Inflationary pressures lead to growing economic pessimism among small businesses [WSJ/Vistage Nov 2021]

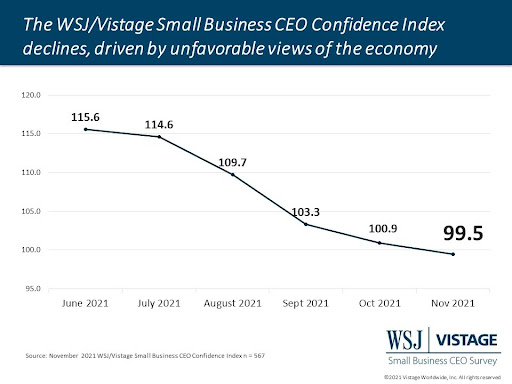

While projections and expansion plans for small businesses have held steady over the last 3 months, worsening sentiment about the economy continues to erode confidence among small businesses. The WSJ/Vistage Small Business CEO Confidence Index declined to 99.5 in November, the sixth consecutive month of decline since the peak in May.

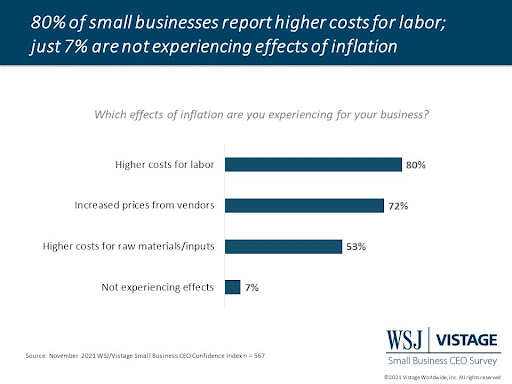

For the second month, the proportion of small businesses that expect the economy to worsen in the next 12 months (34%) was greater than those that expect it to improve (26%). The reason can largely be found in rising costs; 80% of small businesses reported higher costs for labor, the top inflationary pressure. Over two-thirds cited that rising costs were the greatest supply chain challenge they were facing, and 72% reported increased prices from vendors.

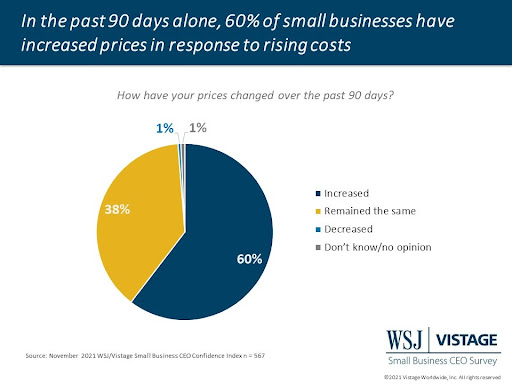

Despite rising costs, growth projections are still strong with 69% of small businesses projecting increased revenues in the next 12 months. Recent price increases — which were implemented by 60% of small businesses in the last 90 days — have led to sustaining expectations for profitability. Nearly half (48%) of small businesses expect improving profitability, while an additional 35% expect profitability to remain the same.

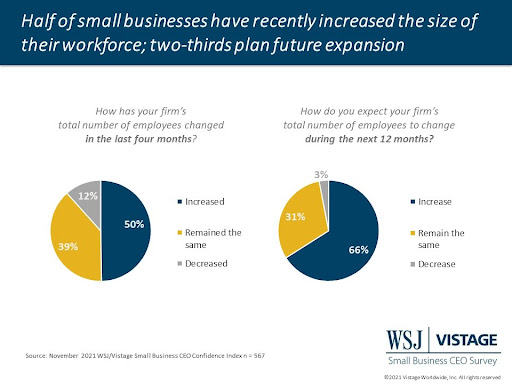

The promise of growth is outweighing the increased costs, leading small businesses to expand their workforce to accommodate growth as two-thirds (66%) plan to add personnel in the coming year. In the last four months alone, half (50%) of small businesses reported that their workforce has grown. This adds to the increasing costs for labor as not only are small businesses paying more, they are also growing their workforce at the same time.

Underlying these challenges are changing expectations for vaccine and testing mandates. Our survey revealed that 42% of small businesses have not made any recent changes to their COVID-19 policies in response to growing cases or government actions, however it is important to note that just 10% of respondents reported having 100 or more employees and therefore the majority of respondents would not be impacted by any mandates. The question for small business leaders will be how to establish and enforce their own policies while maximizing the opportunity to find talent from those who voluntarily or involuntarily become available in the labor market.

With inflation recently hitting a 31-year high, many of today’s CEOs have not had to lead businesses through these challenging economic conditions. While growth opportunities remain strong, rising costs, talent scarcity and COVID market dynamics continue to create headwinds that are preventing forward momentum. CEOs must ensure their company is prepared to execute strategies to capitalize on projected growth while also diligently managing costs. It is a delicate balance that requires close attention to changing conditions and ongoing course correction in order to succeed in difficult circumstances.

Download the November report for complete data and analysis

For the complete dataset and analysis of the November WSJ/Vistage Small Business CEO Confidence Index survey from University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Declining optimism about the economy continues

- Expansion plans over the next 12 months hold steady

- Revenue and profit expectations continue to moderate

Related resources

DOWNLOAD THE NOVEMBER 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE NOVEMBER 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

The CEO Pulse Inflation Resource Center

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The November WSJ/Vistage Small Business CEO survey was conducted November 1-8, 2021 and gathered 567 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our December survey, in the field December 6-13, 2021, will capture the sentiment of small businesses as they approach year end and plan for next year.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey