Talent scarcity and wage increases contribute to decline in small business confidence [WSJ/Vistage October 2021]

People are the fossil fuel for growth, but the scarcity of talent is slowing the speed and trajectory of growth for small businesses. In the latest WSJ/Vistage Small Business CEO Confidence Index survey, 55% of small businesses reported that hiring challenges are limiting their ability to operate at full capacity. That is not stopping their search for talent; 65% plan to add personnel in the year ahead. The talent challenge compounds itself with inflation as higher wages are required to compete for employees. Nearly the same proportion of small businesses who are expanding their workforce are also increasing pay to be competitive; 62% report they are boosting wages to address talent shortages.

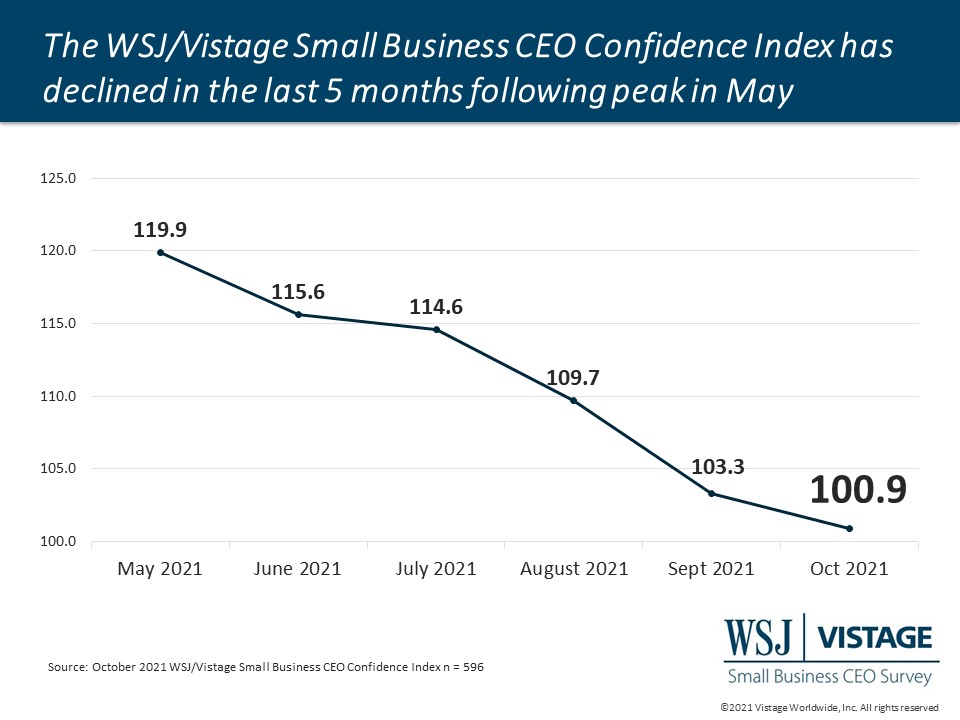

These persisting challenges are part of what has led the WSJ/Vistage Small Business CEO Confidence Index to decline for the fifth month, reaching 100.9.

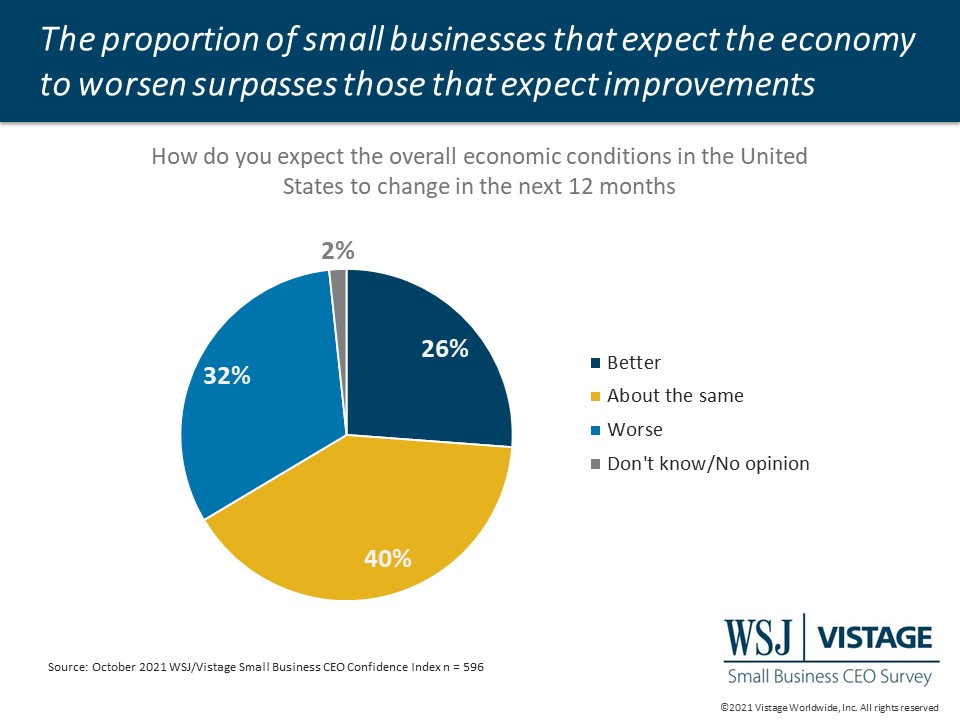

Another contributing factor to the decline of the Index was small business sentiment about future economic growth. For the first time since the depths of the pandemic, the proportion of small businesses expecting improvements (26%) has fallen below the proportion that believe it will get worse in the year ahead (32%). This is due to the economic headwinds that continue to persist.

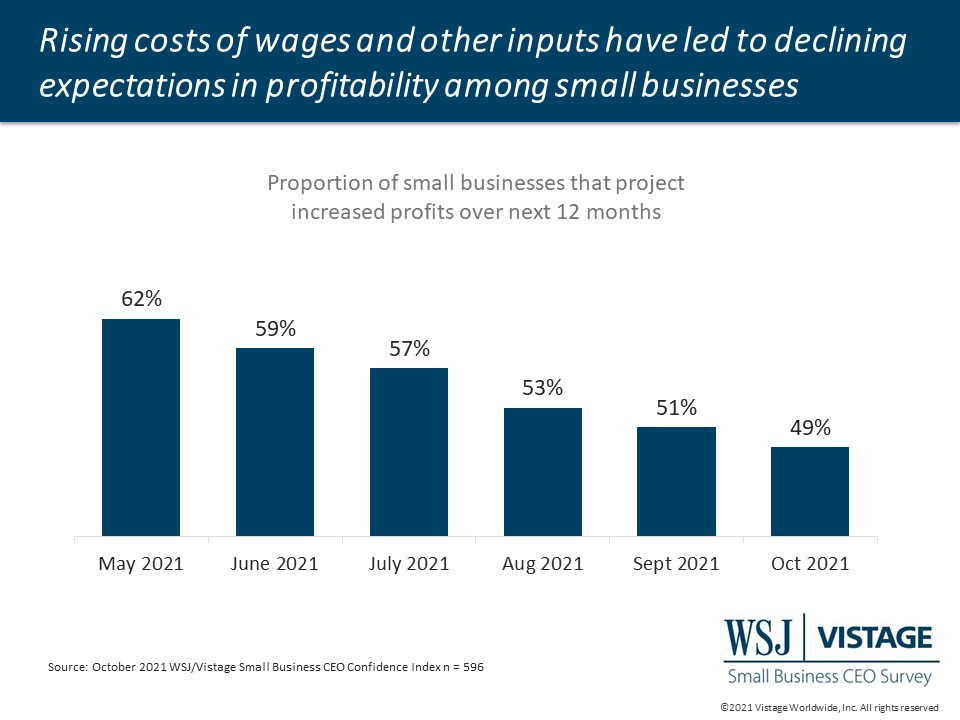

Along with talent scarcity and rising wages, supply chain challenges continue to plague small businesses. Last month in the September WSJ/Vistage Small Business CEO survey, we learned that 38% of small businesses reported that supply chain challenges were worsening. These factors continue to negatively impact expectations for profitability among small businesses, especially in manufacturing, wholesale trade and construction. While nearly half (49%) of small businesses expect increased profits in the year ahead, this is a 10-point drop from June and the lowest figure since August of 2020.

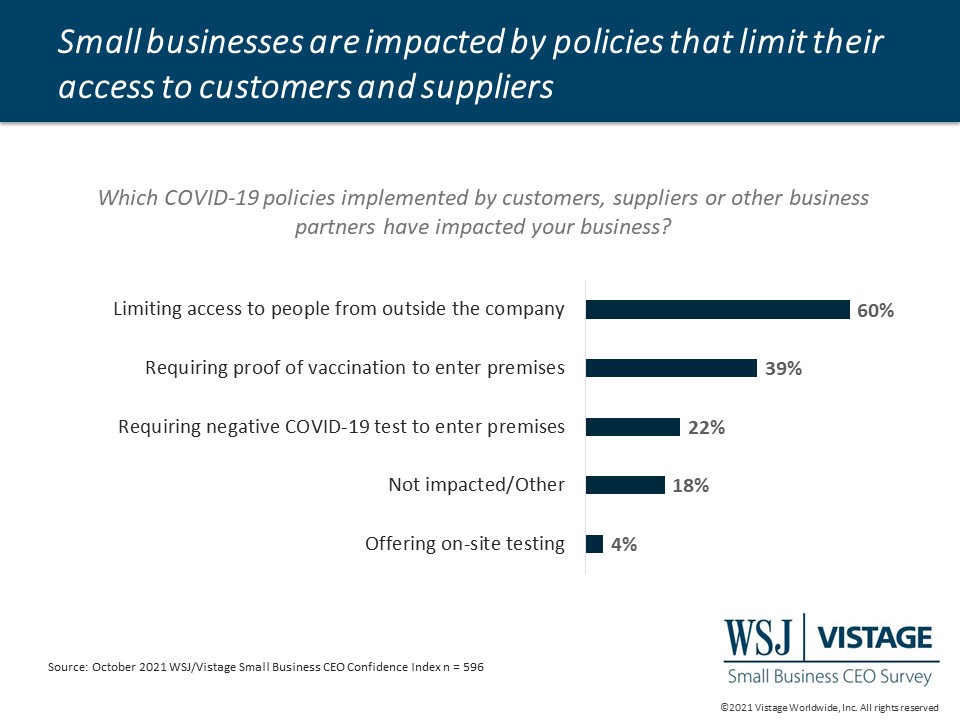

The pandemic continues to present challenges that inhibit growth as well. Vaccine mandates are contributing to the worker revolution with many employees seeking new alternatives, which might create a new talent pool for small businesses. And while small businesses might not have to comply with vaccine mandates based on their employee size, they are faced with complying to the policies of customers, suppliers and partners. In fact 60% of small businesses said COVID-19 policies have limited access to customers, suppliers and partners, 39% report that their customers, suppliers and partners require proof of vaccine to enter the premises.

Distribution of the booster along with the approval of the vaccine for children 5-11 may release another wave of spending from families that remained conservative during the surge this summer. While holiday spending has potential for a positive impact on the economy, supply chain and hiring challenges through the holiday season may continue to impact the availability and therefore the costs of goods and services. There might be a silver lining for small businesses that can quickly pivot to meet the demand this holiday season that larger businesses may be challenged to meet.

Download the October report for complete data and analysis

For the complete dataset and analysis of the October WSJ/Vistage Small Business CEO Confidence Index survey from University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Declining optimism about the economy

- Hiring plans soften while investments tick upwards

- Revenue and profit expectations continue to moderate

Related resources

Download the October 2021 WSJ/Vistage Small Business CEO Confidence Report

Download the October 2021 WSJ/Vistage Small Business CEO Conference Inforgraphic

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The October WSJ/Vistage Small Business CEO survey was conducted October 4-11, 2021 and gathered 596 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our November survey, in the field November 1-8, 2021, will capture the sentiment of small businesses as supply chain challenges continue and vaccine mandates impact businesses over 100 employees.

Category : Economic / Future Trends

Tags: coronavirus, Hiring, revenue, WSJ Vistage Small Business CEO Survey