Vistage CEO Confidence Index slips in Q1 2018

The confidence of CEOs from small and midsize businesses (SMBs) has slipped in the past quarter but remains high, according to new data from Vistage.

The Vistage CEO Confidence Index, calculated as part of Vistage’s quarterly survey of SMB CEOs, measured 105.8 in Q1 2018. By comparison, the index was 110.3 last quarter (Q4 2017) and 106.8 one year ago (Q1 2017). The Q1 2018 survey had 1,712 respondents.

To calculate the index, researchers account for factors including CEO opinions on current economic conditions, expected economic conditions, expected changes in employment, planned fixed investments, expected revenue growth and expected profit growth. The index has a strong track record of predicting GDP growth.

In his analysis of the results, Dr. Richard Curtin of the University of Michigan expressed a positive outlook. “Although the Vistage CEO Confidence Index retreated from the decade high recorded at year-end 2017, it still remains quite favorable,” he said. “The decline in confidence was mainly due to a moderation in the pace of growth expected for the national economy during the year ahead.”

The peak index recorded last quarter, he continued, was likely influenced by CEOs’ anticipation about tax return. “It is not unexpected that those initial, very optimistic expectations were slightly reduced once firms more clearly understood the provisions of the legislation that was signed into law,” he said.

Other key findings from the quarterly survey include the following.

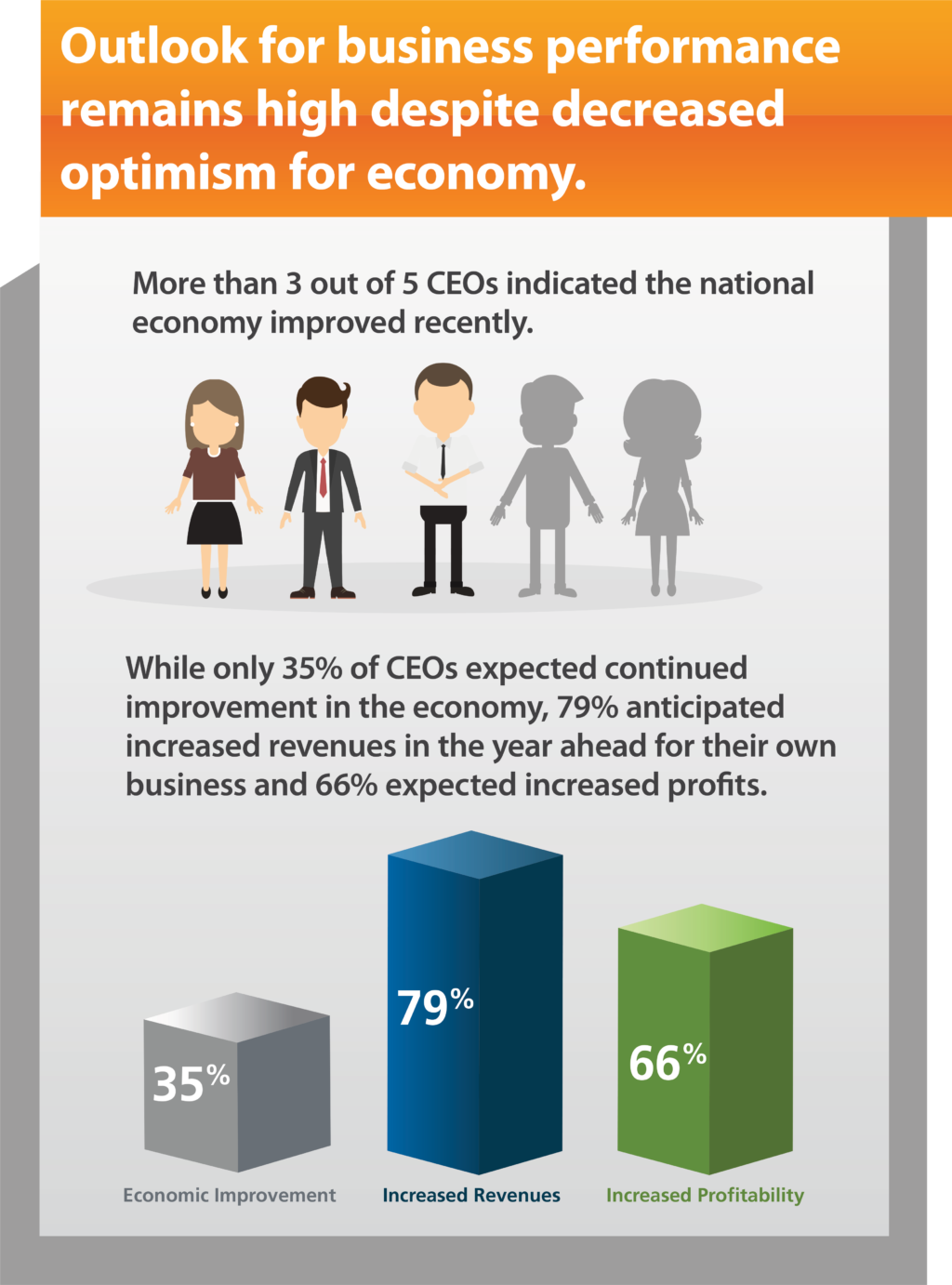

Most CEOs believe U.S. economy has improved

About three out of five SMB CEOs (62%) said that the U.S. economy has recently improved, similar to last quarter’s 66%. SMB CEOs were less optimistic about future prospects for economic growth, however. Only 35% said that they expected the economy to grow in the next 12 months, compared to 45% last quarter.

“The decline in the pace of economic growth may be due to firms anticipating that the impact from higher inflation and rising interest rates would be more noticeable in the overall economy than on the outlook for their own firm,” said Curtin. “Or it could be partly due to a reaction to recent trade policy developments. Or it could simply reflect a more realistic assessment of the tax legislation.”

By contrast, SMB CEOs are optimistic about the growth prospects of their own businesses. The majority of CEOs (79%) expect their company’s revenues will grow in the next 12 months. This is close to the record peak (83%) recorded last quarter. Two-thirds of CEOs (66%) also anticipate increase profits, which is nearly equal to last quarter’s peak record of 67%.

“Although revenues, profits and planned increases in investments and employees were slightly below last quarter’s levels, they were all more expansive than in the Q1 2017 survey,” noted Curtin.

Hiring and investment plans remain strong

Hiring and investment plans remain strong

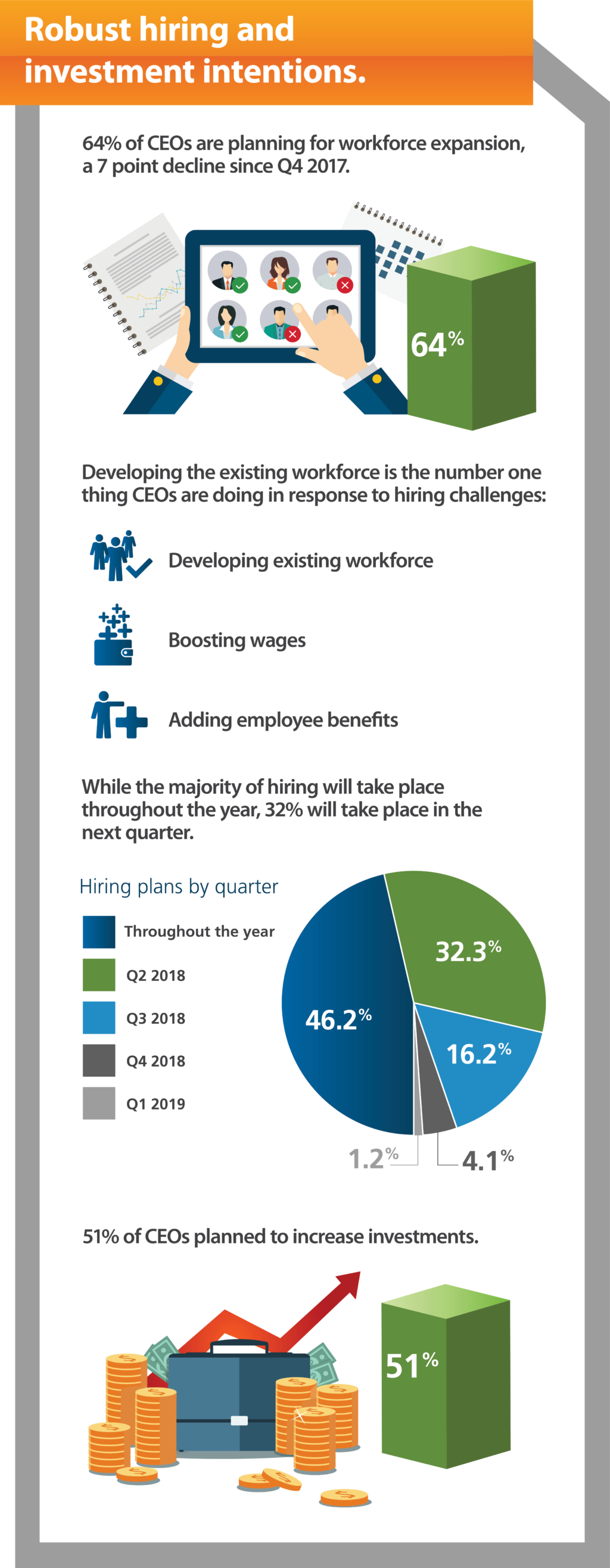

In the next 12 months, nearly two-thirds of SMB CEOs (64%) plan to expand their workforce. This is lower than the 71% recorded last month but higher than the 60% recorded one year ago. Only 4% of CEOs plan to reduce the number of employees in their firms, which is equal to the lowest-ever percentage recorded last quarter.

A tight labor market means that “finding and retaining employees continues to be challenging,” said Dr. Curtin. To address these hiring issues, firms are using a variety of strategies, including training employees for higher-level positions (67%), offering higher wages (62%) and offering more benefits (33%).

“In this robust economy, it is not surprising that few CEOs favor slowing sales or delivery times,” added Curtin. He noted that the percentage of CEOs using these strategies is only 13% and 10%, respectively.

Similar to last quarter, many SMB CEOs plan to invest in new plant equipment in the year ahead. More than half (51%) of CEOs said they will increase investment expenditures, compared to last quarter’s 54% — a decade high — and last year’s 47%.

In the past two quarters, only 7% of CEOs said they planned to decrease their investments. This is the lowest ratio recorded since 2004.