CEO sentiment holds with little change from Q3 [Q4 2022 CEO Confidence Index]

In the golden age of sailing, mariners knew that the area near the equator where the trade winds shifted hemispheres could produce the doldrums, a time when the wind didn’t blow either way leaving them essentially in the same spot for days. The same can be said for the Q4 Vistage CEO Confidence Index, which saw little movement from the prior quarter, indicating that CEOs are pondering which way the business winds will blow in the year ahead.

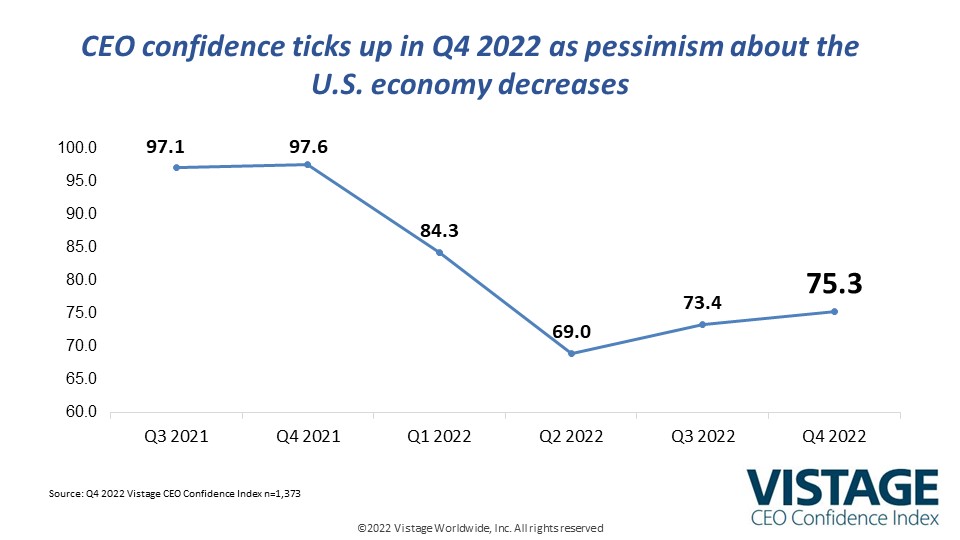

The Q4 Vistage CEO Confidence Index rose 1.9 points in Q4 to reach 75.3, which is the fourth lowest reading since the Great Recession. Looking across the six core components of the Index, the shifts in CEOs’ responses between improved, stayed the same and worsened largely offset each other. While plans for increased hiring in the year ahead rose, that improving sentiment was tempered by confidence in the economy remaining near historic lows.

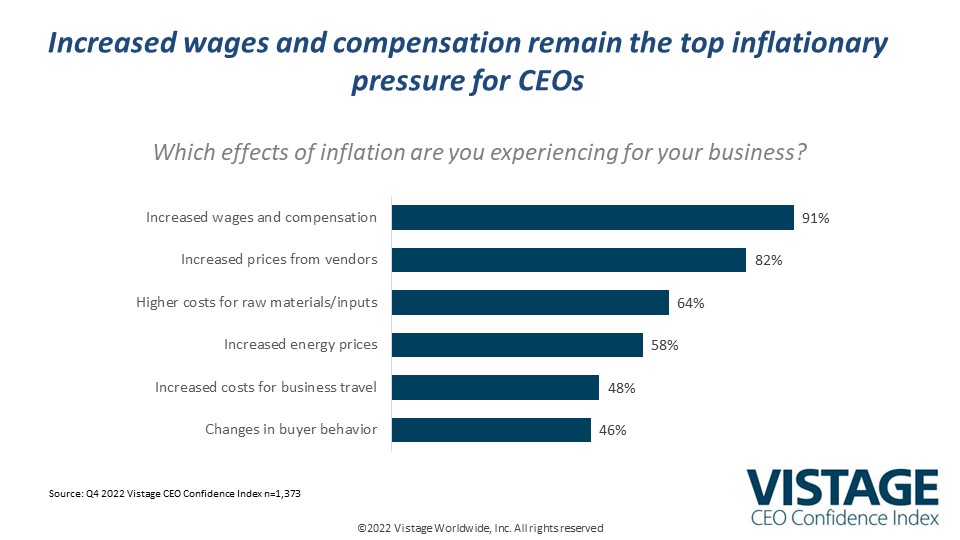

The long-anticipated recession has yet to materialize, but business conditions are hard with economic growth projected to be low and slow for the year ahead. Costs continue to rise, just not as fast. The supply chain, once a major drag on the economy, is improving and energy prices are also coming down. But this reduction in cost pressure is offset by increased wages and compensation, which continue to be fueled by — and to fuel — the ongoing talent wars. The result is a negligible change in CEO confidence and a more stable, yet depressed business environment with no clear direction.

More hiring ahead

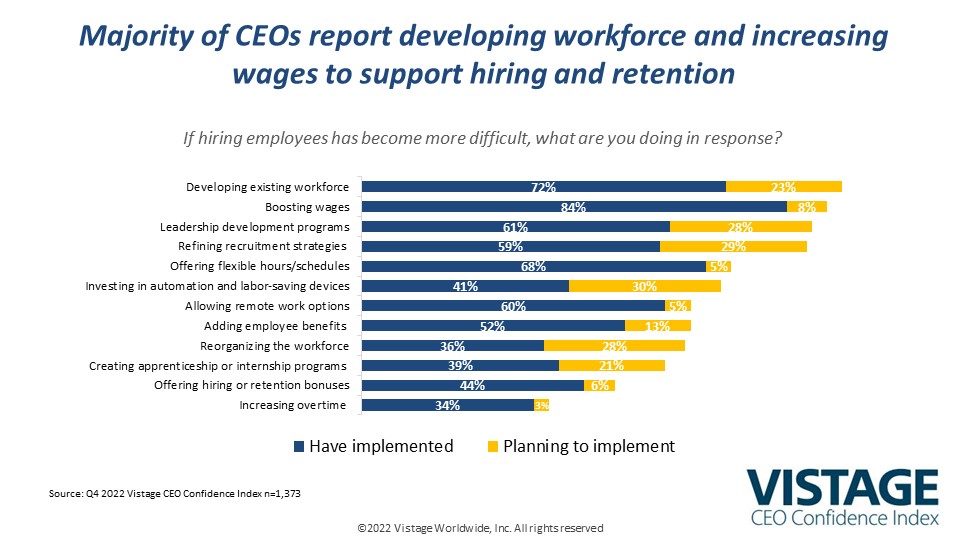

Despite a challenging economic environment, 60% of CEOs say they will be increasing headcount in the year ahead, with only 7% planning on reducing headcount. While big company layoffs make headlines, a talent-hoarding mentality has set in as small and midsize business CEOs are reluctant to lay off hard-won new employees. With 61% of CEOs saying hiring challenges are impacting their ability to operate at full capacity, they know that regardless of how the economy vacillates the availability of workers will remain tight.

Consistent with prior quarters, 84% are increasing wages and compensation to attract and compete for talent. Additionally, offering hiring bonuses (44%), flexible hours and scheduling (68%), and offering remote work options (60%) are all tactics being increasingly leveraged to hire better people faster. That dynamic carries over to existing employees as resentment can build if they perceive inequities in compensation between new workers and those that have been with the business for a long time.

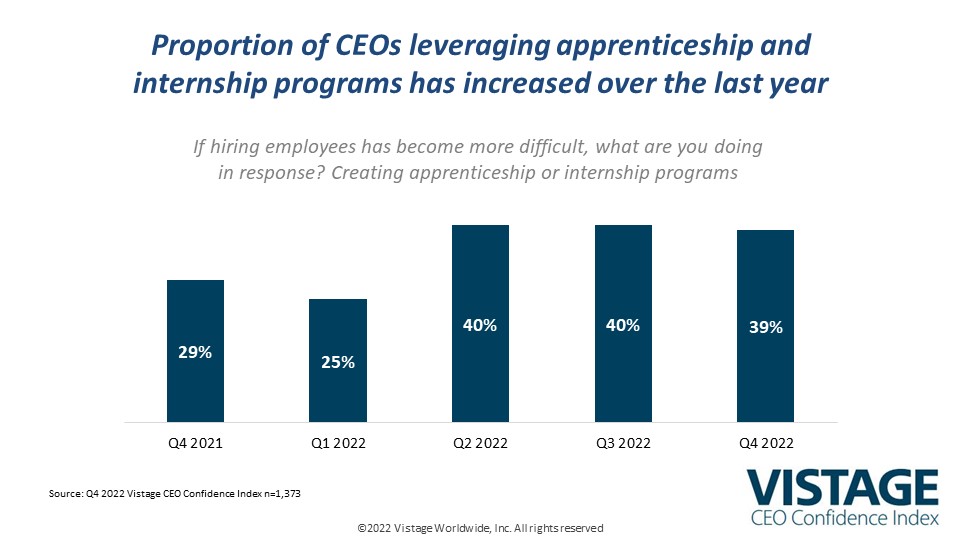

Creating apprenticeship and internship programs has also seen significant growth in the last year, especially in manufacturing and construction. A year ago, 29% of CEOs said they had invested in these programs. Now 39% have made that investment with another 21% planning on creating them. A long-game strategy, these programs identify, develop and nurture potential future employees to insure a pipeline of qualified and known workers.

Attention to retention

Hiring has gotten most of the attention as CEOs continue to add headcount, but underlying that is the need to replace workers lost to better jobs. The quits rate remains over 4.0 million per month from a domestic workforce of 163.5 million, according to the U.S. Bureau of Labor Statistics, translating to a total annual employee turnover of 29%. Even those organizations not increasing headcount are faced with hiring to replace lost workers.

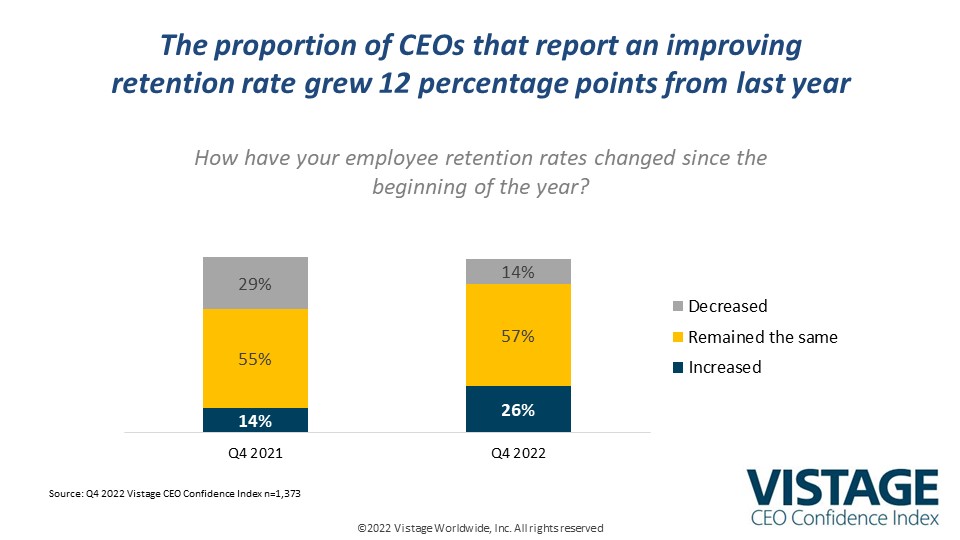

Retention rates, however, are improving. In a sharp reversal from a year ago, 26% of CEOs report increasing retention rates with just 14% experiencing decreased retention compared to 29% from Q4 2021. The loss of any worker immediately creates a productivity loss depending on how long it takes to find, hire and train a replacement. Moreover, a revolving door of workers dilutes culture and inspires others to seek new employment.

The core of every employee’s experience is their boss, the person they report to. Their boss defines their responsibilities, establishes their goals and measures their performance. More importantly, the boss brings culture to life for the worker and team. It is established that workers don’t leave companies — they leave bosses. In recognition of that reality, 61% of CEOs are investing in leadership development programs, up 5 points since June. Another 28% are planning on investing in leadership development. Our Building Better Bosses report helps CEOs think about their approach to leadership development.

Inflation’s long tail

Inflation has begun a slow descent, calming fears of the 1979-80 inflation surge that led to the Federal Reserve raising interest rates to 18% to control it. In that cycle, it took 3 years, with unemployment rates reaching 10.8% in 1982 and a harsh recession to get inflation under control and back to below 4%. None of that is projected for 2023, yet even as inflation falls, it will be some time before it reaches acceptable levels and is unlikely to return to the sub-2% rate from pre-pandemic days.

The impact of the sharp rise has taken its toll. Increased costs for everything, led by rising wages and compensation, have forced CEOs to constantly raise prices to their customers to offset the increases they are absorbing. Last year, 77% reported plans to raise prices in the year ahead whereas this year 70% plan on increasing prices in the next 12 months. Although energy costs have backed off and the supply chain is improving the availability of materials and inputs, the bite of inflation still hurts.

Most significant is the change in customer behavior as a result of inflation. Already changed as a result of the pandemic, buyers are now increasingly sensitive to increasingly higher prices and their insecurity about the 2023 economy. Nearly half (46%) of CEOs now say buying behavior has changed. Beyond price, the buying dynamic has become more difficult. With more workers changing jobs and new people replacing them, chances are the decision-makers, influencers and end users from prior decisions have changed as well, confirming the adage that every buyer makes every decision differently every time.

Compounded now by the hybrid workplace, the buying team is less connected and more challenged to collaborate in this model, which makes buying more dysfunctional. When you add to the equation new salespeople selling products and services that are new to them, this creates buying chaos. Those that can adapt most quickly to the altered dynamic with highly trained salespeople led by sales leaders who offer coaching and training have the greatest opportunity.

The new reality

Regardless of whether we enter a recession or experience weak or slowing growth, it will be a challenging marketplace in 2023. It’s hard to hire and retain employees, it’s hard to maintain costs, and it’s hard to pass on price increases to customers under the same economic pressures without losing them. However, as veterans of the pandemic, CEOs are now well-versed in economic volatility. The hard-learned lessons of navigating a collapsing-then-surging economy will fortify CEOs to trim their sails for whichever way the trade winds may blow in the year ahead.