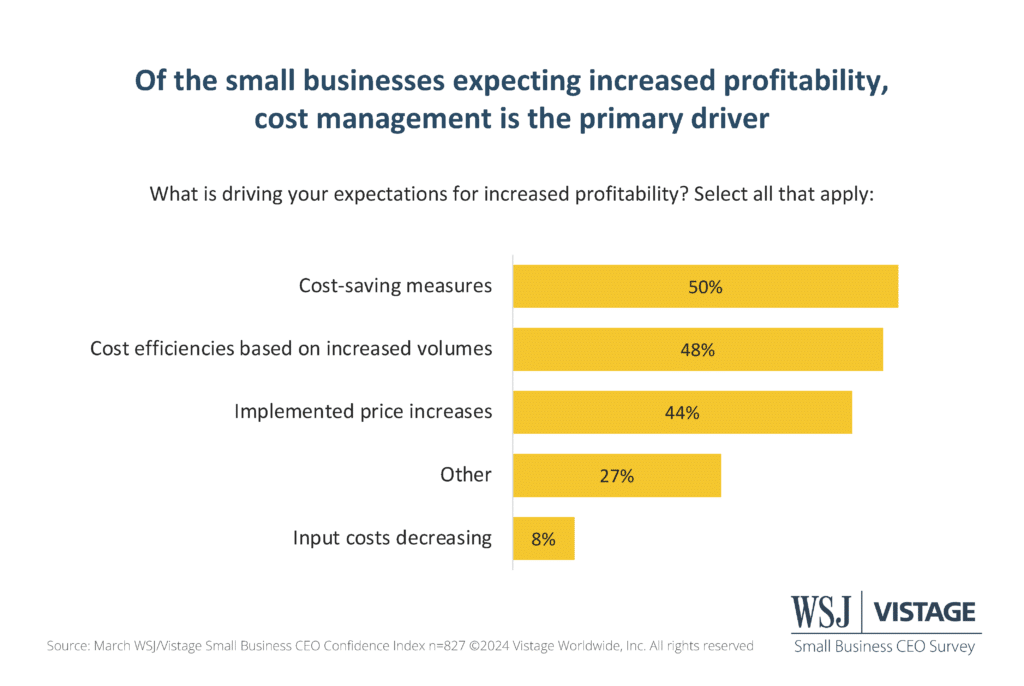

The factors of the WSJ/Vistage Small Business Index that declined fell marginally and included economic sentiment compared to a year ago, along with revenue and profitability projections.

With economic optimism on the rise, the data shows that investing for the future is beginning to rise as well. Small businesses can gain an early lead in growth by preparing for the rising trend and starting their ramp-up period once growth accelerates.

Changing customer demand impacting revenue projections

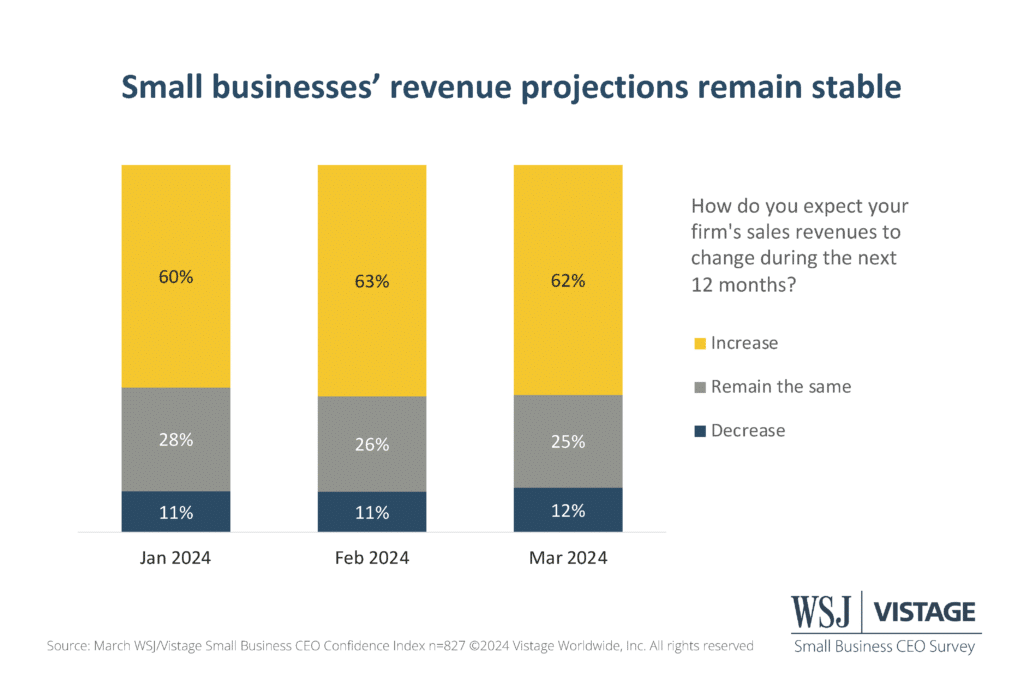

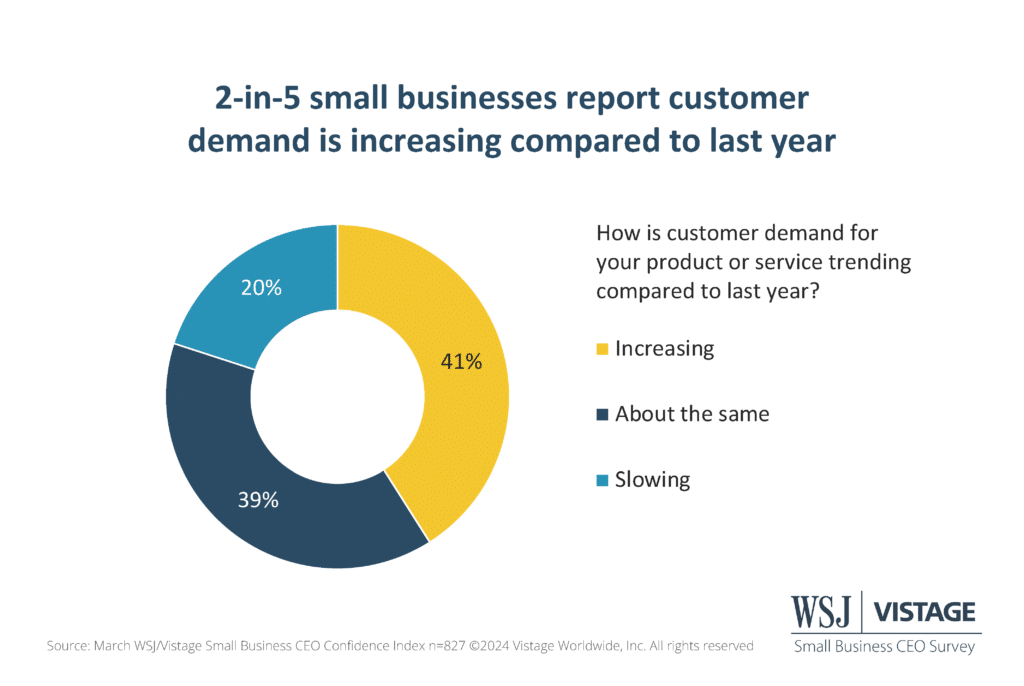

More than 6-in-10 (62%) small businesses expect increased revenues in the next 12 months. Several elements contribute to this expectation, including selling the same volume at higher prices and increasing demand, which grows the customer base. Our analysis delved into the role of those 2 elements and found changing demand is the bigger factor in impacting revenue expectations.

For the small businesses projecting increases in revenue over the next 12 months:

- 59% report they plan to raise prices in the same period

- 51% reveal that customer demand is growing, while just 11% report it is slowing

“In our industry, we cannot simply increase the price of our service. To fight it, we are focusing on cross-selling by other high-margin products/services,” says Yong Lee, CEO of Rev77, a digital marketing agency based in Tempe, Arizona.

For the small businesses projecting decreases in revenue over the next 12 months:

- 48% report they plan to raise prices in that same timeframe

- Just 15% reveal that customer demand is growing, while 52% report it is slowing

“We are aggressively looking to develop business to fill the gaps in our pipeline,” says Lisa Bell Reim, president of architecture and interior design firm Oculus, Inc. in St. Louis, Missouri. “We are doing this through increasing our seller/doer model, coupled with better marketing collateral.”

While those expecting increased revenues are slightly more likely to raise prices, customer demand is the biggest differentiator. As different business segments enter phases of the business cycle at different times, it is critical to understand what cycle your industry is in to prepare accordingly.

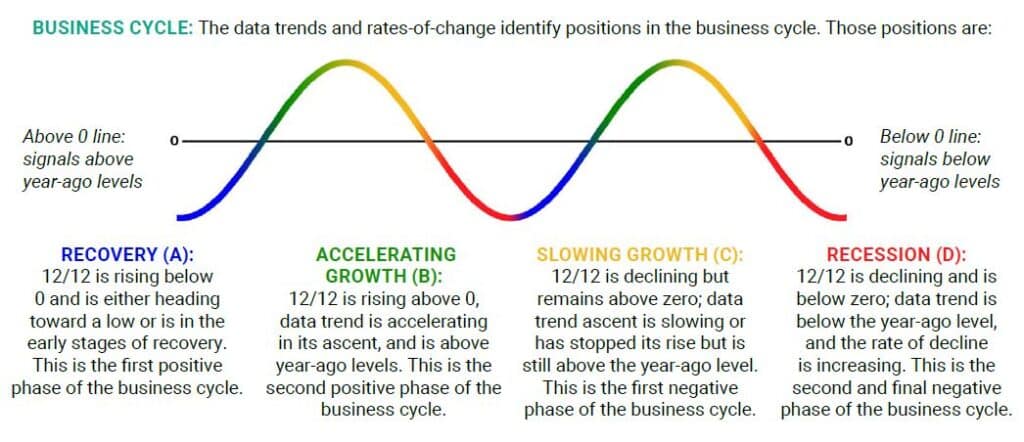

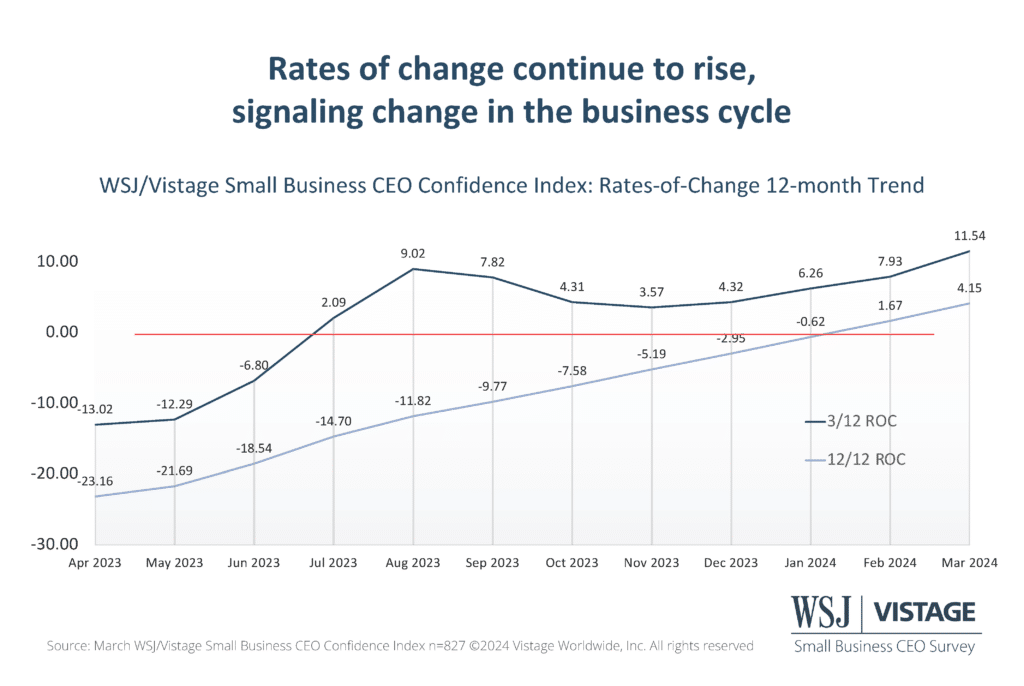

Rates-of-change show increasing velocity

Rates-of-change captures the velocity of change and momentum at a higher level versus looking at month-over-month or year-over-year change alone. When comparing the 3-month moving average of the WSJ/Vistage Small Business Index to the same 3 months a year ago, you can see that the 3/12 rate of change has been positive since July and has continued to rise over the last 5 months.

Additionally, a 12/12 rate-of-change compares the 12-month moving average to the 12-month moving average of the same period one year ago — in this case, comparing the average of Feb 2023-March 2024 to Feb 2022 — March 2023. Last month marked the first time the 12/12 rates-of-change rose above zero, leading to a promising development.

With both rates of change showing a consistent upward trend and currently above zero, there is a strong indication we have entered a new accelerating growth phase of the business cycle. Businesses should take advantage of this phase by investing to maximize growth opportunities.

Rates-of-change: A rate-of-change is the ratio comparing a data series during a specified period to that series during the same period one year ago. These figures are expressed as an annual percent change and reveal whether activity levels are rising or falling compared to the prior year. A 3/12 rate of change represents the year-over-year percent change of a three-month moving average, and the 12/12 rate of change represents the year-over-year percent change of a 12-month moving average.

The March WSJ/Vistage Small Business CEO Confidence Index was comprised of responses from 827 leaders of small businesses reporting annual revenues of $1-20 conducted March 4-18, 2024.

March highlights:

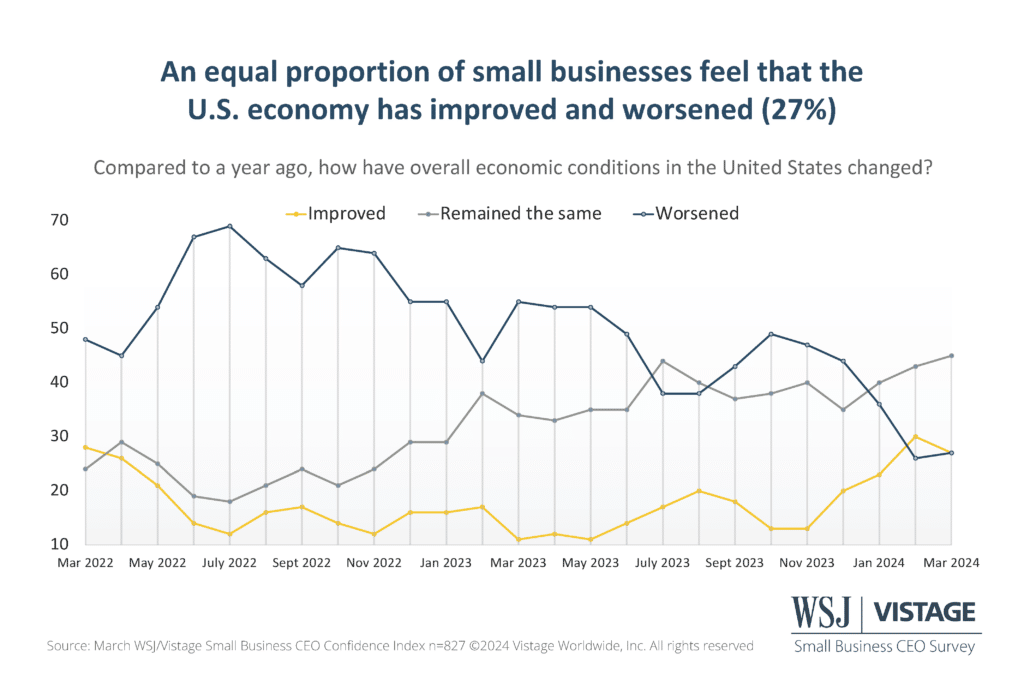

- Current Economy: Looking back over the past 12 months, an equal proportion of small businesses report that the U.S. economy has improved as believe it has worsened (27%).

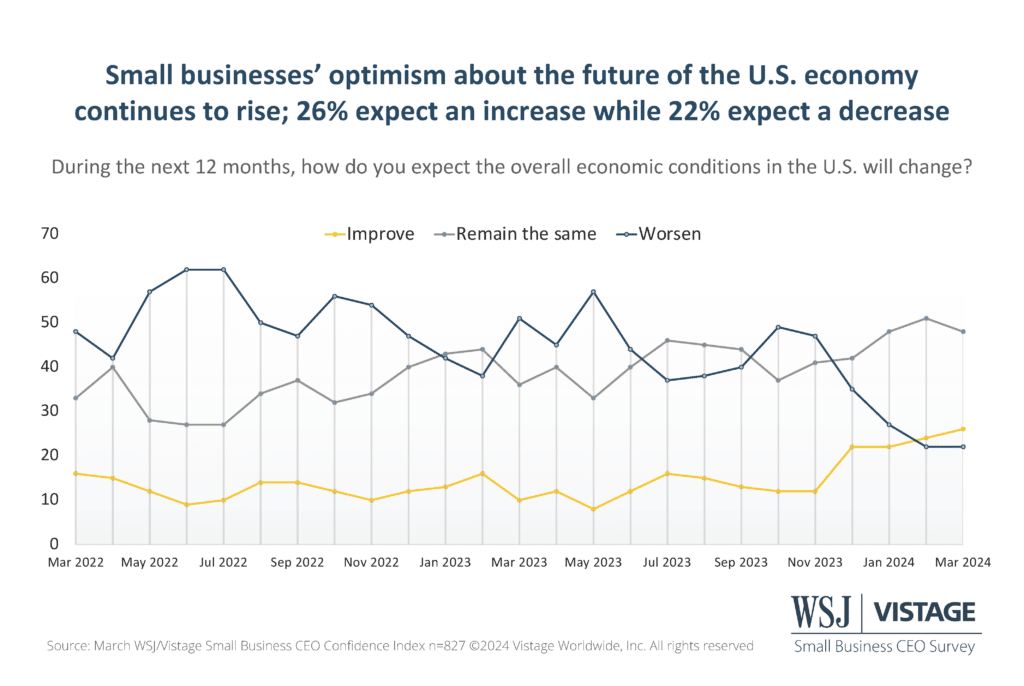

- Future Economy: The proportion of small businesses expecting the economy to improve in the next year rose 2 points to reach 26%, while the proportion that expects it to worsen remains at 22%.

- Revenue projections: 62% of small businesses expect increased revenues in the next 12 months, on par with last month.

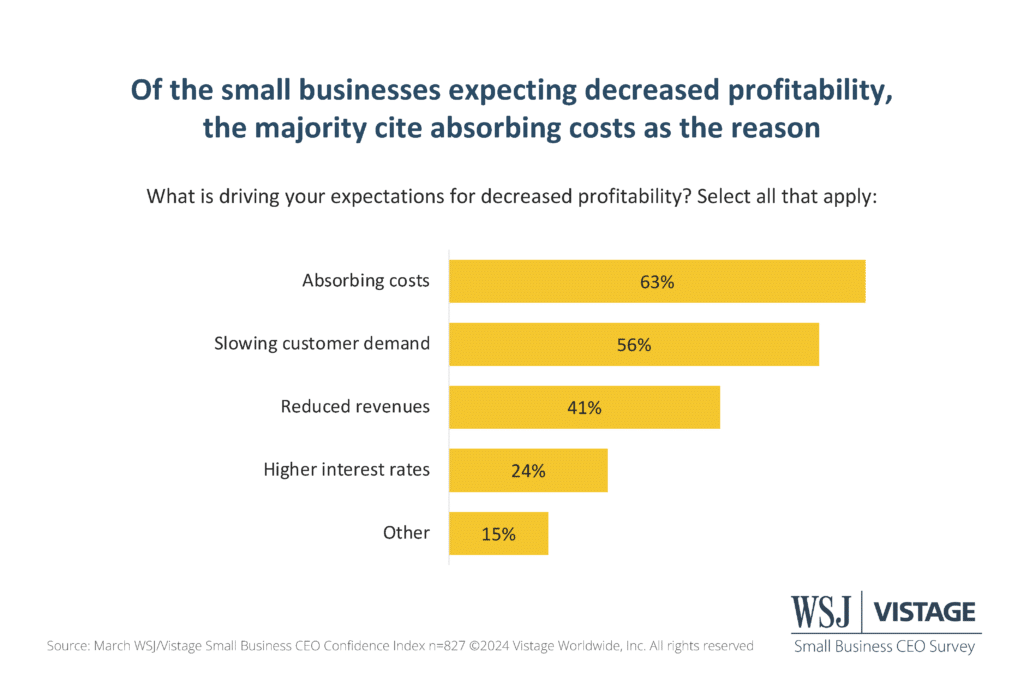

- Profitability projections: Less than half (48%) of small businesses expect increased profits in the next 12 months, while 17% expect them to decline.

- Fixed investment plans: The proportion of small businesses planning to increase investments edges over one-third (34%), while 13% plan to reduce spending in the next 12 months.

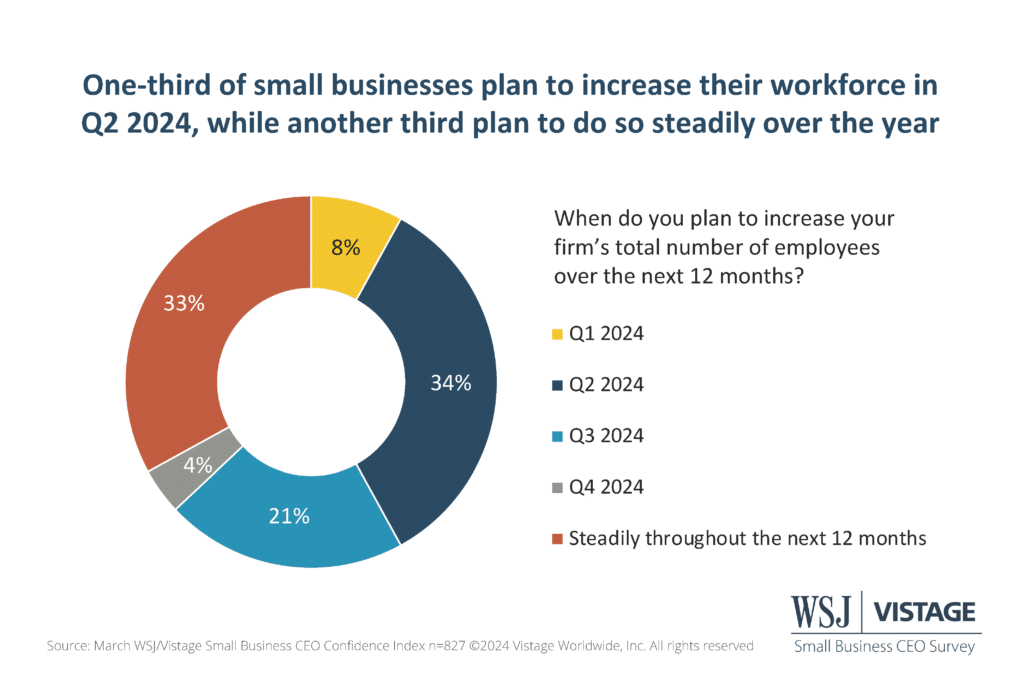

- Workforce expansion plans: Over half of small businesses (54%) plan to expand their workforce in the next 12 months, the second highest proportion in a year.

To explore the full March 2024 WSJ/Vistage Small Business data dataset, visit our data center or download the infographic.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey