CEO confidence adjusts upward [Q3 2023 Vistage CEO Index]

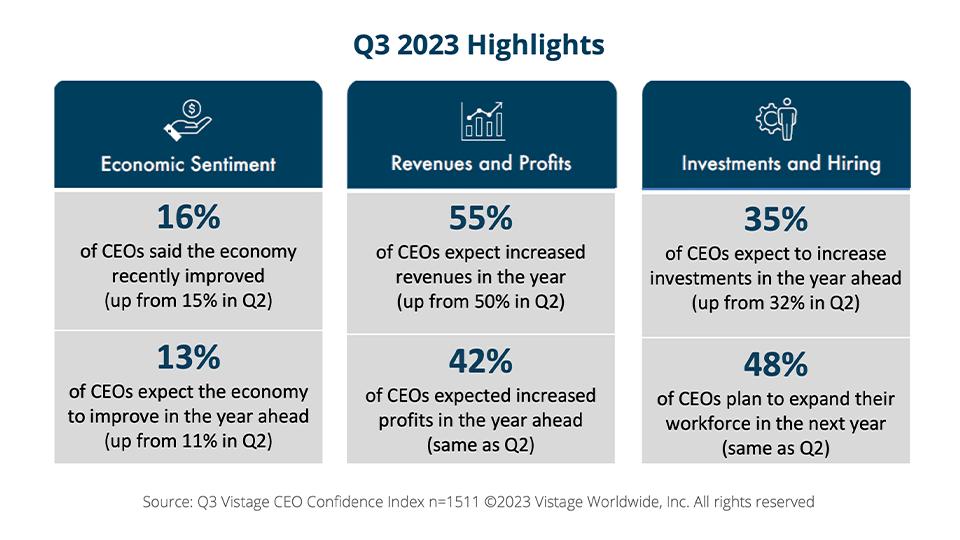

“Are we there yet?” is both the refrain of small children on long car trips — and CEOs looking for the start of the next growth cycle. The answer for both is “not yet” as the Q3 2023 Vistage CEO Confidence Index continues to move sideways, as it has over the last 5 quarters. The minor rise of the Index to 76.0 is attributed to small increases in economic confidence, but 4 of the other components that comprise the Vistage CEO Index remain the same.

The last 5 quarters have established a new floor for the Vistage CEO Index well below historical norms. The heat on hiring has been turned down considerably with just 48% planning on increasing headcount in the year ahead, the lowest number in the last 10 years with the exception of Q2 2020. Moreover, plans to decrease headcount crept up 2 points to 10%. Investments also remained close to the prior quarter.

With expectations for revenue and profits flat, it’s no surprise that the top leadership challenge was managing growth. Sluggish demand due to hesitant customers, a desire for profitable growth and the need to scale for future growth cycles indicates that the new abnormal has become the status quo.

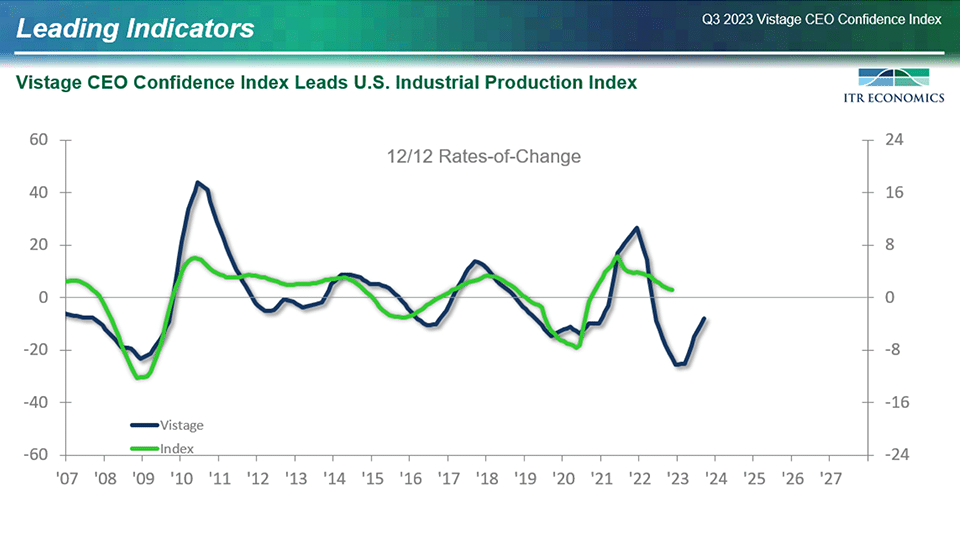

Based on the predictive power of the Vistage CEO Confidence Index, we won’t “be there” for at least another 12 months, which means the economic conditions of the last 5 quarters will continue until pent-up demand initiates the growth cycle or an unforeseen economic event happens (i.e. a government shutdown or extended auto workers strike) that sends the market into more turmoil. In the meantime, CEOs will have to be patient and focus on preparation to be best positioned for the predicted rise in their industry and market.

Leading indicator: U.S. Industrial Production Index

Initial analysis conducted by ITR Economics using 20 years of data revealed the Vistage CEO Index to be a leading indicator for the U.S. Industrial Production Index 9 months in advance. Businesses that rely on that segment of the economy can use the Vistage CEO Index as a predictor for the future.

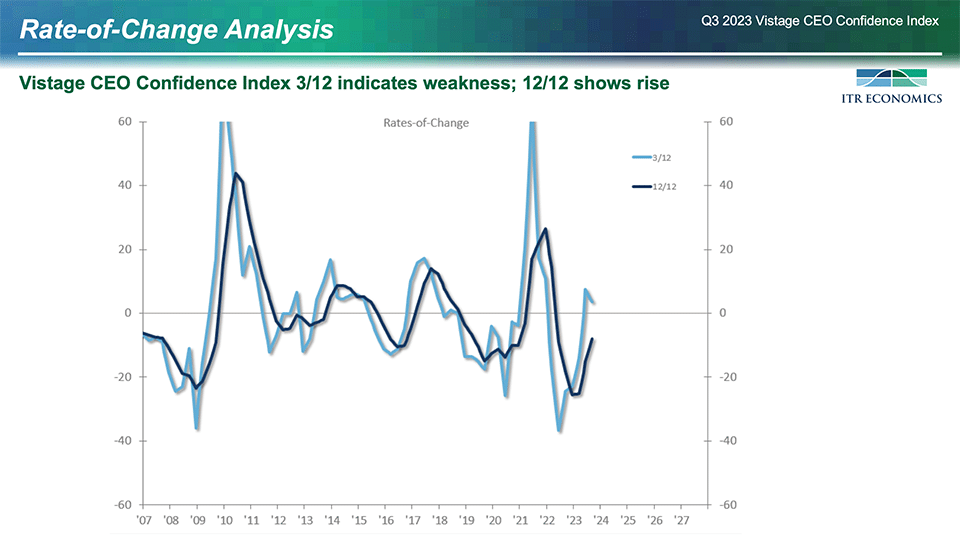

Using ITR Economics’ “rate-of-change” analysis with the Q3 data, Jackie Green, VP of Economics for ITR, determined there was a rise in the Vistage CEO Index when looking at the 12/12 rate of change, which aligns with their forecasts for a return to growth in 2025. However, the 3/12 rate of change indicates a weakness in the current cycle, consistent with their forecasts for a mild recession in 2024.

Watch my conversation with ITR’s Jackie Green to gain valuable insights that will help CEOs make informed decisions about their business for the short and long term.

The Q3 Vistage CEO Confidence Index survey was conducted September 5-19, 2023, and gathered 1,511 responses from CEOs and key executives for small and midsize businesses that are active Vistage members.

Focus on Leadership: Strategic Planning

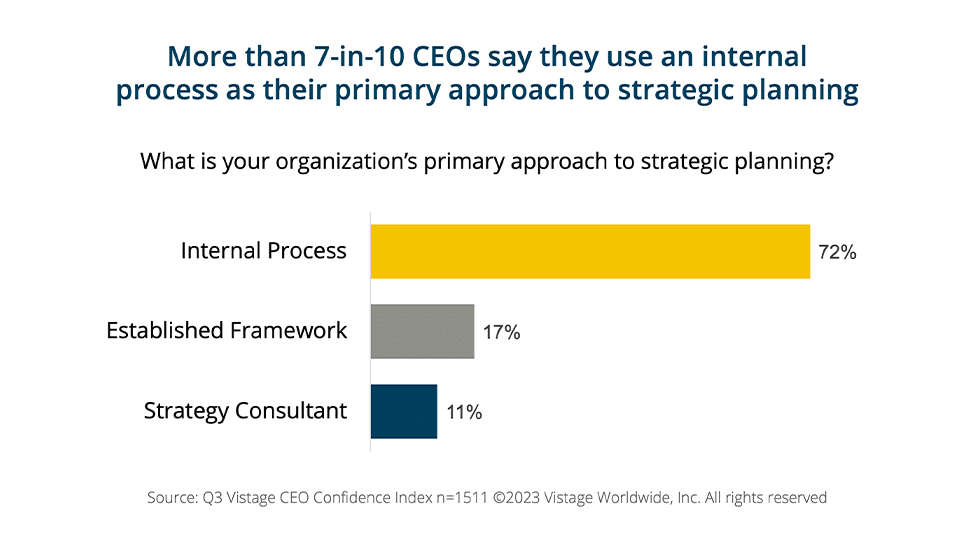

Overwhelmingly, CEOs of small and midsize businesses rely on a homegrown approach to strategic planning with 72% reporting they rely on an internal process, 17% relying on known frameworks and just 11% relying on a third-party strategy consultant.

Read the complete analysis in our Q3 2023 Vistage CEO Confidence Index report, and examine trends in our new data center over time.

For 20 years, the Vistage CEO Confidence Index has been the definitive voice of high-performing, high-integrity small and midsize business leaders. It’s provided the world-class insights that chief decision-makers need in service to our vision of being the most trusted resource to SMBs.

The Q4 2023 Vistage CEO Confidence Index survey will be in the field December 4-18, 2023, to capture the top decisions and investments of CEOs of small and midsize businesses heading into the new year, including their plans for mergers, acquisitions or sale of their business.

Category : Economic / Future Trends

Tags: CEO Confidence Index