Economic trends affecting business in 2019

In Part 4 of our series on external trends impacting small and midsize companies in 2019, we study economic trends affecting business.

As we transition into 2019, the mood of the nation is both optimistic and skittish. In the 10th year of a record broad-based recovery, there is strong consensus by economists that a soft landing (or recession) is on the horizon for late 2019 or in 2020. However, most do not believe we will have a significant downturn given that the U.S. is at full employment.

Small and midsize business leaders are trying to reconcile:

- Whether tariffs represent a negotiating tactic by the Trump administration or the long-term trade policy of the United States. The stakes are significant. The slowing of Chinese GNP is the wildcard to the global economy.

- Deloitte projects that the current tariff scenarios will reduce U.S. GNP by 0.4 percent in 2019, and that the U.S. has a 25 percent chance to slide into a recession next year. In 2020, our economy could grow as little as 1 percent, making it more vulnerable to various unforeseen world events. With a split congress, political risks could range from a federal government shutdown to impeachment proceedings.

- Heightened volatility in the capital markets represents a conundrum for investors who are starving for yield. [i] While bond yields have risen from 2.4 at the beginning of the year to 3.2 in October, interest rates are still relatively low. [ii]

- Yet, U.S. nationals continue to yield high profits. Profits for S&P companies are up around 25 percent this year. [iii]

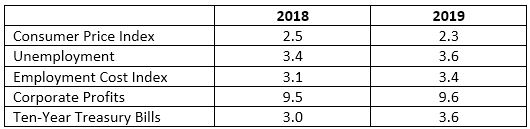

- Inflation is in check for now. The Congressional Budget Office projects the Consumer Price Index to be 2.2 percent in 2019.

- Housing is unaffordable in many large cities, and rising interest rates create a ceiling for real estate prices. Multi-unit and commercial real estate present poor capitalization rates in the 3- to 4-percent range in top markets.

- A study in Inc. Magazine revealed that among CEOs, “scaling” was their top concern (86 percent), but “finding and retaining good staff” was their No. 1 barrier (62 percent).

- Europe is even more vulnerable than the U.S. The turmoil around Brexit will be front and center throughout 2019. Germany’s Merkel and Great Britain’s May are losing influence in the region, and the loss of Britain as a financial hub brings more uncertainty to the European Union, which will elect new leadership in 2019.

GNP & other key indicators

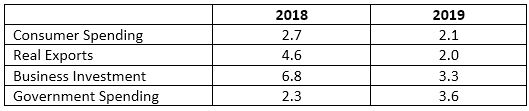

The greatest probability is that the U.S. economy will “soften” in 2019. According to Deloitte, projections for the four components of GNP tell a story of fundamental shifts in the U.S. economy:

According the Congressional Budget Office, other key indicators include:

- Entering the Christmas season, consumers have an appetite for spending as evidenced by strong retail and automobile sales.

- Buoyed by the tax cut, business spending rose a robust 7 percent this year. In particular, amended accelerated depreciation rules have been a boon for heavy equipment and real estate, but its long tail does not provide much incentive for investors to dive in right away. A consequence of tax reform was a flurry of corporate buy-backs.

Read part 1 – Ecological and social trends affecting business in 2019

Read part 2 – Technology trends affecting business in 2019

Read part 3 – Political trends affecting business in 2019

Economic trends impacting business in 2020 and beyond

China and Tariffs

As U.S. companies face the prospect of a prolonged trade war with China, many Vistage members are looking at alternatives such as India, Singapore, the Philippines and Mexico for offshore production. While President Donald Trump continues his sabre-rattling about immigration, Mexico is a critical trade partner. Mexico has a host of problems, and the election of leftist Andrés Manuel López Obrador and subsequent announcement about policy rattled markets, which have sold off Mexico’s currency and stocks. U.S. trade with Canada and Mexico combined exceeds trade with China.

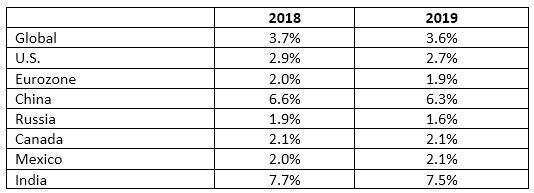

Since China was admitted to the World Trade Organization in 2001, its interests have been on a collision course with the U.S. It had been presumed by many that all trade was good trade, until 2.4 million jobs were lost to China between 1998 and 2011, a key contributor to the suppression of blue-collar wages. [iv] China is expected to slow to 6.3 percent growth in 2019. [v]

As China does not import enough from the U.S. to match tariffs dollar for dollar, it is likely to resort to other means. Some allege that China’s retort to tariffs is further manipulation of its currency. From May 1 to August 1, the yuan fell 7 percent to the dollar. China may limit M&A activities of U.S. companies that want to do business there. [vi]

Industries growing in China include new energy, electric power equipment, agricultural equipment and biopharmaceuticals. One likely scenario is that tariffs could be replaced with quotas, which will restrict imports and provide Trump cover.

Global outlook

While a slowing of the U.S. economy is almost certainly around the corner, U.S. growth is expected to outpace most of the developed markets around the world. Brexit comes at a time when nationalist movements have thrown the EU into disarray. German Chancellor Angela Merkel has lost influence in the region, and Italy’s budget deficit is a political quagmire. [vii] Britain’s financial system provided much-needed stability to the EU, and its exit will create more uncertainty.

Kiplinger projects growth in key markets in 2019 to be: [viii]

Other global trends heading into 2019:

- Italy is experiencing a power vacuum, and early elections could spark more unrest. The newly-formed coalition government is trying to reduce taxes at a time when Italy’s budget has a significant deficit.

- France is growing slowly (about 1.6 percent in 2019), but President Macron offers an ambitious agenda to reform business and government there. [ix]

- Canada’s economy, which tends to skew toward energy prices, still has unemployment around 6 percent.

- Japan has ultra-low unemployment but will raise its national sales tax to 10 percent in November, tempering demand. [x] Over 30 percent of Japan’s population is over age 65.

- Emerging markets in leading growth countries include Syria (9.9 percent), Bangladesh (7.7 percent), India (7.7 percent), Ethiopia (7.3 percent) and Laos (7.3 percent). Most are normalizing in the wake of newfound political stability. [xi] There will be key elections in India, Indonesia and Nigeria. Higher interest rates and an economic slowdown are hurting in developing countries such as Turkey, Brazil and South Africa. [xii]

- In markets like Africa, South America and Central America, the hope of economic prosperity is often tied to connectivity. In Brazil, 15 percent of the population has broadband (in Venezuela, 5 percent).

- Inflation in Turkey is 25 percent in the wake of political wrestling.

- Lower oil prices will hurt Russia, as half of government income comes from energy revenue.

- India will host elections in 2019, as the government tries to infuse liquidity and capitalize on opportunities to divert exports from China. [xiii]

Key sectors [xiv]

Automotive-Global car sales are expected to rise 5 percent in 2019. The confluence of tariffs and higher prices from Mexico is likely to increase prices in the years ahead. Producers around the world are embedding more technology in their vehicles, and 5G will enable autonomous vehicles in 3 to 4 years.

Aerospace and defense–Moody’s projects large aircraft orders to increase by 8 percent in 2019. Most U.S.-based aerospace suppliers have swelling backlogs. Top airlines are upgrading their fleets to more fuel-efficient models. The U.S. government is putting a lot of pressure on its supply chains to rationalize costs, but also adhere to stringent cybersecurity and other standards.

Financial services-Many banks are under the strain of broadened international regulation. Tax reform was a boon to U.S. banks, and total global assets are expected to swell by 6 percent in 2019. Expect Democrats in Congress to try to counter efforts by the Trump administration to reduce banking regulation.

Healthcare-U.S. healthcare spending is still double that of any industrialized nation (a staggering $11,000/person per year). While markets have begun to normalize, healthcare inflation is still unruly, with big fluctuations in increases for private companies. With Trump’s efforts to unwind universal healthcare, employers will offer slimmed-down coverages.

Retail-Retail is transforming overnight as brick-and-mortar companies realize the potential of omnichannel marketing. In particular, new technologies like artificial intelligence are enabling new experiences and customer-centric insights. [xv] Voice recognition enables consumers to find any product anywhere. Bots will redefine customer service. Look for more M&A and vertical integration across technology companies and brick and mortar (such as with Amazon and Whole Foods).

Mining and materials-The cost of metals has fluctuated drastically as a result of the threat of tariffs. The Economist predicts that global aluminum prices will fall by 3 percent in 2019, and steel by 17 percent. China-based companies are buying up much of the world’s rare metals supply.

Telecom– 5G will reshape telecom in 2019 with a wave of 5G-enabled technologies, which will increase processing speeds by more than 10 times.

Debt, interest rates and liquidity

Debt has been the root cause of almost every financial downturn in history. A recent Bloomberg Businessweek study of the largest 50 acquisitions in the last five years found that more than half took on debt that would land them in “junk bond” status were it not for their upside projections. There are entire industries that are over-leveraged.

Central banks may not have learned their lesson. According to the International Monetary Fund, there were 124 banking “meltdowns” between 1970 and 2007, illustrating that regulation, leverage and liquidity ebb and flow based on economic conditions. [xvi] Certainly there has been a tightening of regulation and credit. Fundamentally, the U.S. government still underwrites home ownership in the U.S. through tax policy and lending, and another housing bubble could lead to more chaos. The U.S. will have a deficit of about 6 percent of GNP in 2019.

The Federal Reserve Bank projects the median federal funds rate to be 2.7 in 2019 (0.6 higher than 2018). Given the recent turmoil of markets, it is now expected that there will be one to two rate hikes in 2019 (down from the expectation of four earlier in the year).

Employment

Ugh. It’s an inconvenient truth that wages are escalating quickly. According to the Congressional Budget Office, the Employment Cost Index will swell significantly in 2019 from 4.1 to 4.4 percent. Large employers, such as Amazon and Walmart, are resetting the market for unskilled workers in the wake of higher minimum wage rates and federal wage rules. Some cities, such as Denver and Iowa City, have unemployment rates below 3 percent, although unemployment may be a bit of a skewed number given vast underemployment in the gig economy.

Housing

A housing imbalance remains throughout the U.S., with average home prices up around 5 percent. Some markets, including Seattle and Portland, are cooling, as they have become unaffordable especially with higher interest rates. [xvii] Single-family starts were up 6 percent in 2018 ($900,000) as builders start to catch up with demand. The South and West represent 75 percent of the building. Overall, prices are up 12 percent since 2006.

Oil

Oil pricing is more of a correction than a trend. The later summer surge was in reaction to the U.S. pulling out of the Iran nuclear deal. Meanwhile, U.S. production remains strong. [xviii] The U.S. Energy Information Administration predicts oil prices to normalize at $74 per barrel in 2019.

References

[i] The Kiplinger Letter November 16[ii] Are Jumpy U.S. Equities Hiding a Nasty Surprise? By Peter Coy, Bloomberg Businessweek

[iii] The World in 2019, The Economist

[iv] The China Effect by Tom Orlik, Bloomberg Businessweek

[v] The Kiplinger Letter November 9

[vi] The Kiplinger Letter July 20

[vii] Growth Outlook, Bloomberg Businessweek

[viii] The Kiplinger Letter October 12

[ix] The World in 2019, The Economist

[x] Growth Outlook, Bloomberg Businessweek

[xi] The World in 2019, The Economist

[xii] The Economy by John Schoen, CNBC

[xiii] Growth Outlook, Bloomberg Businessweek

[xiv] The World in 2019, The Economist

[xv] STORES’ 2019 Retail Industry Trend Forecast by Susan Reda, NRF’s Magazine

[xvi] Has Finance Been Fixed? The Economist

[xvii] The Kiplinger Letter August 3

[xviii] The Kiplinger Letter November 9

Related articles

Category : Economic / Future Trends