Small business confidence remains steady and cautious [WSJ/Vistage Sept 2023]

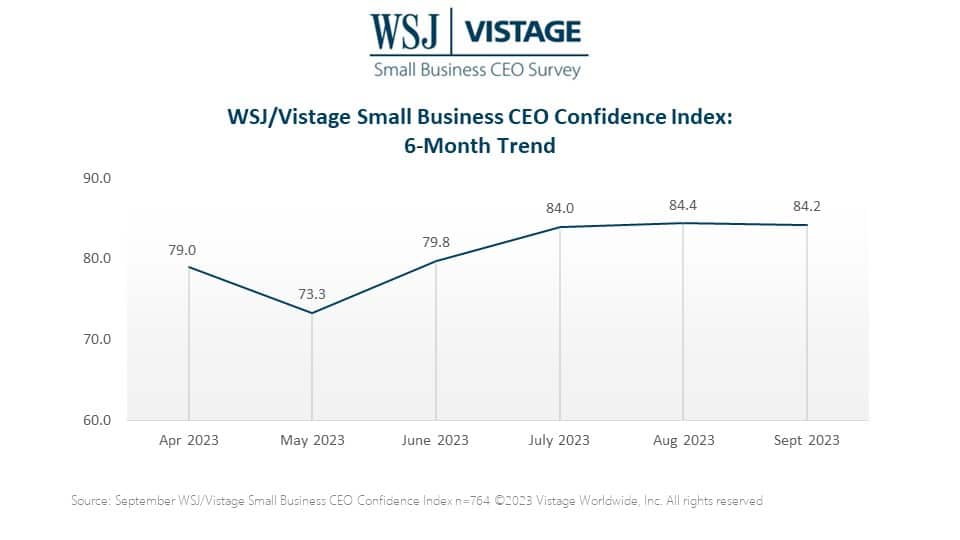

After 3 months of incremental rise, small business confidence dipped slightly in September as the WSJ/Vistage Small Business CEO Confidence Index declined nominally to 84.2. The last three months have been above the year-to-date average of 81.4, and other than the dip in May when rising interest rates harmed expectations for the year ahead, these fears have retreated and confidence has rebounded.

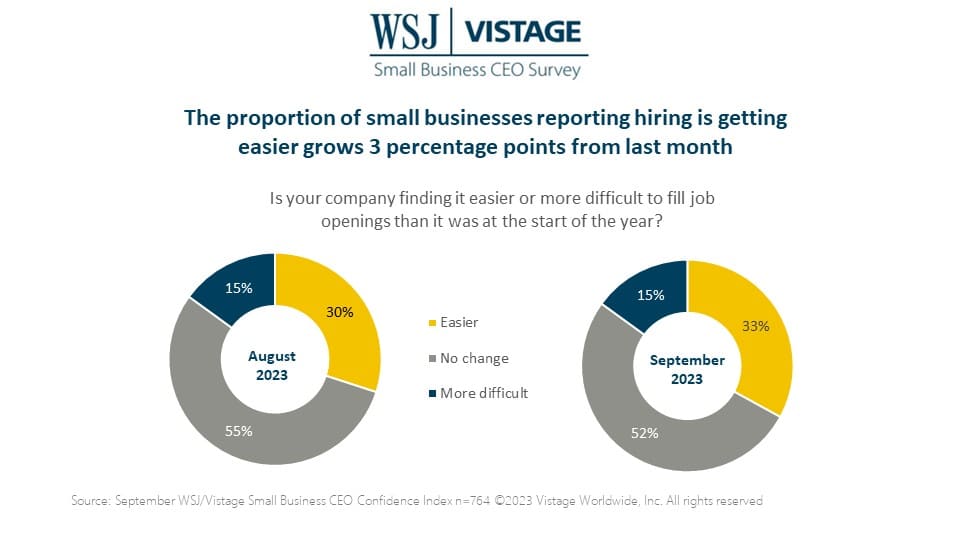

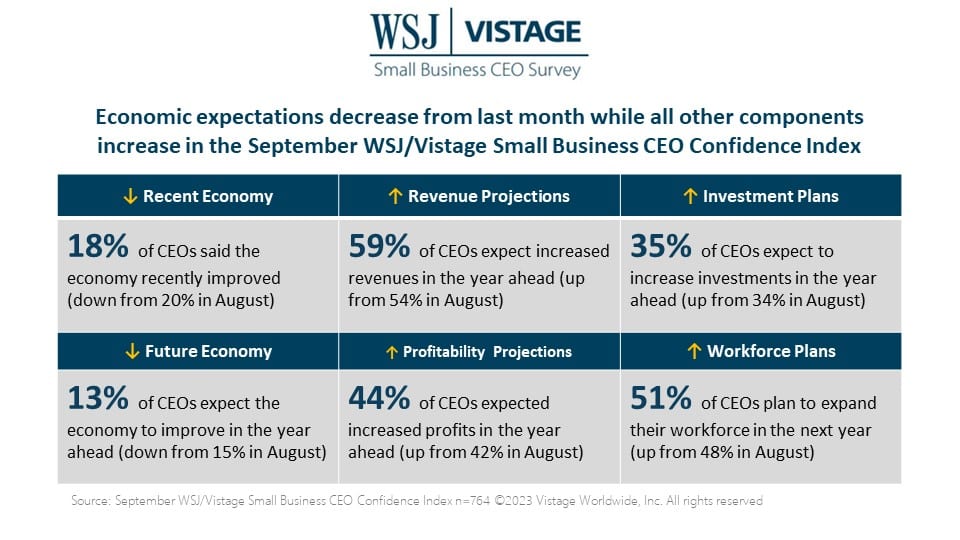

Analysis of this monthly survey of small business leaders showed that workforce plans and revenue projections for the next 12 months are slightly more optimistic, while economic optimism declined incrementally, resulting in a negligible monthly decrease in the WSJ/Vistage Small Business Index.

Changes in the individual components that comprise the WSJ/Vistage Small Business Index continue to undulate, with insignificant shifts over the months, while the overall waterline of small business confidence remains low compared to last year’s average of 84.2 and 2021’s average of 107.3.

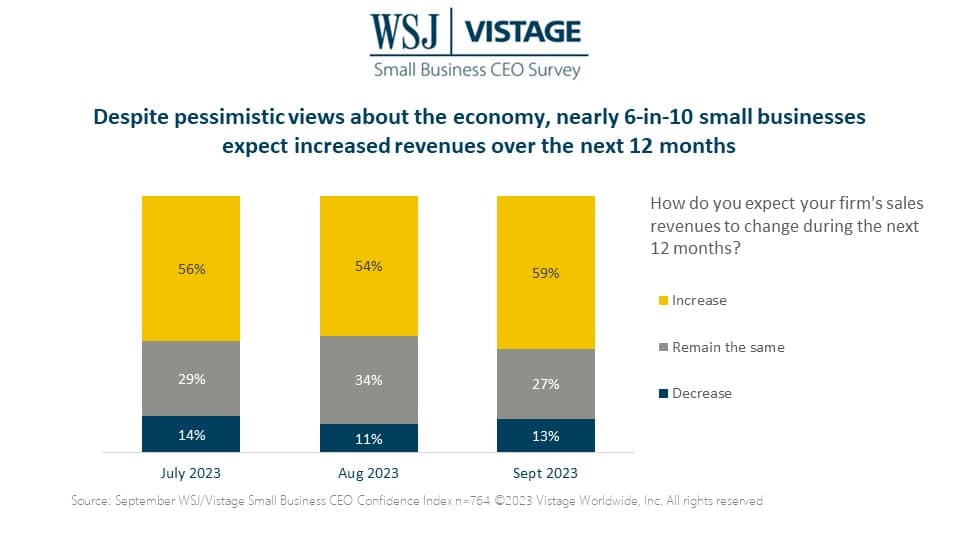

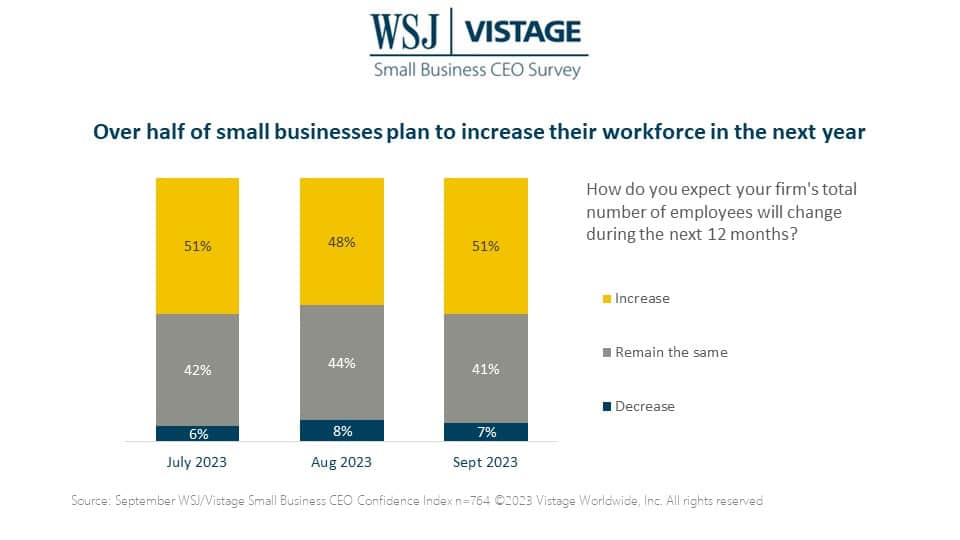

Overall, small businesses are keeping their eye on the road ahead, but in the short term, growth is still seen in certain sectors as evidenced by the fact that 59% of small businesses expect increased revenues in the next 12 months, which coincides with an uptick in workforce expansion plans as 51% of small businesses prepare to add personnel.

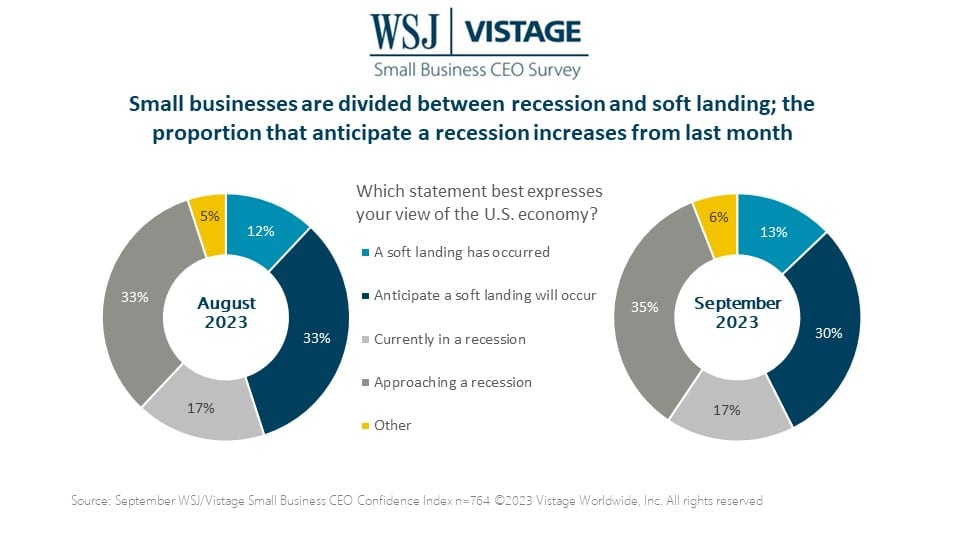

Small businesses remain divided between recession and soft landing

Last month, 45% of small businesses reported that a soft landing had occurred (12%) or would occur in the future (33%), while 50% reported that the U.S. economy was in recession (17%) or approaching one (33%).

This month’s data shows that more small businesses have shifted to team recession: 43% reported their belief that a soft landing has occurred (13%) or is going to occur (30%). In comparison, 52% of small businesses reported that the U.S. economy was in recession (17%) or are approaching one (35%).

Our partner for economic forecasting, ITR Economics, shares that certain segments are showing improvements, while others have been in a recession. Identifying and monitoring leading indicators will help small business CEOs determine the direction of their industries and businesses and make decisions for the future accordingly.

Investing in the future: Artificial intelligence

As emerging technologies are projected to transform businesses, our survey captured how small businesses will invest in AI technology budgets for the year ahead. However, data from earlier this year shows that small businesses have been slow to adopt emerging technologies;

- In March, 34% of small businesses stated that generative[a] AI platforms such as ChatGPT were not currently relevant.

- Analysis of the June WSJ/Vistage Small Business Index revealed that 30% of small businesses were not using or testing AI.

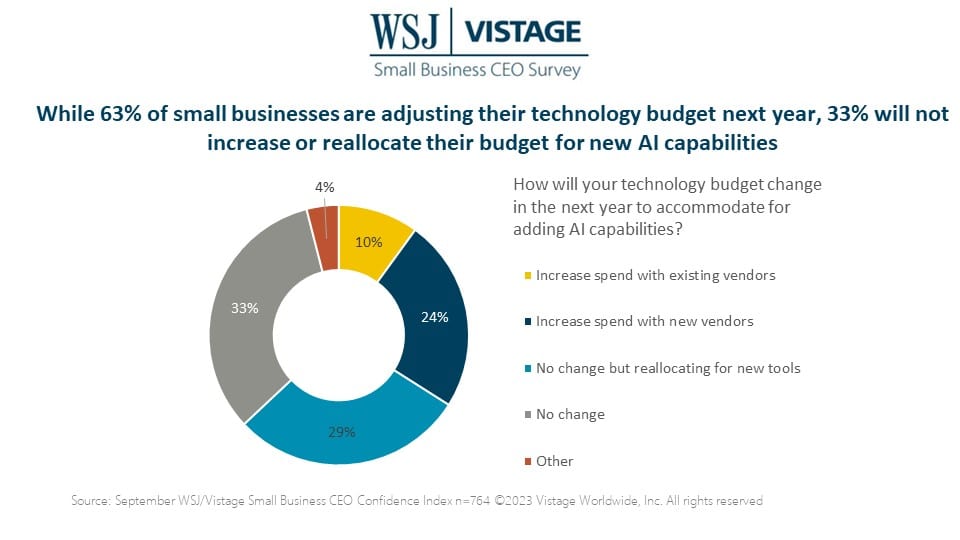

This month’s survey revealed that 33% of small businesses reported their budget would not change to add or accommodate AI capabilities.

However, on the other end of the spectrum, when looking at those budgeting for AI, 63% of small businesses are early adopters of AI, with 10% planning to increase spend with existing vendors, 24% reporting they will increase their spend with new vendors and 29% planning to reallocate existing budget for new tools.

Components of the WSJ/Vistage Small Business Index

The September WSJ/Vistage Small Business CEO Confidence Index was informed by 764 leaders of small businesses who responded to the Q3 Vistage CEO Confidence Index survey, which was in the field September 5-19, 2023. Highlights include:

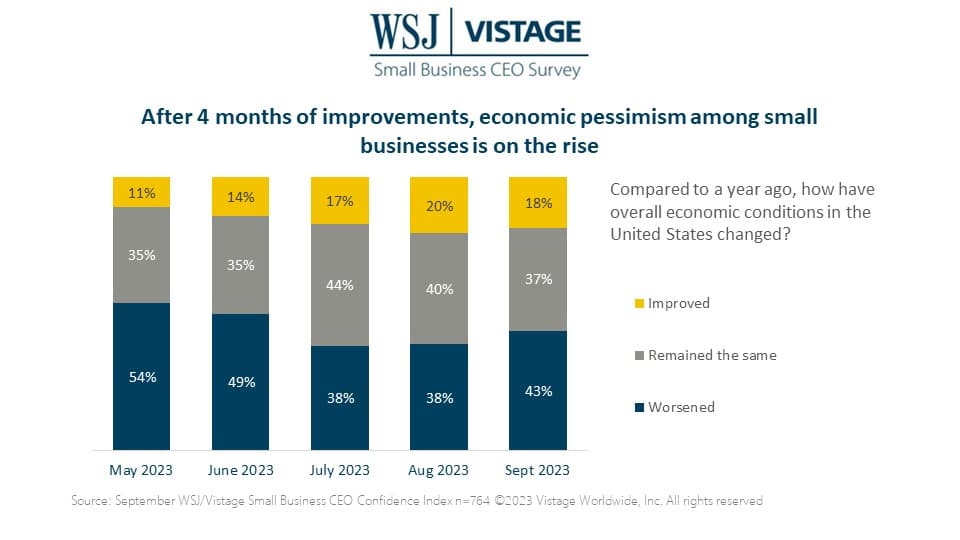

- Current Economy: 18% of small businesses said the U.S. economy has improved compared to last year, down from 20% last month. Meanwhile, 43% said the economy worsened, a five-point increase from last month.

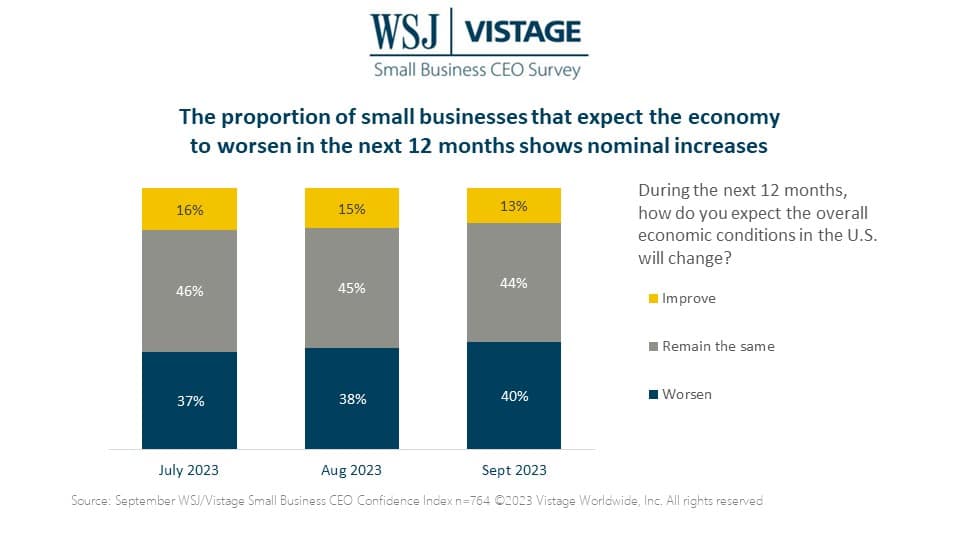

- Future Economy: Just 13% of small businesses expect the U.S. economy to improve in the next 12 months, while 40% expect it to worsen — these figures indicate increasing pessimism about the economy going forward.

- Revenue projections: The proportion of small businesses expecting increased revenues rose 5 points to 59%, while 13% expect revenues to decrease over the next 12 months.

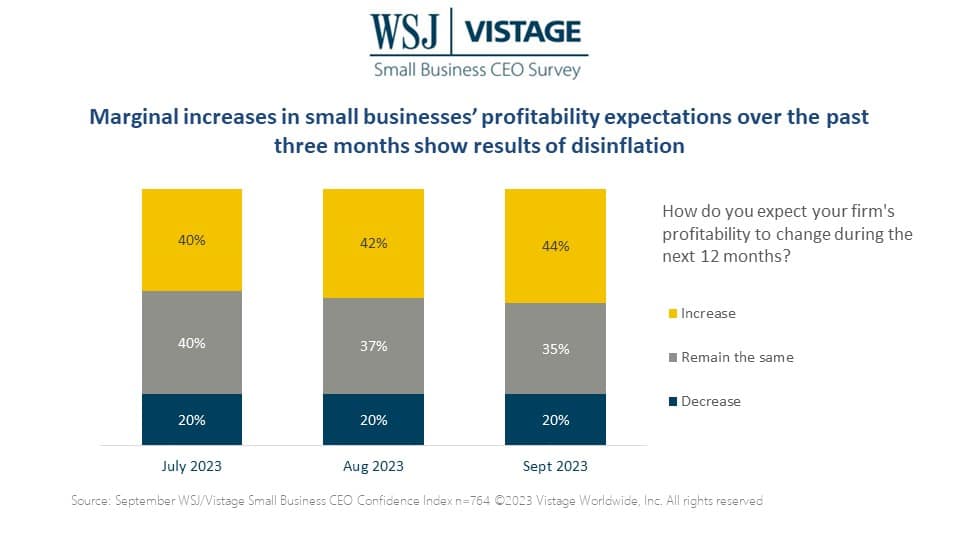

- Profitability projections: 44% of small businesses expect increased profits in the year ahead, slightly above the average over the past year. Overall profitability expectations have remained stable this year, and since June profitability expectations have shown year-over-year improvements for the first time since August 2021.

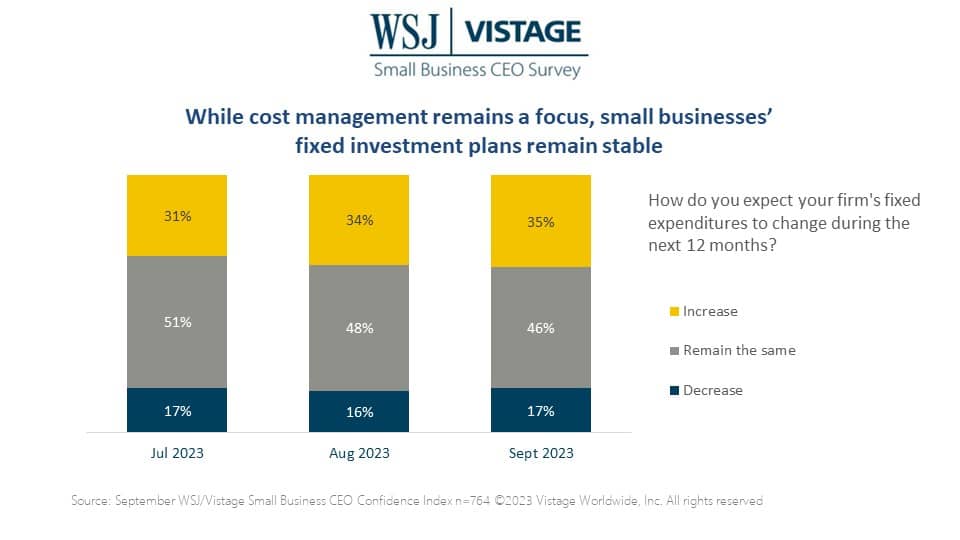

- Fixed investment plans: The proportion of small businesses who plan to increase fixed investments rose for the fifth month to reach 35%. The proportion that plans to decrease fixed investments (17%) has remained stable all year.

- Workforce expansion plans: Over half of small businesses (51%) plan to increase their workforce while 41% plan to maintain the size of their workforce in the next 12 months. Just 7% report plans to decrease their workforce, a figure that has remained stable since June of 2022.

For deeper insights on the September 2023 WSJ/Vistage Small Business data, visit our data center or download the infographic.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey