CEO Projections 2024: Bridging the gap to growth

Executive Summary

CEO’s expectations for a growth cycle will need to be tempered with patience as 2024 will be a year of no to low growth ahead of a rising economic growth cycle in 2025. In the Q4 2023 Vistage CEO Confidence Index, 50% of CEOs believe we are having or will experience a soft economic landing in 2024, while 46% believe we are in or will be entering into a recession. Inflation is trending down, but prices are 15% above where they were. Interest rates have peaked but are at 30-year highs, and workforce velocity has slowed but is still at pre-pandemic levels. This creates a lot of contradictions for CEOs must lead through.

The Vistage CEO Confidence Index has stabilized over the last 6 quarters with a slightly rising trend suggesting we have entered into the “Now Normal.” Economic sentiment is holding the Vistage CEO Index at bay; while there have been improvements from the lows of last year, just 20% of CEOs thought the economy had recently improved despite impressive quarterly GDP figures. Moreover, only 21% anticipate an improving economy in the year ahead. With little room to fall, the Vistage CEO Index rose to 82.0, a six-quarter high — however, it was still below any other pre-pandemic quarter since the Great Depression.

Focus on Business Optimization

Nearly 1,400 CEOs who responded to the Q4 Vistage CEO Confidence Index survey shared their decisions, investments, opportunities and challenges for 2024. From these open-ended responses, our analysis distilled four top themes that align with the Vistage Decision Model.

Nearly 1,400 CEOs who responded to the Q4 Vistage CEO Confidence Index survey shared their decisions, investments, opportunities and challenges for 2024. From these open-ended responses, our analysis distilled four top themes that align with the Vistage Decision Model.

1. Talent

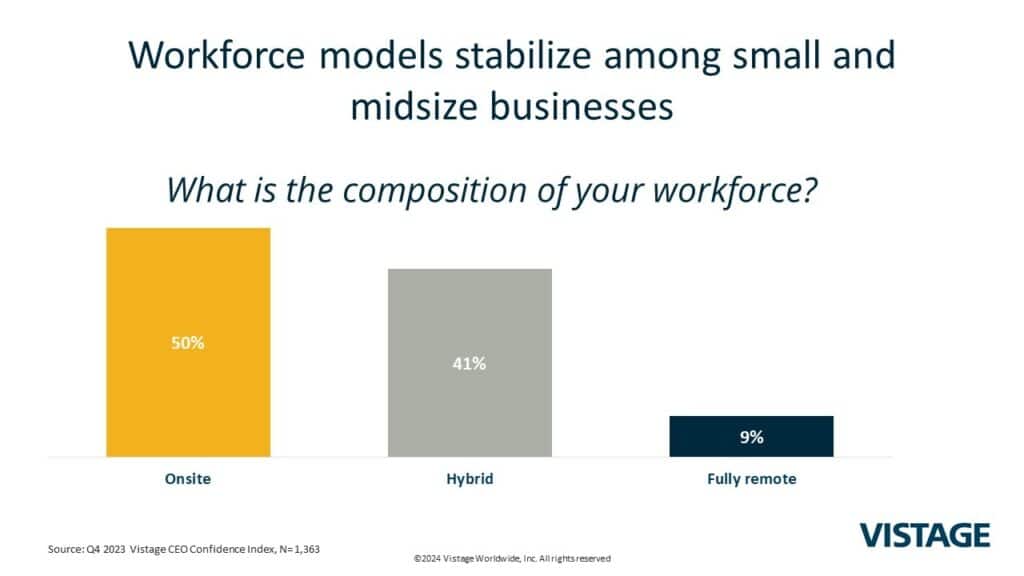

Hiring and retention remain both the top decision and a significant challenge for CEOs. Workforce development is a critical investment for both workers and managers/leaders to improve performance and engagement. Succession planning rose to importance as CEOs look ahead to the needs of their business.

There has been a truce in the talent wars as hiring slows and retention rises. The workplace status quo has now been set. Wnd the longer that status quo remains in place, the stronger it becomes. As CEOs consider bringing workers back to the office full-time, they will be breaking that truce and risk losing people. As the economy accelerates into the growth cycle in 2025, the demand for workers will accelerate and generate opportunities for workers, reigniting the talent wars.

Related content:

Managing Workforce Velocity: Improving Employee Retention

Building Better Bosses: Leadership Development

2. Financials

Continuing economic concerns about inflation, interest rates, and the workforce were top of mind for CEOs. With no ability to influence these data points, their relative stability becomes part of what is now normal. The hard-learned lessons of the pandemic remain in play as access to capital and the associated cost were a big factor in investments and a major challenge. Most interestingly, 52% of CEOs are looking to complete an acquisition, sell or exit their business. Most of this activity will occur over the next 5 years as the growth cycle continues.

The key financial consideration is the concept of valuation. CEOs typically have an over-inflated perception of their business’s value or apply a simple multiplier model. Applying an accepted discipline for determining valuation is the first step toward creating and monitoring an objective valuation assessment.

Related content:

Mergers and acquisitions trends for 2023 and beyond

Funding strategic acquisitions through private capital markets

3. Operations

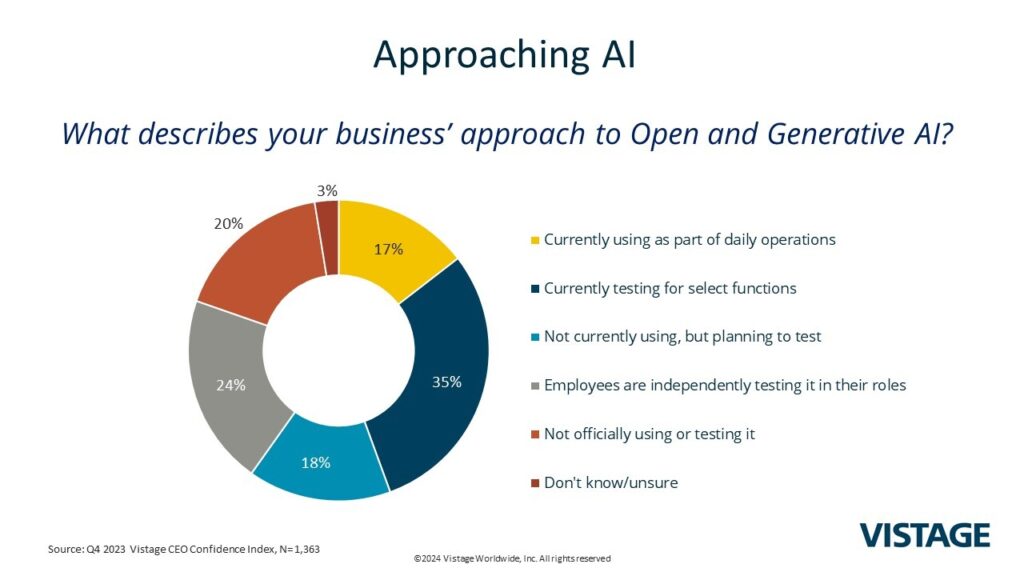

Operations are unique to each type of business. However, technology is common to all and remains a top investment and challenge for CEOs. Automation in the form of robotics as well as business applications like HCM or CRM are drivers of the business. Cyber-security also remains a huge business risk as 58% of CEOs report having an active and up-to-date cyber strategy in place, leaving 42% to hope they are not the next one to get hijacked.

The importance of accelerating digital transformation becomes clearer with the rise of artificial intelligence. AI grabbed all the headlines for technology in 2023 but didn’t gain traction. And it will improve individual productivity long before organizations — especially SMBs — will learn how to harness its power. CEOs are approaching AI cautiously. Identify the right AI apps for your workers, and train them extensively while accelerating your organizational transformation.

Related content:

Business Trends for 2024 and Beyond [Webinar on demand]

Artificial Intelligence Resource Center

4. Customers

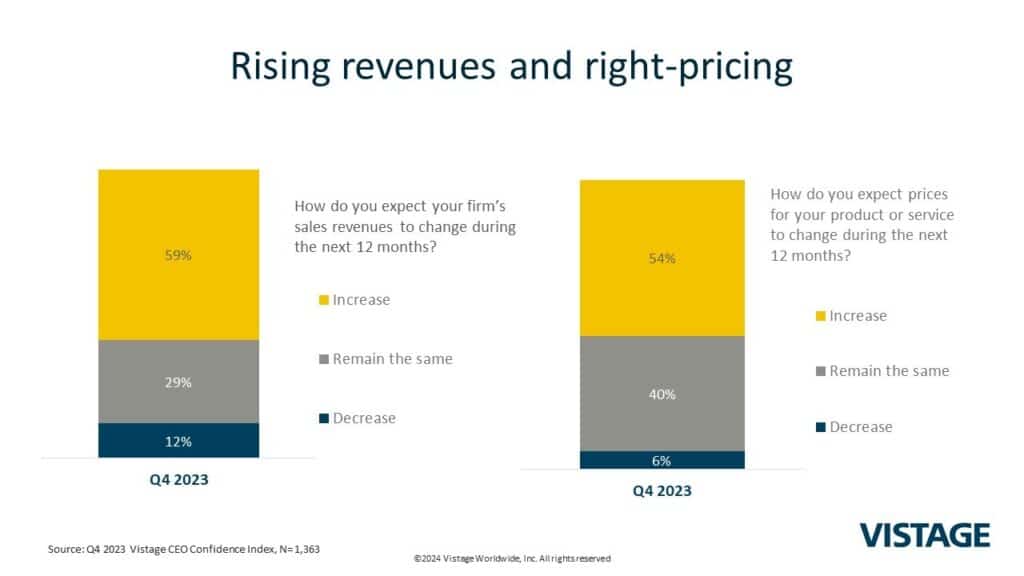

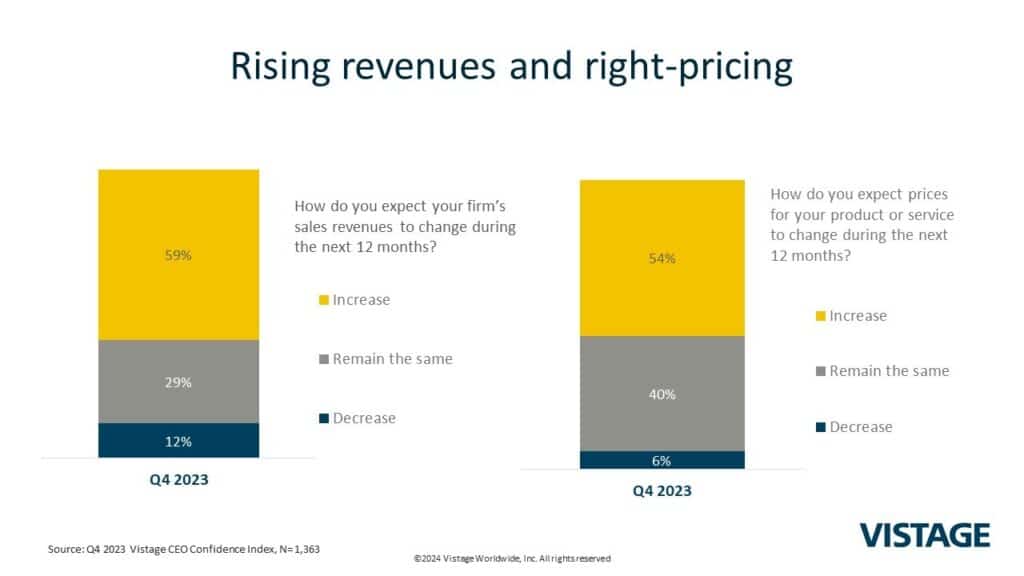

Getting closer to your customers is always the right answer in every economy. They will be your first indication of the rise in your market. Sales cycles will begin to accelerate, postponed projects will come back to life, and the economic engine will begin to fire. Many CEOs are investing in developing new products and expanding their markets as they seek growth, evidenced by the fact that 59% expect increased revenues in the year ahead. The discipline, alignment, and execution of sales and marketing functions is a constant challenge.

Additionally, pricing is a powerful contributor to growth. The rapid (and sometimes haphazard) price increases as a result of spiking inflation have passed leaving some organizations’ pricing misaligned within their market. CEOs should make sure their pricing is appropriate for their market before the status quo solidifies and customers and prospects object.

Related content:

National Growth Conference recap: Pricing insights from Casey Brown

7 questions about pricing strategy

Conclusion: The Power of Strategic Planning

Bridging the gap to growth demands strategic planning, and the stability of the “Now Normal” — barring any Black Swan events — provides clarity and balance to the 2020s. Over 7-in-10 (72%) of CEOs use an internally developed process for strategic planning. While CEOs grade themselves highly, our panel of Strategic Planning experts found otherwise. The opportunity presented by the pending growth cycle, bookended by a predicted recession beginning in 2030, will reward those who are great at planning, but maybe not those who think they are.