Rising human capital costs, uncertainty impact small business confidence [WSJ/Vistage Oct 2023]

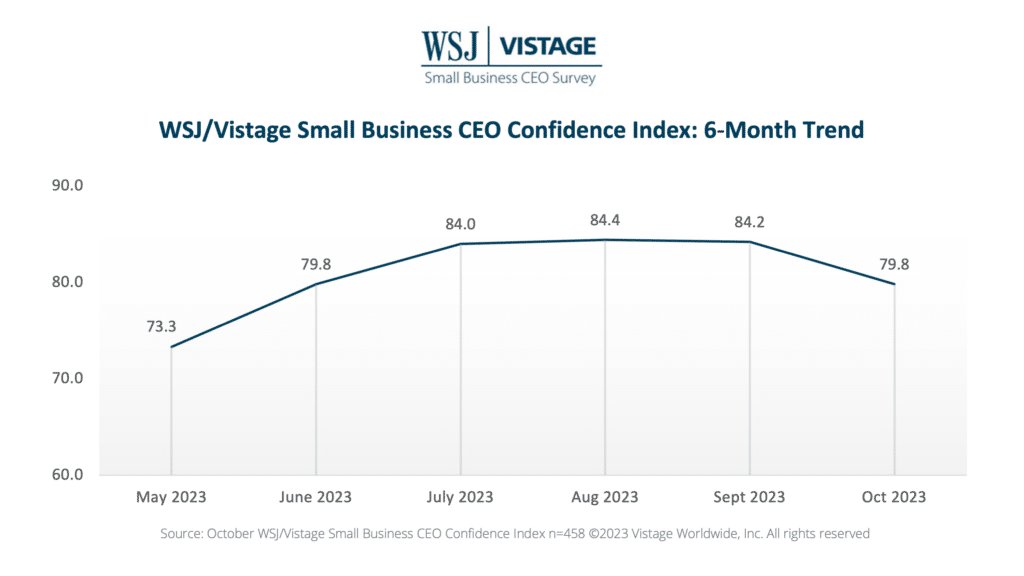

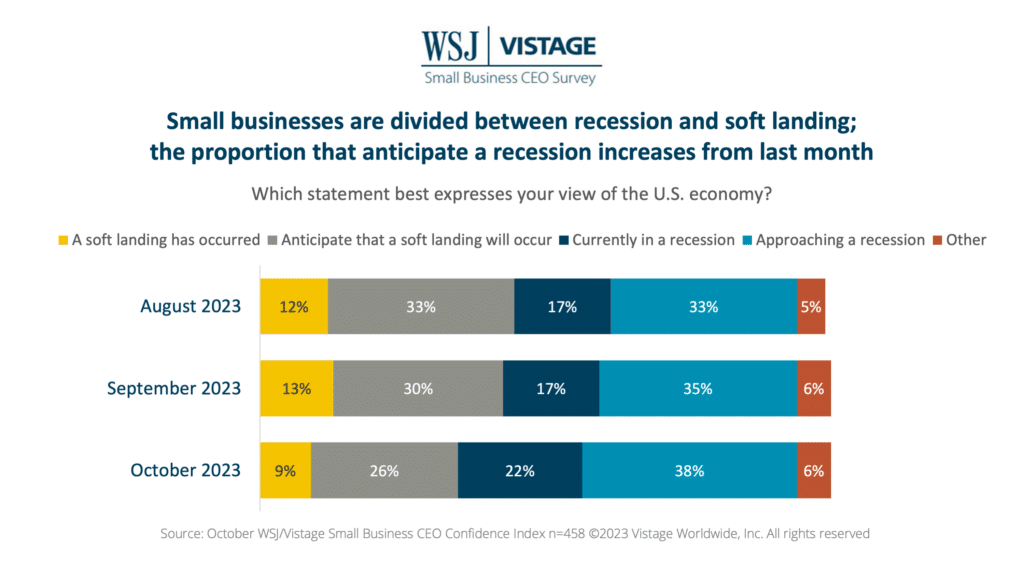

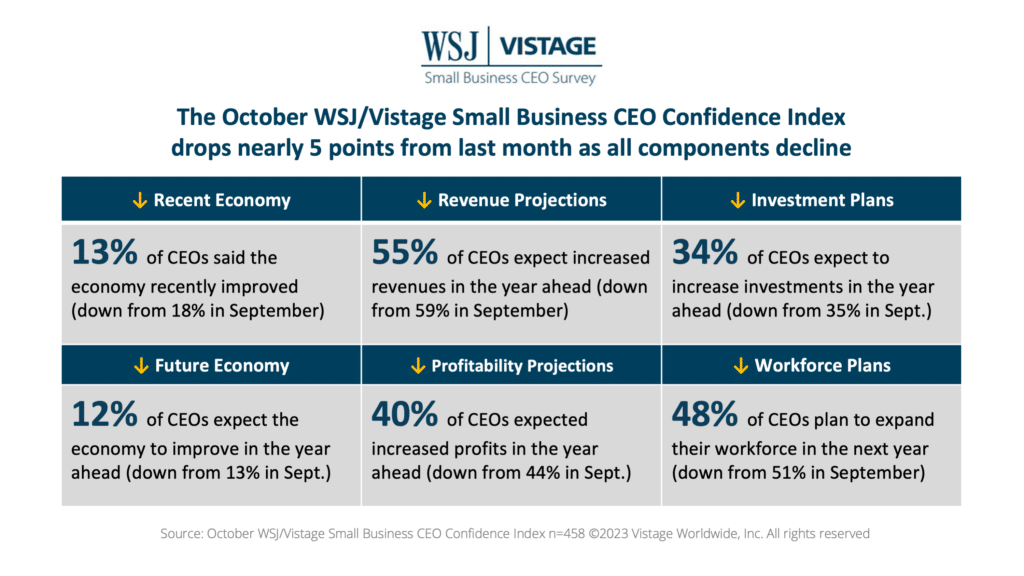

Despite inflation increasing just 3.7% for the past 2 months and the U.S. Federal Reserve deciding not to raise interest rates in September, small business sentiment about the economy’s future has declined. The WSJ/Vistage Small Business CEO Confidence Index fell to 79.8, a level last reported in June 2023, while remaining within the average for this year.

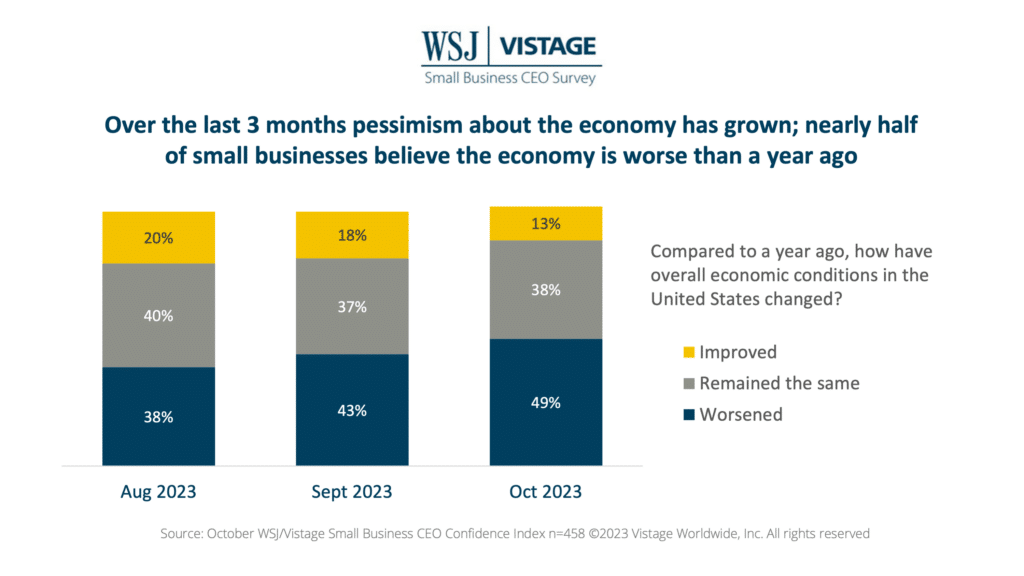

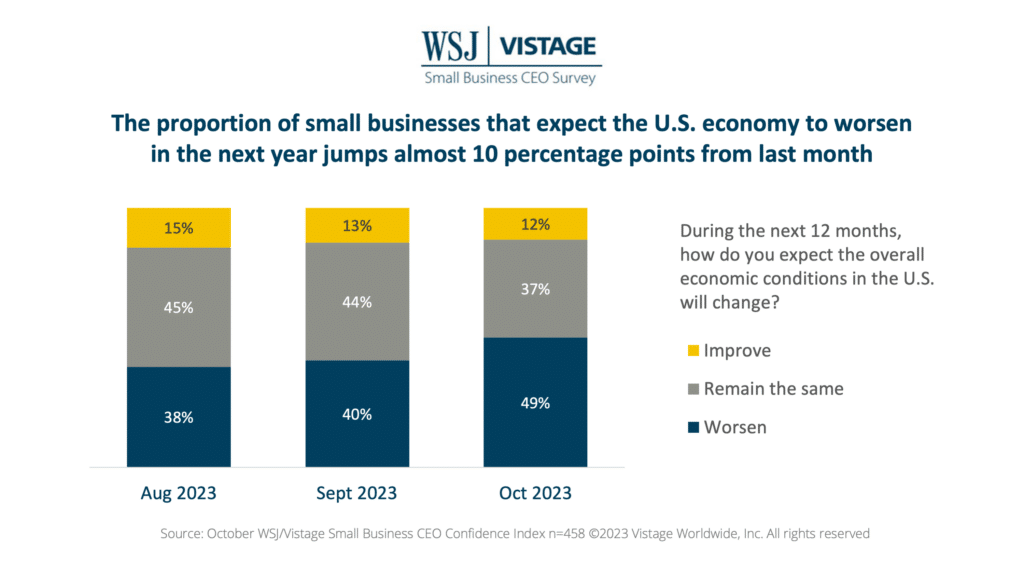

While the components that comprise the WSJ/Vistage Small Business Index declined from last month, analysis of this monthly survey of small business leaders showed that economic sentiment is on the decline. Most notably, the proportion of small businesses that expect the economy to worsen in the year ahead has risen to 49%, a 9-point gain in one month.

Mind the margins, build your reserves

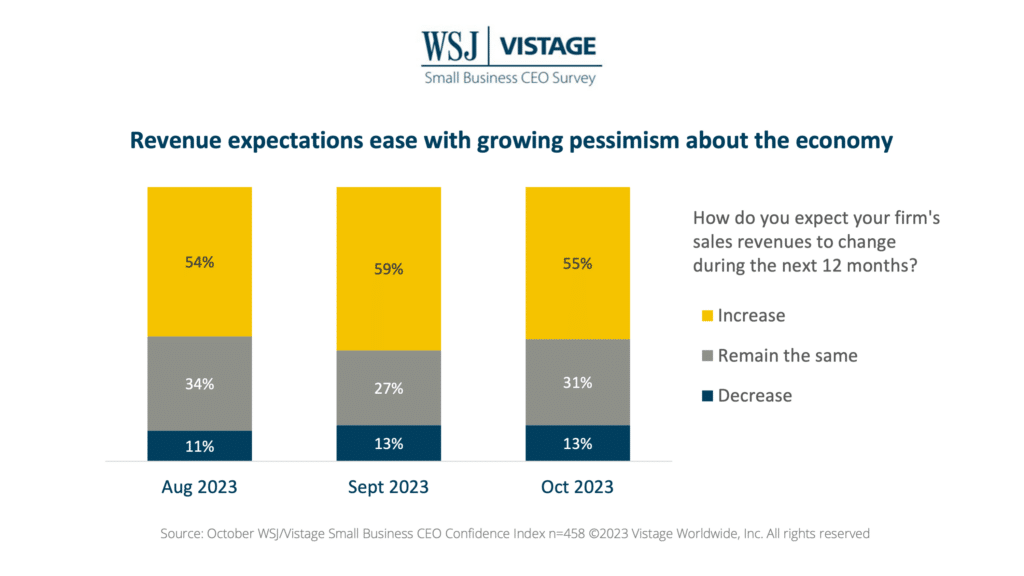

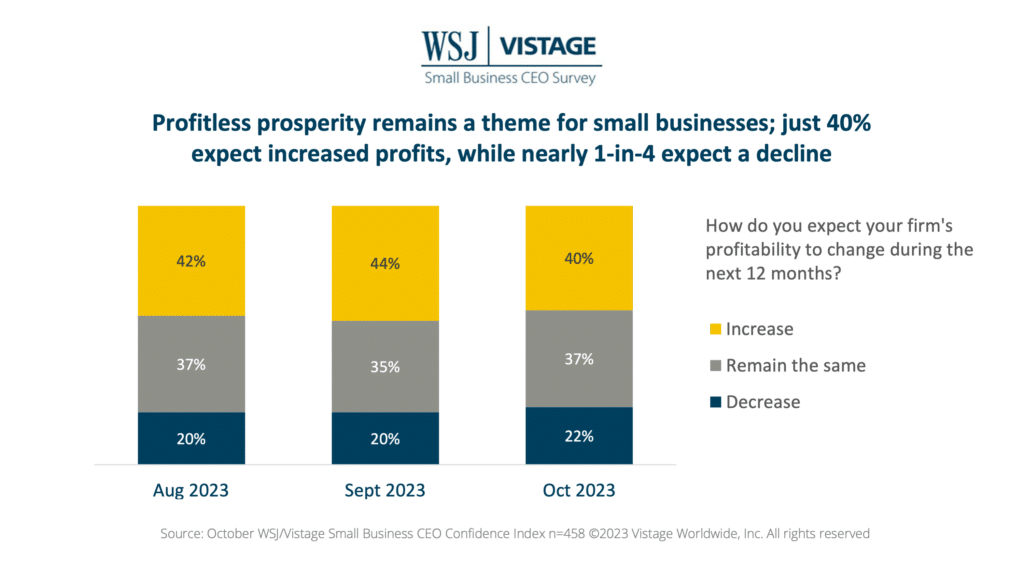

While 55% of small businesses expect increased revenues in the next 12 months, just 40% expect increased profits. Jackie Greene, vice president of economics for ITR Economics, warns that it is critical to protect margins in this period of “profitless prosperity” where revenue is rising but profits are declining. Input costs are a big part of this, and as Greene said in her analysis of the Q3 Vistage CEO Confidence Index, “the human cost is not coming down. That is getting more and more expensive.”

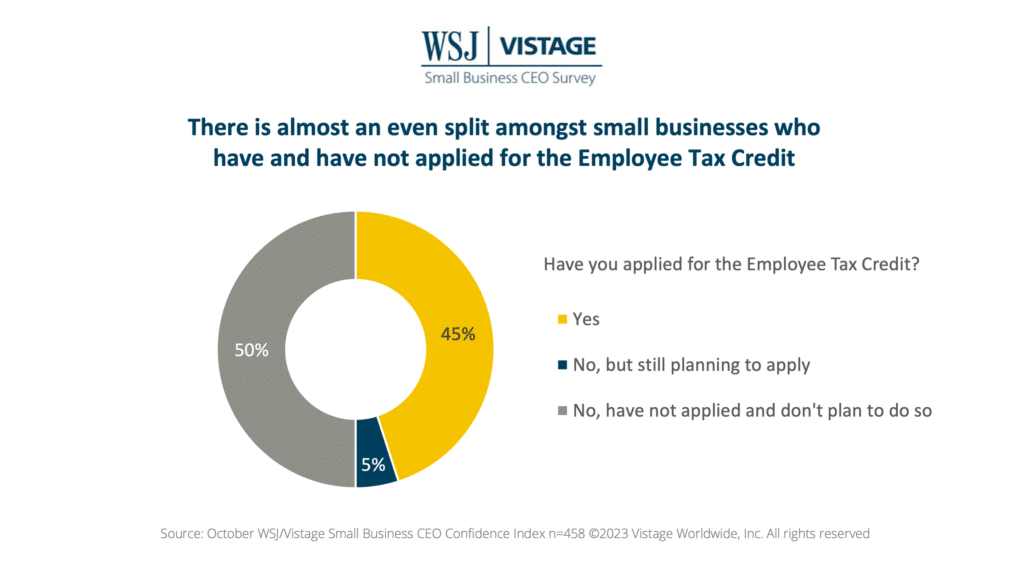

While the pandemic may be in the rearview mirror, businesses still have the opportunity to take advantage of government support by taking advantage of the Employee Retention Tax Credit (ERTC). Half of the small businesses surveyed will benefit from this program, with 45% reporting they have already filed and another 5% planning to file in the future. Kitt Letcher, president and CEO of the Better Business Bureau of Central Oklahoma, shared, “We qualified for several quarters and have used that money to bolster our reserves. Our board also approved using the funds to give employees a well-deserved year-end bonus in appreciation for their work and steadfast attitude during the pandemic.”

With others citing a complex process and long waiting periods to receive checks, small businesses may find this the effort to file a worthy investment as demand slows and profits dip further.

Rising costs of human capital

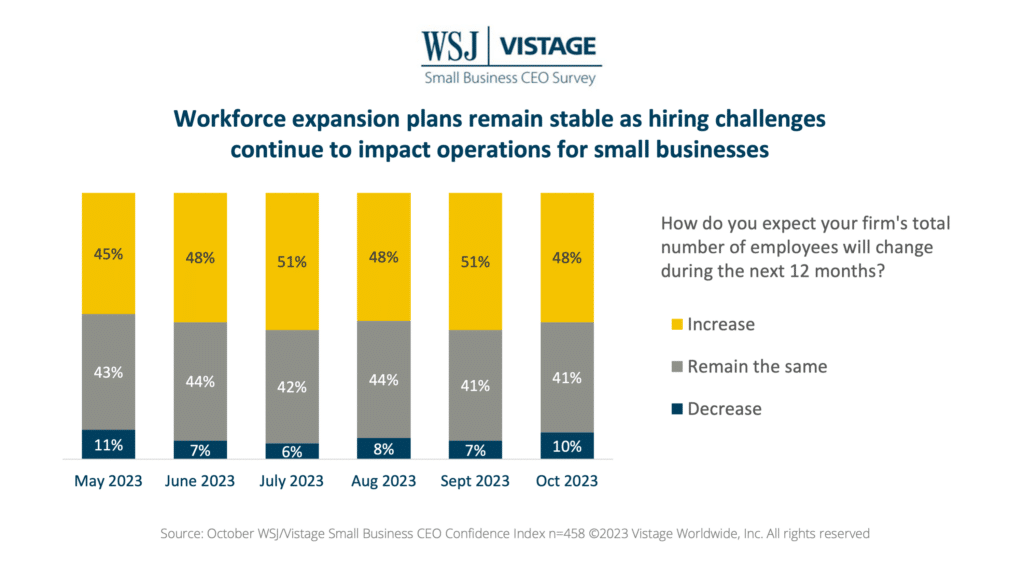

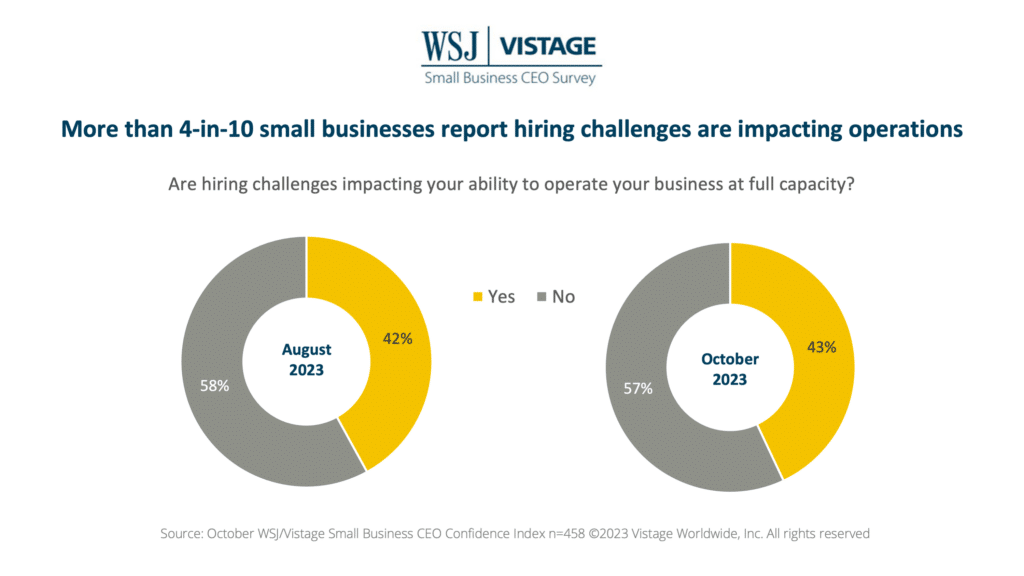

For the 48% of small businesses planning to increase their workforce, this will result in incremental personnel expenditures on two fronts: increasing payroll and increased costs for health insurance.

The 41% of small businesses that plan to maintain the size of their workforce are not immune to rising costs. Earlier this year our report — Managing Workforce Velocity: Improving Employee Retention — revealed that boosting wages was a top retention tactic among SMBs.

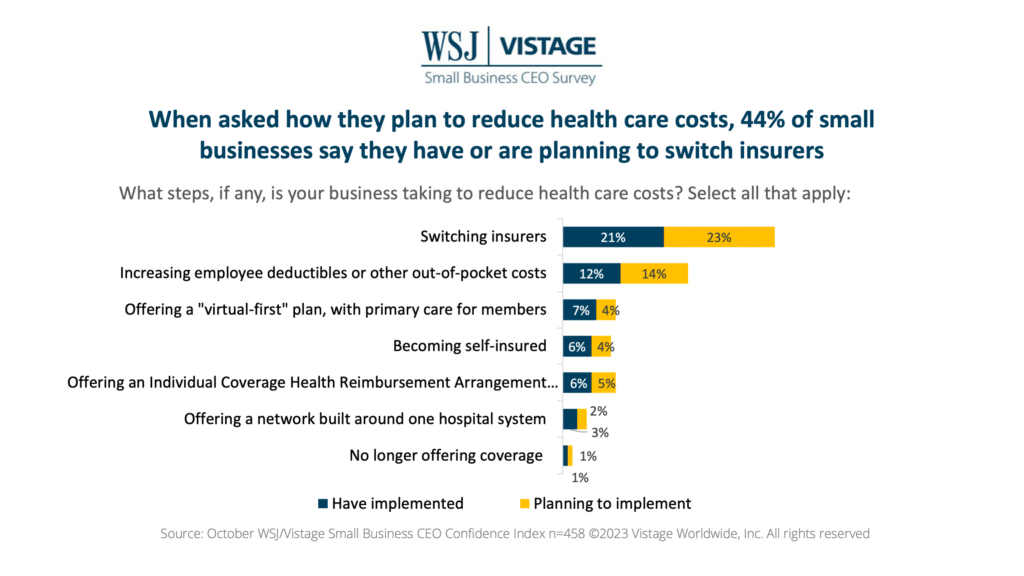

Another way small businesses improved their retention was through adding or enhancing employee benefits — a competitive differentiator in the war for talent as a valuable part of the overall compensation package. While rising health-care costs contribute to human capital being more expensive, small businesses recognize the importance of managing costs versus reducing them.

When asked for details about managing health-care costs, David Sincock, president of the Rancho Cucamonga, California-based SI Testing, shared, “We are not reducing health-care costs. We pay 100% for our employees and family. We consider it a great investment.”

While human capital continues to impact the bottom line significantly, it’s important to recognize that talent — good talent — will be crucial for small businesses, particularly in their ability to navigate through the mild recession forecasted for 2024. By building both capacity and capabilities, businesses can ensure growth during the next business cycle.

October highlights

The October WSJ/Vistage Small Business CEO Confidence Index was informed by 458 leaders of small businesses who responded to the October WSJ/Vistage Small Business CEO Confidence Index survey, which was in the field October 9-16, 2023. Highlights include:

- Current Economy: Only 13% of small businesses reported an improved U.S. economy compared to last year, while 49% said it has worsened, an increase of 11 points from 2 months ago.

- Future Economy: A scant 12% of small businesses are hopeful that the U.S. economy will improve over the next year. Conversely, 49% expect the economy to worsen, a significant 9-point increase from the previous month.

- Revenue projections: The proportion of small businesses expecting increased revenues dropped to a still-healthy 55%, while just 13% expect revenues to decrease over the next 12 months.

- Profitability projections: 40% of small businesses expect increased profits in the year, while 22% expect them to decline.

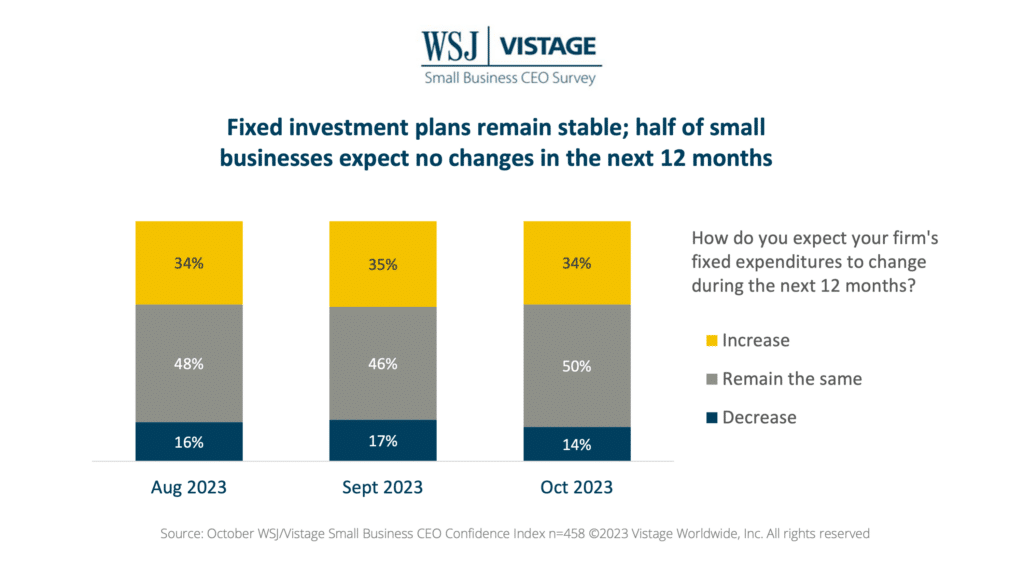

- Fixed investment plans: The proportion of small businesses who plan to increase fixed investment held at 34%; the proportion that plan to decrease fixed investment fell to 14%.

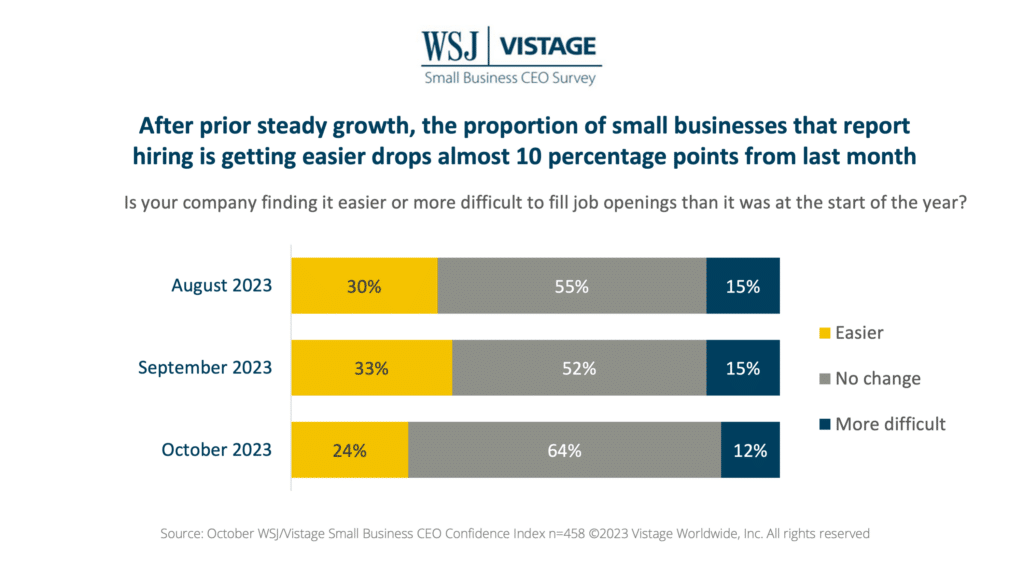

- Workforce expansion plans: Just under half of small businesses (48%) intend to increase headcount, while 41% plan to maintain the size of their workforce in the next 12 months. One-in-10 businesses report plans to decrease their workforce, an increase of 3 percentage points from last month.

For deeper insights and to explore the full dataset from the October 2023 WSJ/Vistage Small Business survey, visit our data center or download the infographic.

Category : Economic / Future Trends

Tags: economic factors affecting business, Human Capital, rising costs, WSJ Vistage Small Business CEO Survey