Improvement in CEO confidence is ‘good-bad news’ [Q3 2022 Vistage CEO Confidence Index]

The temperature in Phoenix might be “down” to 95 degrees — theoretically good news as it may be cooler than the 105-degree mark reached the day before — but that’s still really hot. That is the concept of “good-bad news.” The improvement is good news, however, the end result is still less than desirable.

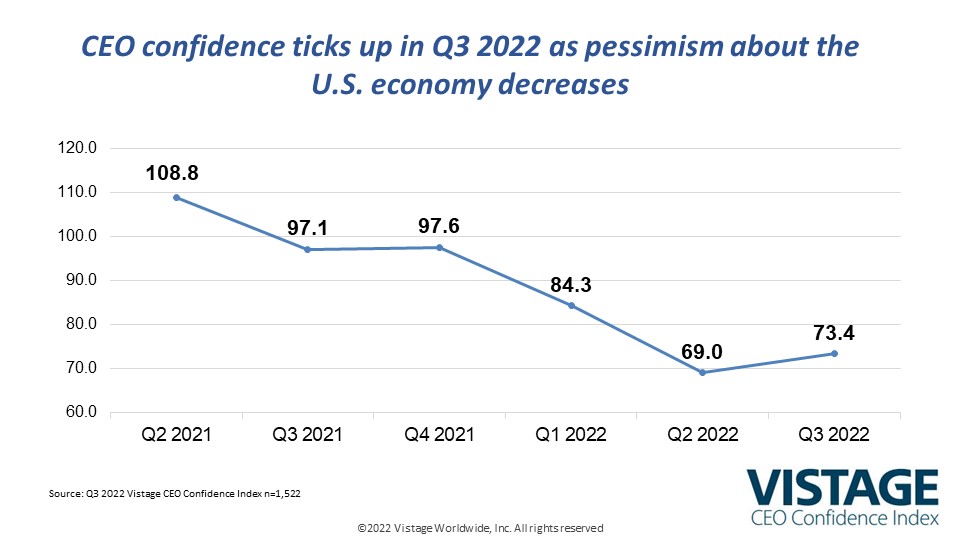

The Q3 Vistage CEO Confidence Index rose 4.4 points from 69.0 to 73.4. While that’s good news — it represents the first rise in the Index in a year — it’s still the third-lowest reading since the “Great Recession.” Slight improvements in economic expectations, along with small increases in revenue and profit expectations, lifted the average off the bottom but gave no signals as to what might happen next.

With the 2023 planning cycle beginning for many small and midsize businesses (SMBs), the direction of the economy remains uncertain. What is certain is that while inflation may have peaked, it doesn’t appear to be going down nearly as fast as it went up — another example of good-bad news. The hiring landscape is not as bad as it was in the first half, but it remains a major challenge for all SMBs.

Hiring remains a challenge

Over half (52%) of CEOs report plans to increase headcount in the year ahead, the same proportion as last quarter. That’s on top of the 53% of CEOs who have already increased headcount since the start of the year, compounded by the fact that 30% plan to hire more than originally planned. On the other side, employee retention rates decayed a bit, with 24% of CEOs reporting decreases in retention, an incremental decline from last quarter.

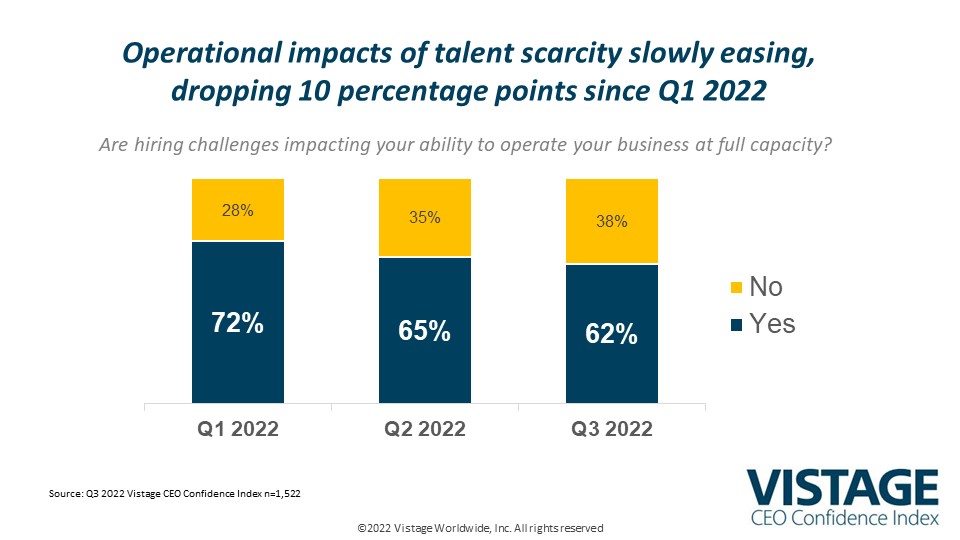

Hiring continues to be the biggest contributor to inflationary pressures, with 91% of CEOs reporting that rising wages and compensation are impacting their business. Increases in wages also are a key strategy in hiring, and accordingly, 82% of CEOs have boosted wages to compete, with another 9% planning to boost wages in the future. In effect, this brings the total to 91%, which is basically all small and midsize businesses. With all the economic volatility over the last year, in the theme of good-bad news, 62% of CEOs report hiring challenges are impacting their ability to operate at full capacity, a 10-point drop since earlier this year. However, that is still over 6-in-10 small and midsize businesses that don’t have the talent needed to meet customer demand.

The need for talent is not going to end soon. Short of a major recession that results in massive layoffs, there will continue to be more jobs available than job seekers. This gives workers leverage as they seek to “upgrade” their job status improving their responsibilities, compensation and flexibility. The push by some CEOs to mandate a return to the office will backfire, creating a retention risk for the segment of workers who value the flexibility that work-from-home (WFH) positions offer. With many companies now offering WFH work options, those workers will be able to find an opportunity that suits them better. Employee retention rates are the canary in the coal mine, a lagging indicator that tells CEOs that their workplace is not retaining — and probably not attracting — top talent.

The structures of the industrial era, analog workplace have been replaced by the Workplace 180 as revealed in our latest report Decision Factors: Unleashing Workforce Productivity. In response to the COVID-induced workforce revolution, a new workplace is emerging that balances the productivity gains for individual tasks that are best done in isolation with the benefits of face-to-face interactions. Unleashing workforce productivity will power those organizations that can find the right balance between home and office while penalizing in the form of turnover for those that don’t. The speed of change suggests there are no right answers, just constant monitoring of the most important asset of any organization: its people.

Has peak inflation passed?

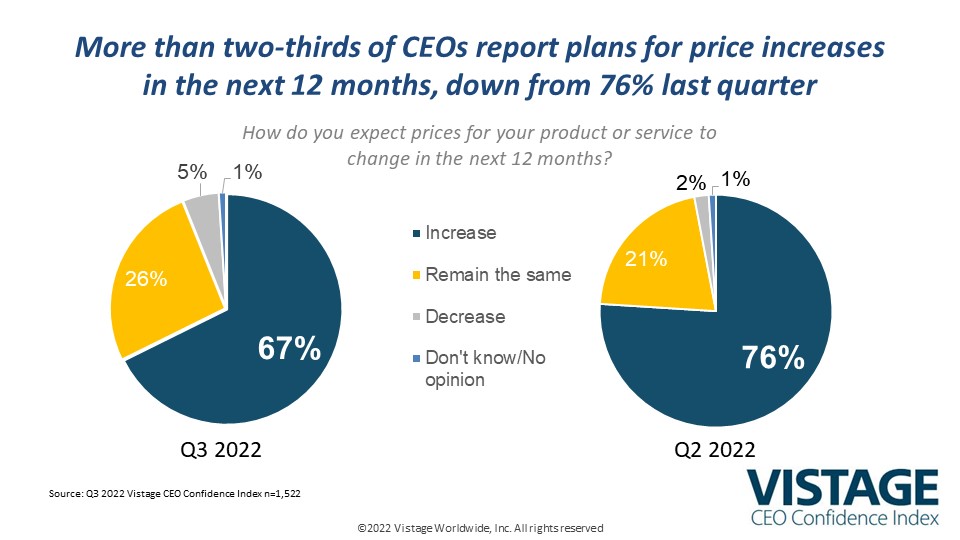

More good-bad news is that while inflation remains close to July’s 40-year high, it might have peaked with the 8.3% growth in August. The effects of inflation have shifted incrementally compared to Q2, which confirms that while the rise may have stopped, the implications remain. The higher cost of everything is triggering another wave of price increases for CEOs to absorb, but also pass on. Over two-thirds (67%) of CEOs plan on increasing prices in the year ahead, down from 76% in Q2, but still significant.

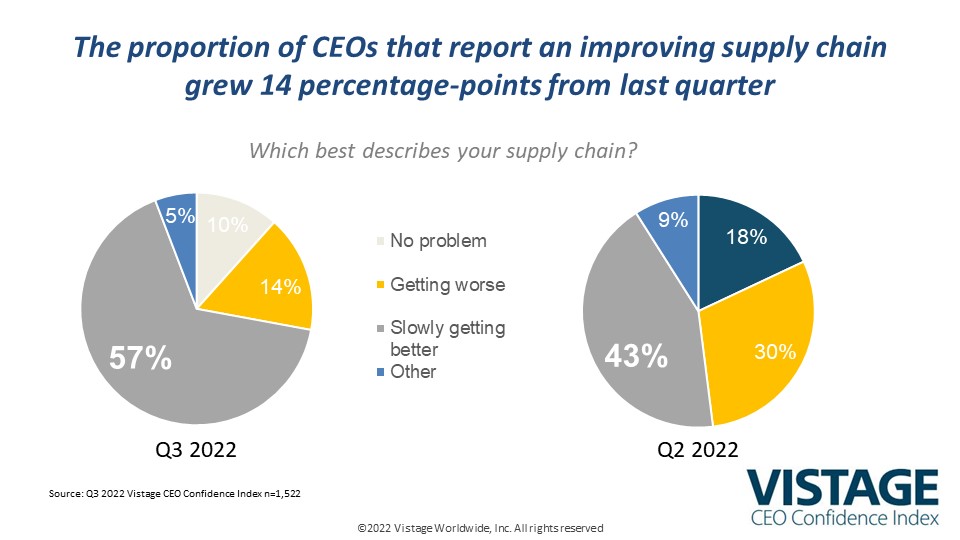

Another indication that inflation’s worst days are behind us is the slowly improving supply chain. While still a long way from where it was pre-pandemic, lessening demand coupled with improving execution shows gradual improvements. The costs for shipping containers have fallen 63% from their peak, and the 109 ships backed up off Los Angeles in January is down to just 8 in mid-September. 57% of CEOs now say their supply chain is slowly improving, up from 43% in Q2 and just 33% in Q1.

Inflation continues to force CEOs to increase prices to maintain margins. Raising prices can be done in the form of blunt force or with a subtle hand. Vistage speaker Casey Brown, CEO of Boost Profits shared her expertise on the strategic art of price increases in a recent webinar. Segmenting pricing, creating core messages, supporting the team and arming your salespeople with great messages are among the key insights. Price increases are also factored into future revenue growth; 61% of CEOs report price increases will contribute to sales revenue growth in the 12 months. Getting pricing right is imperative as customers — like all of us — are increasingly tired of the “rising cost of everything.”

Managing continued uncertainty

Following a decade of relative economic stability, the volatility and uncertainty of the last 2 years present CEOs with challenges they’ve never faced before. The only certain thing is continued uncertainty. Interest rates will not return to prior levels. Inflation will come down, but not to where it was, and the demand for talent will not abate. However, the hard lessons learned through the pandemic of tightly managing cash flow, staying close to their customers and above all taking care of their people will best position CEOs to ride out the uncertainty and be first in line to capitalize on the next rising business cycle.

Related Resources

DOWNLOAD THE Q3 2022 Confidence Index REPORT

DOWNLOAD THE Q3 2022 Confidence Index INFOGRAPHIC

Category : Economic / Future Trends

Tags: CEO Confidence Index, economic forecast, Hiring, inflation