Goodbye capital gains tax! Is 2021 the year to sell?

Download Capital Gains Tax webinar presentation slides

Tax increases are coming. The proposed capital gains tax changes could have a big impact on the proceeds from the sale of your business. ACT Capital’s Bob Hild discusses the future tax situation and how it will affect you.

This session is ideal for business owners who are considering an exit in the next few years and covers:

- The current state of M&A

- Proposed tax changes and their impact

- Why your business may be worth more post-pandemic

- How to prepare your business and maximize its value when you go to sell

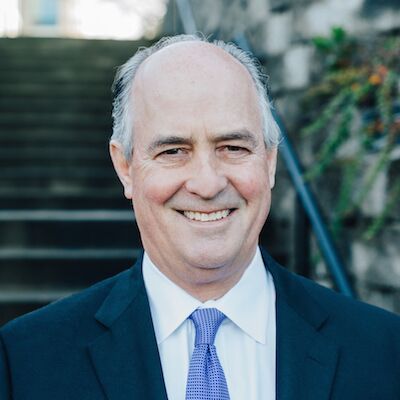

About the presenter

Bob Hild is Chairman and CEO ACT Capital Advisors. Prior to joining ACT, Mr. Hild co-founded Invest West Capital, LLC, a West Coast oriented private equity firm focused on mid market acquisitions. During his tenure with IWC, he served as CEO of five portfolio companies and conducted over 20 mergers, acquisitions, and sales, representing in aggregate more than $200MM in transaction value. His senior management leadership experience includes light manufacturing, food processing, retail store fixture and durable medical products manufacturing, industrial recycling, critical power, and legal support services. Currently he serves on the board of directors of Critical Power Exchange and Columbia Medical Products. Previously, Bob was a senior manager of Corporate Finance for Ernst and Young, providing advisory services to both buyers and sellers of mid market companies. Mr. Hild is a graduate of Brigham Young University’s School of Accountancy and an MBA from the Marriott School of Business at Brigham Young University.

Bob Hild is Chairman and CEO ACT Capital Advisors. Prior to joining ACT, Mr. Hild co-founded Invest West Capital, LLC, a West Coast oriented private equity firm focused on mid market acquisitions. During his tenure with IWC, he served as CEO of five portfolio companies and conducted over 20 mergers, acquisitions, and sales, representing in aggregate more than $200MM in transaction value. His senior management leadership experience includes light manufacturing, food processing, retail store fixture and durable medical products manufacturing, industrial recycling, critical power, and legal support services. Currently he serves on the board of directors of Critical Power Exchange and Columbia Medical Products. Previously, Bob was a senior manager of Corporate Finance for Ernst and Young, providing advisory services to both buyers and sellers of mid market companies. Mr. Hild is a graduate of Brigham Young University’s School of Accountancy and an MBA from the Marriott School of Business at Brigham Young University.

Related resources

Category : Exit Planning