The Corporate Transparency Act: What small businesses need to know before Jan. 1

12/4/24 Update: A federal court has halted the implementation of the Corporate Transparency Act’s beneficial ownership reporting requirements. This will remain in effect until the conclusion of legal proceedings. As of this update, businesses are not required to comply with the reporting requirements.

If you have a small business with less than 20 employees and up to $5 million in annual revenues as an entity like a limited liability company or S corporation, the act now requires you to give information about ownership and control.

Our partner, the U.S. Chamber of Commerce, breaks down this rule and its potential impact on U.S. small businesses.

What is the Corporate Transparency Act?

The Corporate Transparency Act, voted on by Congress as a proactive measure to get ahead of shell companies and money laundering, requires eligible small businesses to fill out a Beneficial Ownership Information (BOI) report. The requirements include an $85 fee for filing and about 3 hours, according to experts.

Penalties are steep. Those who don’t comply could face a $10,000 fine and up to 2 years in jail. New businesses have 90 days from the time of their creation to complete the form and file, while those with existing businesses have until the end of the year.

Who is the governing body?

The Financial Crimes Enforcement Network, an arm of the U.S. Department of the Treasury, is handling the BOI filing and reporting. The group — otherwise known as FinCEN — focuses on financial crimes and corporate compliance services.

Who is impacted?

The Corporate Transparency Act targets small businesses that are LLC and S corporations with less than 20 employees or 5 million in revenue. You are exempt if you have over 20 employees and over $5 million in annual revenue.

Also, note that those with an ownership stake will be required to submit certain changes (i.e. marital status) that were not previously relevant or reported within 30 days.

What does this entail?

Those impacted by the new law can complete the filing of the Beneficial Ownership Information themselves online.

Information required includes personal information, which may take some time to gather. Changes to your personal information — such as marriage or divorce — may require a new filing within a certain time.

What are most businesses doing?

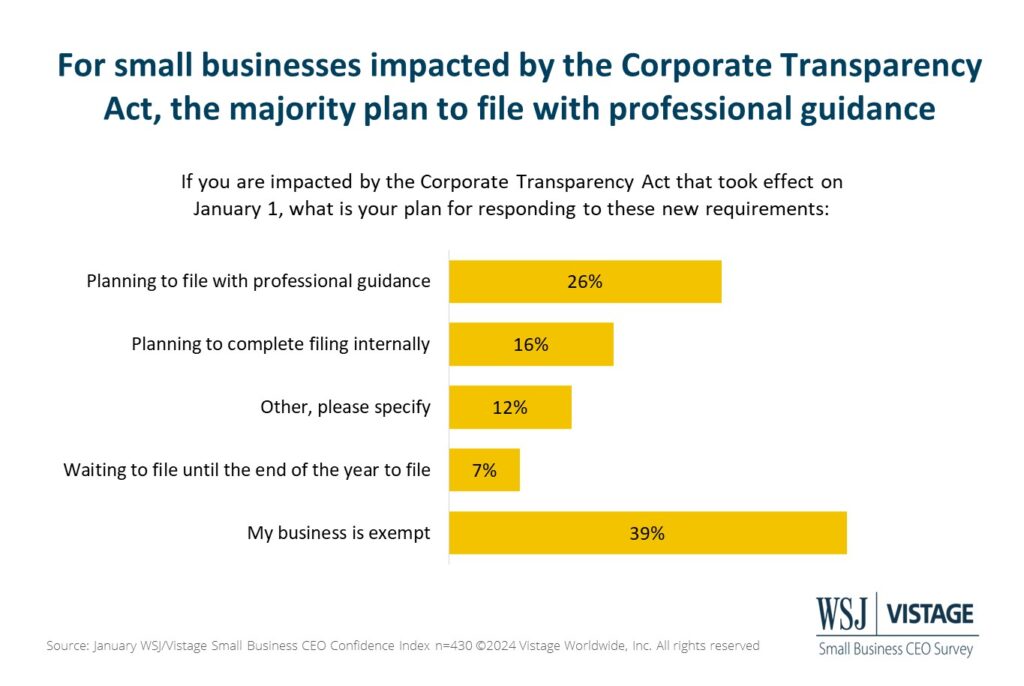

The January WSJ/Vistage Small Businesses CEO Confidence Index found that those required to file are planning to do so with professional guidance.

Expert Opinion: Harry Barth

Top asset protection attorney Harry Barth shares key considerations about the Corporate Transparency Act with Vistage Chairs Beth Adkisson and Tane Minnick.

Top asset protection attorney Harry Barth shares key considerations about the Corporate Transparency Act with Vistage Chairs Beth Adkisson and Tane Minnick.

His top tips for dealing with the Corporate Transparency Act include:

- Review structure and articles of organization, shareholder agreements, and ownership structures.

- Get a FinCEN number, which is like an SSN or a Real ID for a business and guarantees more security.

- Security and transmission of private information is an issue. Getting a FinCEN number makes the process easier.

- The most complicated part of the equation is who is required to report; there are 23 exemptions.

Member Perspective: JD Maher

Another perspective was offered by JD Maher, a Vistage member and estate planning specialist with Archford Capital Strategies in St. Louis. Maher recaps the Corporate Transparency Act below, sharing accompanying links that explain the act, who it applies to, and filing requirements:

Another perspective was offered by JD Maher, a Vistage member and estate planning specialist with Archford Capital Strategies in St. Louis. Maher recaps the Corporate Transparency Act below, sharing accompanying links that explain the act, who it applies to, and filing requirements:

The Corporate Transparency Act mandates the filing of the Beneficial Ownership Information Report (BOI Report) for most small businesses. This new law took effect on January 1, 2024.

The federal government created the CTA to stop illicit activities such as money laundering and fraud by enhancing transparency regarding business ownership and management. This federal law mandates that businesses — including LLCs, FLPs and corporations — submit a BOI Report to the Financial Crimes Enforcement Network (FinCEN). For newly established businesses, the filing deadline is within 90 days of creation, while businesses in existence before January 1, 2024, are required to file by December 31, 2024.

Key information demanded by the law includes details regarding substantial owners and individuals exercising significant control over the company.

To assist leaders who own or run any business entities in navigating through these requirements, Archford has prepared a comprehensive summary document. This document outlines key terms and crucial details to help you determine whether you qualify for exemptions or, if not, the necessary information required for BOI Report compliance. Stay informed by visiting the Archford website for updates and insightful videos on navigating the BOI Report.

For additional insights, please refer to the FinCEN compliance guide.

Emphasizing the critical importance of adhering to this law, it’s imperative to note that non-compliance could lead to significant civil and criminal penalties. Additionally, please be vigilant, as the government has indicated they will not directly send information regarding this topic to business owners.

Other perspectives on the Corporate Transparency Act

Better Business Bureau Great-West Pacific: Carol Roth interview

Learn Vistage members’ perspectives in Vistage Networks [Member Exclusive]

Related Resources

Rates of change illustrate small business optimism [WSJ/Vistage Jan 2024]

Category : Ownership & Governance

Tags: financial management