Succession Strategies: Prepare Your Business for a Successful Exit

Patrick Ungashick, an author and CEO of White Horse Advisors, has devoted 20+ years to helping business owners in a variety of industries and company sizes to formulate exit plans. In his Fridays with Vistage webinar, “Succession Strategies: Prepare Your Business for a Successful Exit,” he reinforces awareness that exiting a business is not an easy process. According to studies, CEOs spend 1500 hours during their last 12 months on the exit, many companies fail to sell or get below target price, and “1 in 3 family businesses survive to the second generation.”

However, as an owner there are ways you can create transferable value in advance to make the exit successful. Patrick says, “growing a business and creating value are not the same thing…” and defines transferable value as “the intangible conditions within a company, unrelated to revenue or profits, that make it easier, less costly and less risky for a buyer or successor to continue and capitalize on the business going forward.” Here are seven areas of transferable value that can improve an owner’s exit strategy by making the company more desirable to the next owner:

However, as an owner there are ways you can create transferable value in advance to make the exit successful. Patrick says, “growing a business and creating value are not the same thing…” and defines transferable value as “the intangible conditions within a company, unrelated to revenue or profits, that make it easier, less costly and less risky for a buyer or successor to continue and capitalize on the business going forward.” Here are seven areas of transferable value that can improve an owner’s exit strategy by making the company more desirable to the next owner:

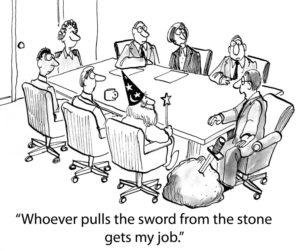

1. Decision-Making Management Team

“There’s a difference between a management team that’s making decisions on a high level versus one CEO and a bunch of doers underneath him or her,” he says. A management team that has proven success and is able to come to decisions without the CEO suggests that there will be good leadership in place during the transitional period and into the new ownership. Establish a benchmark system to measure manager performance and have accurate job descriptions for each of their positions.

2. Owner Independency

In relation to having a decision-making management team, a company with transferable value should be able to keep up operations with little dependency on the owner. He states, “A company that performs at a high level with low levels of owner involvement, that company is more than likely going to withstand a change in control without jeopardizing important relationships…” CEOs should look at whether or not they are able to completely detach from work while on vacation and if there would be concern from top employees and clients should the company switch ownership.

3. Effective Financial Systems and Controls

The financial statements should be clear and inline with industry standards. Potential suitors will begin to see risk if balance statements are disorganized and need explanation.

4. Compelling Business Strategic Plan

“To get out of a business, someone has got to want to get into that business,” he says. Show successors in writing why they should want the company with a detailed business plan depicting its current state as well as future prospects. A formulated plan that outlines “sustainable competitive advantages” and strategies to achieve growth over the next three to five years indicates a well-run and desirable company.

5. Customer Diversification

There are many businesses that steadily produce good earnings; however, they leave themselves exposed to risk as the majority of their revenue stream comes from a handful or less of their customers. Patrick says, “A company with revenue that’s diversified across a wide customer base has very little vulnerability to either market or geographic concentration, that company reduces the risk of loss during a transition and it also presents a much stronger platform for that company to build upon going forward.” If more than 10% of a company’s “trailing 12-month gross revenues or 10% of the trailing pre-tax profits” comes from one customer, then an owner should incorporate steps in their exit strategy to diversify their customer base.

6. “Wild-Card” Intellectual Property

The same way a wild card can add “game-changing value” to a card game, intellectual property can substantially increase the value of a business. Even though an owner may not believe they need patents or copyrights for their business, the fierce competition they’ve risen above should serve as a reminder to protect their brand. A company should have a written positioning statement and brand strategy as well as have their name registered in all potential geographic markets. Also, patent or copyright any technological developments including those that may be overlooked such as simple software programs.

7. Scalable Systems and Processes

A successor needs to know that the business will make it through the transition to new ownership and that it will be scalable afterwards. Almost every successful business has processes that are essential to its operation and give the company its competitive edge. These systems should be documented along with any relatable measurements so they can be passed on. By having scalable processes in place, owners reduce the risk to the successors, and “risk is the evil twin of transferable value.”

To address what could be a difficult period in a business owner’s life, Patrick shares this advice: “When your exit is a happy one, and employees are treated with dignity and are excited about the company going forward, and customers are pleased with how their needs are met and happy for the success story, when families are rewarded, when the financial results are what we want them to be, it is one of the most amazing crowning special experiences of a CEO’s career.”

Additional Resources:

businessexitplanningtools.com

YouTube – search exitplanningtools

Category : Exit Planning